Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1171

Pages:83

Published On:November 2025

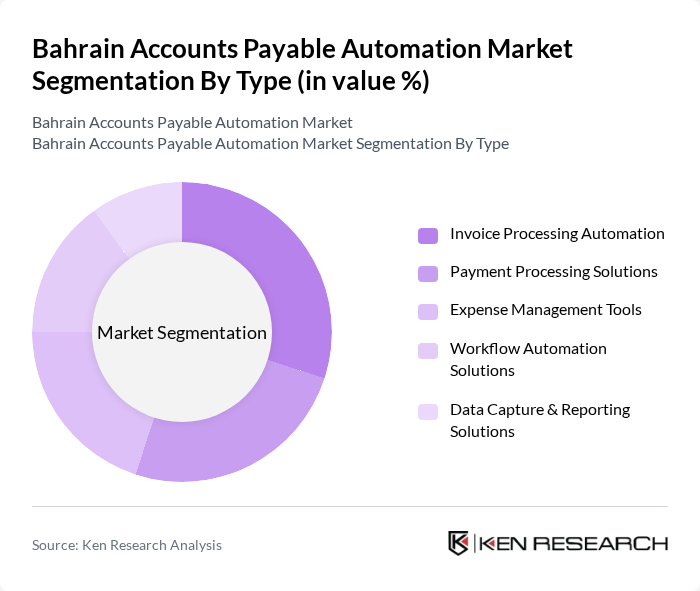

By Type:The segmentation by type includes various solutions that cater to different aspects of accounts payable automation. The subsegments are Invoice Processing Automation, Payment Processing Solutions, Expense Management Tools, Workflow Automation Solutions, and Data Capture & Reporting Solutions. Each of these subsegments plays a crucial role in enhancing the efficiency and accuracy of financial operations. Invoice Processing Automation leads due to its ability to automate invoice capture, validation, and approval, while Payment Processing Solutions and Expense Management Tools are increasingly adopted for their integration capabilities with ERP and mobile platforms .

The Invoice Processing Automation subsegment is currently dominating the market due to its ability to significantly reduce manual errors and processing time. Organizations are increasingly adopting this technology to automate the capture, validation, and approval of invoices, which enhances operational efficiency. The growing trend of digital transformation in finance, including touchless processing and real-time analytics, is driving the demand for such solutions, as businesses seek to streamline their accounts payable processes and improve cash flow management .

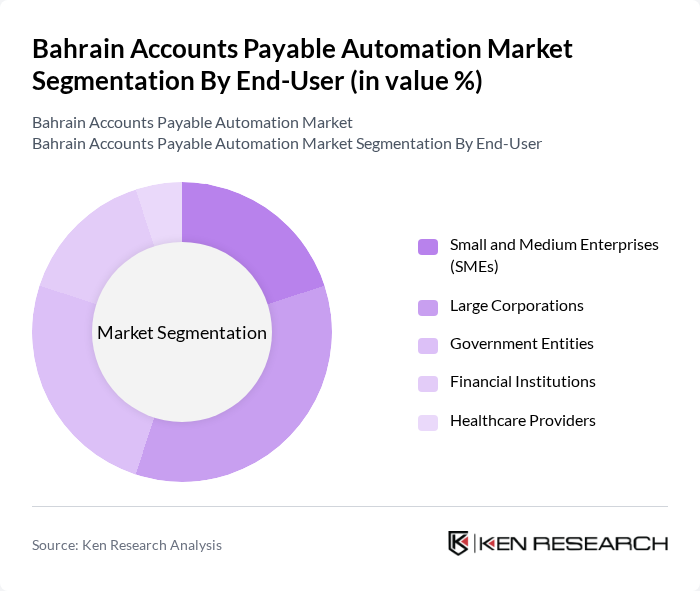

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, Financial Institutions, and Healthcare Providers. Each of these segments has unique requirements and challenges that accounts payable automation solutions can address effectively. Large Corporations and Government Entities are leading adopters, driven by the need for compliance, scalability, and integration with existing ERP systems, while SMEs are increasingly adopting cloud-based solutions for cost efficiency .

