Region:Global

Author(s):Geetanshi

Product Code:KRAA0289

Pages:87

Published On:August 2025

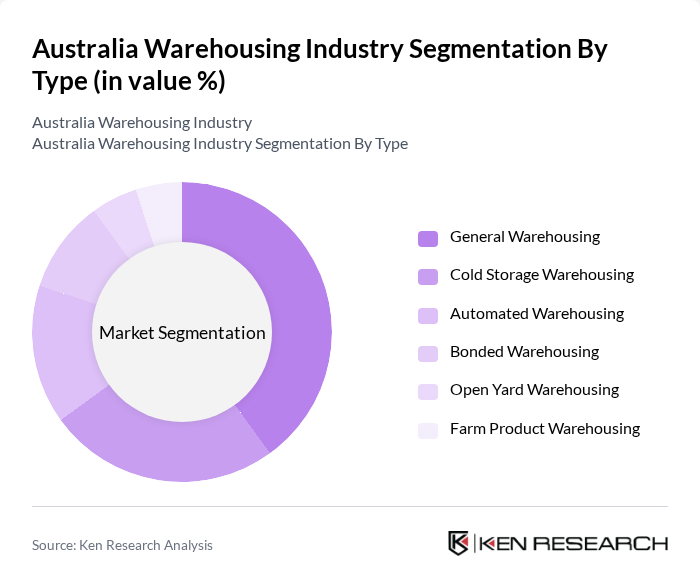

By Type:The warehousing industry in Australia is segmented into General Warehousing, Cold Storage Warehousing, Automated Warehousing, Bonded Warehousing, Open Yard Warehousing, and Farm Product Warehousing. General Warehousing remains the most dominant segment, supported by the broad need for storage solutions across retail, manufacturing, and distribution. Cold Storage Warehousing is expanding rapidly due to increased demand for temperature-controlled logistics in food, pharmaceuticals, and biotechnology. Automated Warehousing is also gaining share as companies invest in robotics and AI-driven inventory management to improve efficiency and accuracy .

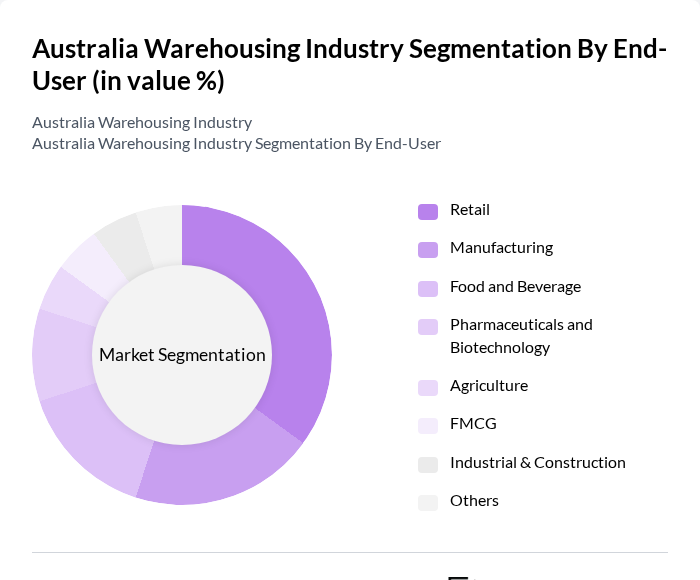

By End-User:The end-user segmentation of the warehousing industry includes Retail, Manufacturing, Food and Beverage, Pharmaceuticals and Biotechnology, Agriculture, FMCG, Industrial & Construction, and Others. The Retail sector leads due to the rapid growth of e-commerce and omnichannel retail models, which require advanced fulfillment and last-mile delivery solutions. The Food and Beverage sector is significant, driven by the need for specialized cold storage and inventory management to maintain product quality. Pharmaceuticals and Biotechnology are also growing end-users, reflecting the expansion of cold chain logistics and regulatory requirements .

The Australia Warehousing Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as Linfox, Toll Group, DB Schenker Australia, Qube Holdings, Mainfreight, Kuehne + Nagel Australia, DHL Supply Chain Australia, Australia Post, C.H. Robinson Australia, Visy Logistics, CEVA Logistics Australia, Amazon Australia, Woolworths Group (Supply Chain & Logistics), Coles Group (Supply Chain & Logistics), and XPO Logistics Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian warehousing industry appears promising, with a strong focus on technological integration and sustainability. As companies increasingly adopt automation and AI, operational efficiencies are expected to improve significantly. Furthermore, the emphasis on sustainable practices will drive investments in green technologies, aligning with global environmental goals. The industry's adaptability to changing consumer behaviors and economic conditions will be crucial in navigating challenges and seizing growth opportunities in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | General Warehousing Cold Storage Warehousing Automated Warehousing Bonded Warehousing Open Yard Warehousing Farm Product Warehousing |

| By End-User | Retail Manufacturing Food and Beverage Pharmaceuticals and Biotechnology Agriculture FMCG Industrial & Construction Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Northern Territory Australian Capital Territory |

| By Service Type | Storage Services Value-Added Services (Packaging, Labelling, Kitting) Transportation and Distribution Services Inventory Management Others |

| By Technology | Warehouse Management Systems (WMS) Automated Guided Vehicles (AGVs) Robotics IoT and Real-Time Tracking Others |

| By Ownership | Private Warehousing Public Warehousing Contract Warehousing (3PL/4PL) Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 60 | Warehouse Managers, Supply Chain Executives |

| Third-Party Logistics Providers | 50 | Operations Directors, Business Development Managers |

| Cold Storage Facilities | 40 | Facility Managers, Quality Assurance Officers |

| E-commerce Fulfillment Centers | 55 | eCommerce Operations Managers, Logistics Coordinators |

| Manufacturing Warehousing Solutions | 45 | Production Managers, Supply Chain Analysts |

The Australia Warehousing Industry is valued at approximately USD 18 billion, driven by the increasing demand for e-commerce and logistics services, as well as advancements in technology and consumer expectations for faster delivery times.