Indonesia Used Car Financing Market Overview

- The Indonesia Used Car Financing Market is valued at USD 40 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for affordable transportation options, the expanding middle class, and the rising availability of digital and traditional financing solutions tailored for used vehicles. The market has seen a significant uptick in transactions as more consumers opt for used cars over new ones due to budget constraints, economic factors, and improved access to credit through both banks and fintech platforms .

- Key cities such as Jakarta, Surabaya, and Bandung dominate the market due to their high population density, urbanization rates, and robust infrastructure. The growing middle class in these urban centers contributes to the increasing demand for used cars. Additionally, the presence of numerous financing institutions, both traditional and digital, in these areas facilitates easier access to financing options for consumers .

- In 2023, the Indonesian government implemented regulations aimed at enhancing consumer protection in the used car financing sector. These regulations require all financing providers to disclose comprehensive information regarding loan terms, interest rates, and potential fees to consumers. This initiative is designed to promote transparency and ensure that consumers make informed decisions when financing used vehicles .

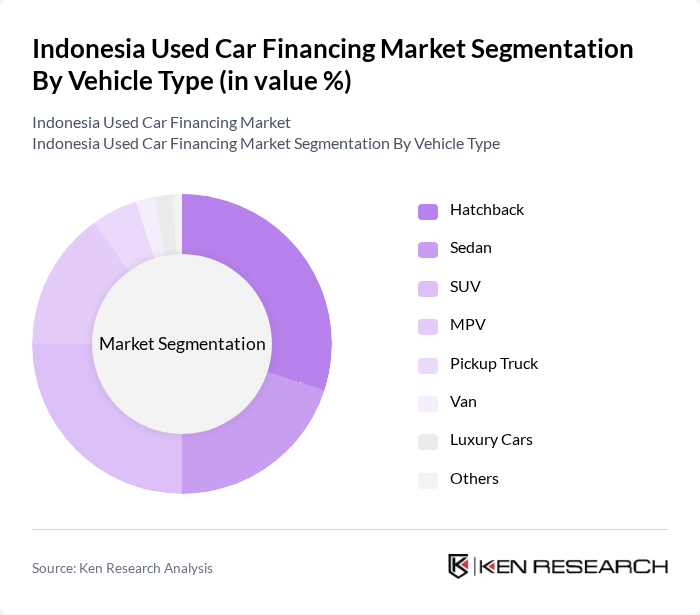

Indonesia Used Car Financing Market Segmentation

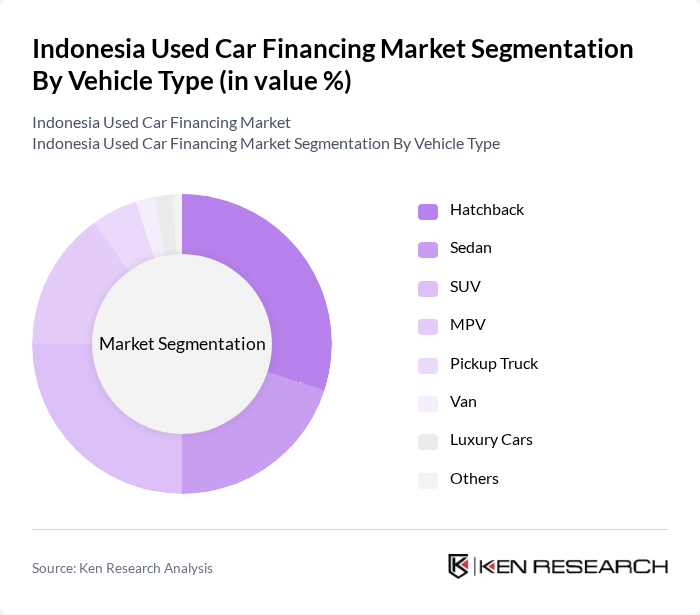

By Vehicle Type:The used car financing market is segmented by vehicle type, including hatchbacks, sedans, SUVs, MPVs, pickup trucks, vans, luxury cars, and others. Hatchbacks and SUVs remain popular due to their affordability and practicality for urban commuting. The market is also seeing a notable increase in demand for family-oriented vehicles like MPVs, reflecting a shift toward larger and more versatile vehicles as consumer preferences evolve. Pickup trucks and vans serve commercial and utility needs, while luxury cars, though a smaller segment, attract aspirational buyers seeking premium features .

