Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4813

Pages:86

Published On:December 2025

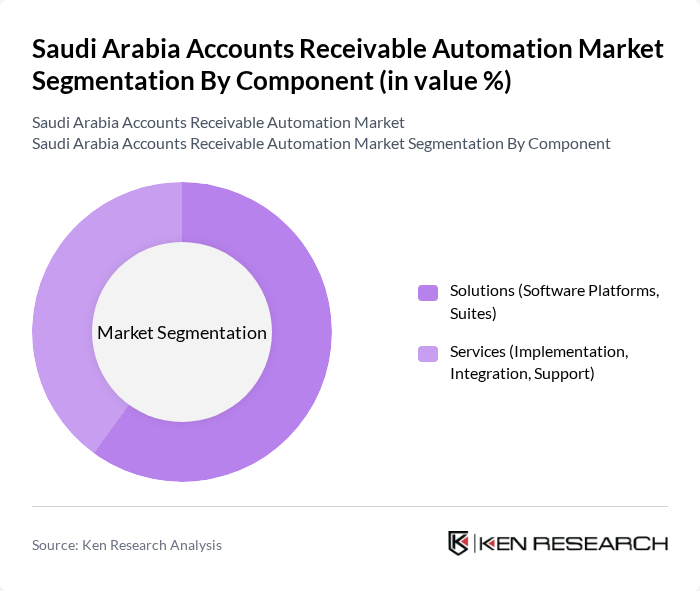

By Component:The accounts receivable automation market is segmented into two main components: Solutions and Services. Solutions include software platforms and suites that automate invoicing, credit management, and payment processes, while Services encompass implementation, integration, training, managed services, and ongoing support that ensure the effective deployment, localization, and maintenance of these solutions in line with Saudi regulatory and IT environments.

The Solutions segment, particularly software platforms and suites, dominates the market due to the increasing need for businesses to automate their invoicing and payment processes and integrate with ZATCA-compliant e?invoicing systems. Companies are increasingly adopting these solutions to enhance operational efficiency, reduce manual errors, improve days sales outstanding (DSO), and gain real-time visibility into receivables. The trend towards digital transformation, cloud?based deployments, and AI?enabled cash application and risk analytics further bolsters the demand for software platforms. As businesses seek to streamline their financial operations and comply with e?invoicing and VAT requirements, the Solutions segment is expected to maintain its leadership position in the market.

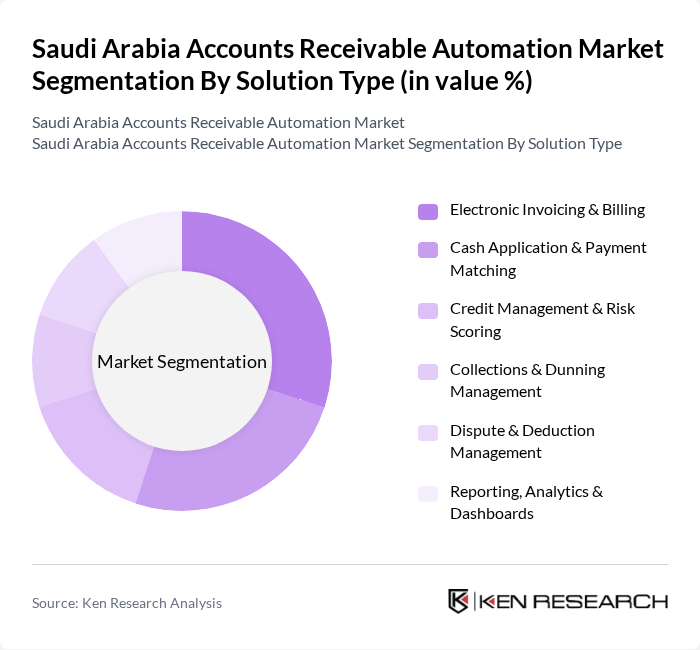

By Solution Type:The market is also segmented by solution type, which includes Electronic Invoicing & Billing, Cash Application & Payment Matching, Credit Management & Risk Scoring, Collections & Dunning Management, Dispute & Deduction Management, and Reporting, Analytics & Dashboards. Each of these solution types addresses specific needs within the accounts receivable process, from front?end invoice generation and compliance to back?end reconciliation, collections, and analytics.