Large Corporations are leading the end-user segment due to their complex financial operations and the need for robust automation solutions to manage high volumes of transactions. These organizations are increasingly investing in accounts payable automation to enhance efficiency, reduce costs, and ensure compliance with regulatory requirements. The trend towards digital transformation in large enterprises is driving the adoption of advanced automation technologies, making this subsegment a key player in the market .

The Bahrain Accounts Payable Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP Concur, Coupa Software, Oracle, Tipalti, Basware, AvidXchange, Tradeshift, Ariba (SAP Ariba), Xero, Zoho Books, Sage Intacct, FreshBooks, Paycor, Bill.com, QuickBooks (Intuit), Serrala, ApprovalMax, Kyriba, FIS Global, Infor contribute to innovation, geographic expansion, and service delivery in this space .

The future of the accounts payable automation market in Bahrain appears promising, driven by ongoing digital transformation and increasing operational efficiency demands. As businesses continue to adapt to technological advancements, the integration of artificial intelligence and machine learning into automation processes is expected to enhance decision-making capabilities. Furthermore, the growing trend of remote work will likely accelerate the adoption of cloud-based solutions, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Invoice Processing Automation Payment Processing Solutions Expense Management Tools Workflow Automation Solutions Data Capture & Reporting Solutions |

| By End-User | Small and Medium Enterprises (SMEs) Large Corporations Government Entities Financial Institutions Healthcare Providers |

| By Industry Vertical | Financial Services (BFSI) Healthcare Retail & E-commerce Manufacturing Oil & Gas Government & Public Sector Others |

| By Deployment Mode | On-Premises Solutions Cloud-Based Solutions Hybrid Solutions |

| By Payment Method | ACH Transfers Credit/Debit Cards Digital Wallets Bank Transfers Others |

| By Geographic Presence | Manama Muharraq Southern Governorate Northern Governorate Others |

| By Integration Capability | ERP Integration Third-Party Software Integration API Integration RPA (Robotic Process Automation) Integration Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Automation | 100 | CFOs, Financial Analysts |

| Healthcare Accounts Payable | 60 | Finance Managers, Procurement Officers |

| Retail Industry Automation | 50 | IT Managers, Operations Directors |

| Manufacturing Sector Solutions | 40 | Supply Chain Managers, Financial Controllers |

| Government Agencies Automation | 40 | Budget Officers, IT Administrators |

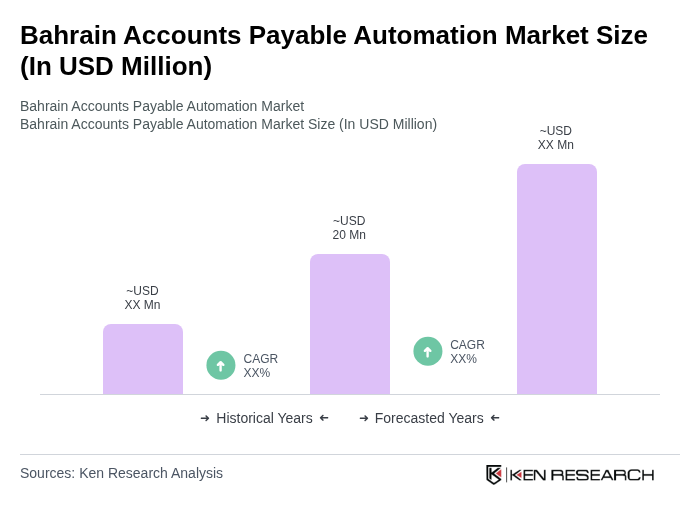

The Bahrain Accounts Payable Automation Market is valued at approximately USD 20 million, reflecting a growing demand for operational efficiency, cost reduction, and enhanced accuracy in financial processes driven by advanced technologies like AI and machine learning.