Region:Middle East

Author(s):Rebecca

Product Code:KRAA0376

Pages:96

Published On:August 2025

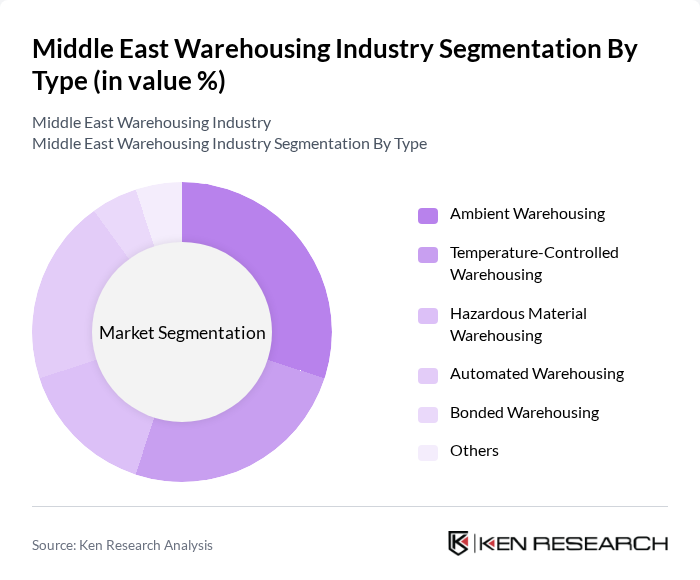

By Type:The warehousing market can be segmented into various types, including Ambient Warehousing, Temperature-Controlled Warehousing, Hazardous Material Warehousing, Automated Warehousing, Bonded Warehousing, and Others. Each type serves specific needs based on the nature of goods stored and the requirements of different industries. Ambient Warehousing is widely used for general merchandise and consumer goods, Temperature-Controlled Warehousing is critical for perishable products such as food and pharmaceuticals, Hazardous Material Warehousing is designed for chemicals and dangerous goods, Automated Warehousing leverages robotics and digital systems for high efficiency, and Bonded Warehousing supports goods under customs control.

The Ambient Warehousing segment dominates the market due to its versatility and ability to accommodate a wide range of products. This type of warehousing is essential for industries such as retail and e-commerce, where quick access to goods is crucial. The increasing demand for efficient storage solutions and the growth of online shopping have further solidified its leading position. Additionally, the rise in consumer expectations for faster delivery times has driven investments in ambient warehousing facilities .

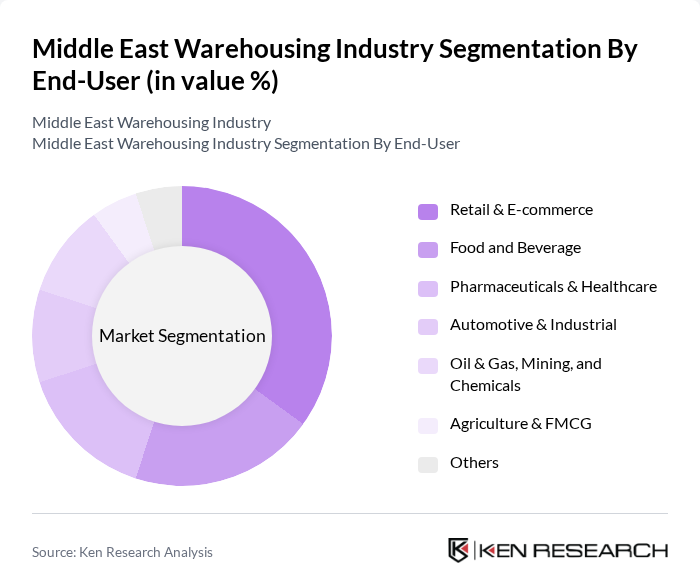

By End-User:The warehousing market is segmented by end-user industries, including Retail & E-commerce, Food and Beverage, Pharmaceuticals & Healthcare, Automotive & Industrial, Oil & Gas, Mining, and Chemicals, Agriculture & FMCG, and Others. Each end-user has unique requirements that influence the type of warehousing solutions they seek. Retail & E-commerce requires rapid order fulfillment and high inventory turnover, Food and Beverage needs temperature control and traceability, Pharmaceuticals & Healthcare demand strict regulatory compliance, Automotive & Industrial focus on just-in-time inventory, while Oil & Gas, Mining, and Chemicals require specialized handling and safety protocols.

The Retail & E-commerce segment is the largest end-user of warehousing services, driven by the exponential growth of online shopping. The need for efficient inventory management and quick order fulfillment has led retailers to invest heavily in warehousing solutions. Additionally, the increasing consumer preference for home delivery and the rise of omnichannel retailing have further fueled demand in this segment. As a result, companies are focusing on expanding their warehousing capabilities to meet the growing needs of this sector .

The Middle East Warehousing Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, Agility Logistics, DB Schenker, Kuehne + Nagel, DHL Supply Chain, CEVA Logistics, GAC Group, Al-Futtaim Logistics, Al Naboodah Group Enterprises, Gulf Warehousing Company (GWC), RSA Global, Tristar Group, Emirates Logistics LLC, Binzagr Logistics, National Shipping Company of Saudi Arabia (Bahri) contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East warehousing industry is poised for significant transformation, driven by technological advancements and increased demand from e-commerce. As governments continue to invest in logistics infrastructure, the region will likely see enhanced connectivity and efficiency in supply chains. Additionally, the integration of automation and smart technologies will redefine operational standards, enabling warehouses to meet the evolving needs of businesses. This dynamic environment presents both challenges and opportunities for stakeholders in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Ambient Warehousing Temperature-Controlled Warehousing Hazardous Material Warehousing Automated Warehousing Bonded Warehousing Others |

| By End-User | Retail & E-commerce Food and Beverage Pharmaceuticals & Healthcare Automotive & Industrial Oil & Gas, Mining, and Chemicals Agriculture & FMCG Others |

| By Service Type | Storage Services Value-Added Services (Packaging, Labelling, Kitting) Distribution & Transportation Services Inventory Management Services Cross-Docking Services Others |

| By Location | Urban Warehousing Suburban Warehousing Rural Warehousing Free Zone Warehousing Others |

| By Ownership | Private Warehousing Public Warehousing Contract Warehousing (3PL/4PL) Cooperative Warehousing Others |

| By Technology Utilization | Manual Warehousing Semi-Automated Warehousing Fully Automated Warehousing Smart Warehousing (IoT, WMS, Robotics) Others |

| By Duration of Lease | Short-Term Lease Long-Term Lease Flexible/On-Demand Warehousing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 100 | Warehouse Managers, Logistics Coordinators |

| Pharmaceutical Distribution Centers | 60 | Supply Chain Directors, Compliance Officers |

| E-commerce Fulfillment Centers | 80 | Operations Managers, IT Systems Analysts |

| Cold Storage Facilities | 50 | Facility Managers, Quality Assurance Leads |

| Third-Party Logistics Providers | 60 | Business Development Managers, Account Executives |

The Middle East Warehousing Industry is valued at approximately USD 45 million, driven by the growth of e-commerce, logistics services demand, and infrastructure investments. This market is expected to continue expanding due to rising consumer spending and technological advancements.