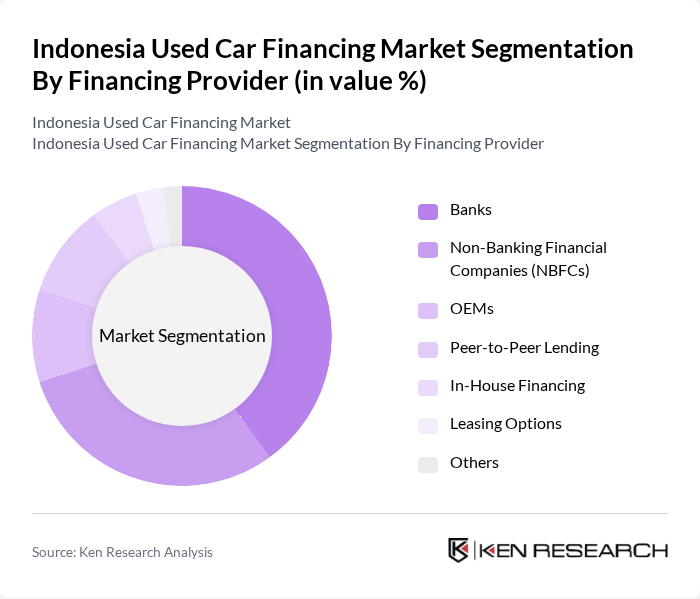

By Financing Provider:This segment includes banks, non-banking financial companies (NBFCs), original equipment manufacturers (OEMs), peer-to-peer lending platforms, in-house financing, leasing options, and others. Banks and NBFCs dominate the market due to their established networks and comprehensive financing solutions. Peer-to-peer lending platforms and digital fintech providers are gaining traction, offering competitive rates and streamlined approval processes, appealing to younger and tech-savvy consumers. OEMs and in-house financing options are also expanding, particularly as automotive brands seek to enhance customer loyalty and capture a larger share of the used car segment .

Indonesia Used Car Financing Market Competitive Landscape

The Indonesia Used Car Financing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Astra Credit Companies (ACC), PT Toyota Astra Financial Services, Suzuki Finance Indonesia, PT JACCS Mitra Pinasthika Mustika Finance Indonesia (MPM Finance), Oto Multiartha, BCA Finance, Adira Finance, Mandiri Tunas Finance, CIMB Niaga Auto Finance, BRI Finance, Mega Finance, FIFGROUP, Kredit Pintar, Bank Negara Indonesia (BNI), Bank Rakyat Indonesia (BRI), Danamon Finance, and TAF Group contribute to innovation, geographic expansion, and service delivery in this space .

Indonesia Used Car Financing Market Industry Analysis

Growth Drivers

- Increasing Middle-Class Population:The middle-class population in Indonesia is projected to reach 143 million by in future, representing a significant increase from 126 million. This demographic shift is crucial as it drives demand for affordable transportation options, including used cars. With rising disposable incomes, more individuals are likely to seek financing solutions to purchase vehicles, thereby stimulating the used car financing market. The growing middle class is expected to enhance overall economic activity, further supporting this trend.

- Rising Demand for Affordable Transportation:In future, the demand for affordable transportation in Indonesia is expected to increase, with an estimated 62% of the population relying on used cars for daily commuting. This trend is driven by urbanization and the need for cost-effective mobility solutions. As public transportation options remain limited in many areas, the used car market is positioned to benefit significantly. Financing options tailored to this demographic will likely see increased uptake, further propelling market growth.

- Expansion of Digital Financing Platforms:The digital financing landscape in Indonesia is rapidly evolving, with over 55 fintech companies offering innovative financing solutions in future. This expansion facilitates easier access to used car financing, particularly for tech-savvy consumers. Digital platforms streamline the application process, reduce paperwork, and enhance customer experience. As a result, more individuals are expected to utilize these services, driving growth in the used car financing sector and increasing overall market penetration.

Market Challenges

- High-Interest Rates on Financing:The average interest rate for used car financing in Indonesia is projected to remain around 11% in future, which poses a significant barrier for potential buyers. High-interest rates can deter consumers from pursuing financing options, leading to lower sales in the used car market. This challenge is exacerbated by the economic environment, where inflation rates are expected to hover around 4.2%, further straining consumer budgets and limiting purchasing power.

- Limited Consumer Awareness of Financing Options:Despite the growth of financing solutions, consumer awareness remains low, with only 32% of potential buyers familiar with available financing options in future. This lack of knowledge can hinder market growth, as many consumers may not explore financing due to misconceptions or lack of information. Educational initiatives and marketing efforts are essential to bridge this gap and encourage more individuals to consider financing for used car purchases.

Indonesia Used Car Financing Market Future Outlook

The Indonesia used car financing market is poised for significant transformation in the coming years, driven by technological advancements and changing consumer preferences. As digital platforms become more prevalent, the financing process will likely become more streamlined and accessible. Additionally, the increasing focus on sustainability may lead to the development of financing products that cater to eco-friendly vehicles, aligning with global trends. Overall, the market is expected to adapt to these dynamics, fostering growth and innovation in financing solutions.

Market Opportunities

- Growth of E-Commerce in Vehicle Sales:The rise of e-commerce platforms for vehicle sales presents a significant opportunity for used car financing. With online sales projected to account for 27% of total vehicle sales in future, integrating financing options into these platforms can enhance customer convenience and drive sales. This trend allows financing companies to reach a broader audience and streamline the purchasing process for consumers.

- Partnerships with Fintech Companies:Collaborating with fintech companies can create innovative financing solutions tailored to consumer needs. In future, partnerships are expected to increase, enabling traditional financing institutions to leverage technology for better customer engagement. These collaborations can enhance credit assessment processes and offer personalized financing products, ultimately expanding market reach and improving customer satisfaction.