The Electronic Invoicing & Billing solution type leads the market, driven by regulatory mandates such as the ZATCA E?Invoicing (FATOORAH) Regulation and the need for businesses to standardize and digitize their invoicing processes. The increasing adoption of digital payment methods, real?time payment rails, and online banking, along with the demand for real-time transaction visibility and automated tax calculation, further enhances the growth of this segment. Cash Application & Payment Matching follows closely, as organizations seek to automate reconciliation of high?volume payments from bank transfers, cards, and local schemes like mada and SADAD to improve cash flow, reduce unapplied cash, and shorten reconciliation cycles. Overall, the focus on efficiency, compliance, and data?driven credit and collections strategies is propelling the growth of these solution types.

The Saudi Arabia Accounts Receivable Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Corporation, FIS (Fidelity National Information Services, Inc.), Fiserv, Inc., HighRadius Corporation, Billtrust (BTRS Holdings Inc.), Esker SA, BlackLine, Inc., Zoho Corporation, Zoho-owned Vtiger / CRM & Billing Integrations, Odoo S.A., Sage Group plc, Xero Limited, Saudi Payments (mada) & SADAD-related AR Integration Vendors contribute to innovation, geographic expansion, and service delivery in this space.

As the Saudi Arabian economy continues to diversify and grow, the demand for accounts receivable automation is expected to rise significantly in future. The integration of advanced technologies such as artificial intelligence and machine learning will enhance automation capabilities, providing businesses with real-time insights and improved decision-making tools. Additionally, the government's ongoing support for digital initiatives will likely accelerate the adoption of these solutions, positioning companies to better manage their receivables and improve overall financial health.

| Segment | Sub-Segments |

|---|---|

| By Component | Solutions (Software Platforms, Suites) Services (Implementation, Integration, Support) |

| By Solution Type | Electronic Invoicing & Billing Cash Application & Payment Matching Credit Management & Risk Scoring Collections & Dunning Management Dispute & Deduction Management Reporting, Analytics & Dashboards |

| By Deployment Model | Cloud (Public & Private) On-Premises Hybrid |

| By Organization Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Industry Vertical | Banking, Financial Services and Insurance (BFSI) Retail & E?Commerce Manufacturing & Industrial Healthcare & Pharmaceuticals Telecom & IT Services Government & Public Sector Others (Logistics, Construction, Utilities, etc.) |

| By Integration Environment | Standalone AR Automation Integrated with ERP Systems Integrated with Accounting / Billing Platforms |

| By End?Market in Saudi Arabia | Government & Semi?Government Entities Private Sector – Large Corporate Groups Private Sector – SMEs & Start?ups |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Accounts Receivable | 100 | CFOs, Finance Managers |

| Manufacturing Industry Automation | 95 | Operations Managers, IT Directors |

| Healthcare Financial Management | 85 | Finance Officers, Billing Managers |

| Telecommunications Receivables Management | 75 | Revenue Assurance Managers, Financial Analysts |

| SME Accounts Receivable Automation | 90 | Business Owners, Financial Controllers |

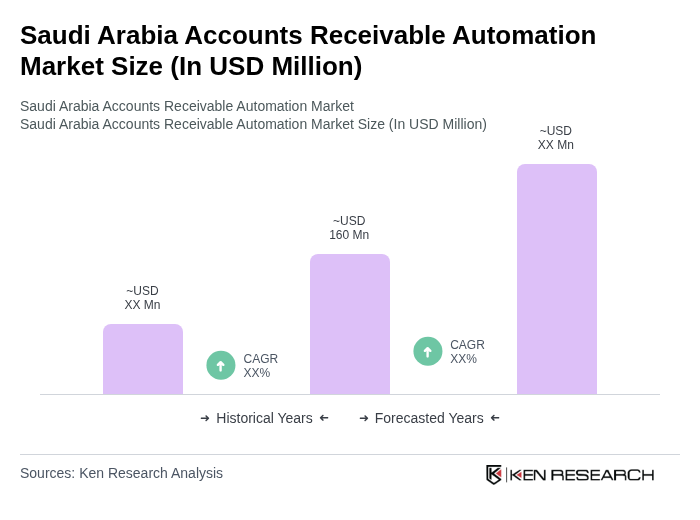

The Saudi Arabia Accounts Receivable Automation Market is valued at approximately USD 160 million, reflecting a significant growth driven by the increasing adoption of digital payment solutions and the need for efficient cash flow management among businesses.