Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4038

Pages:97

Published On:December 2025

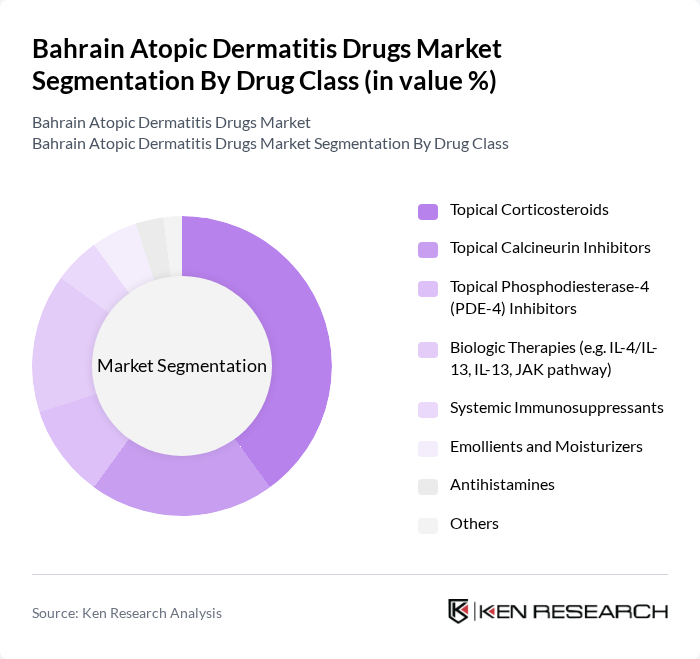

By Drug Class:The drug class segmentation includes various therapeutic options for managing atopic dermatitis. The market is primarily driven by topical corticosteroids, which are widely used due to their effectiveness in reducing inflammation and itching. Other significant classes include topical calcineurin inhibitors and biologic therapies, which are gaining traction due to their targeted action and improved safety profiles. The increasing awareness of skin health and the demand for innovative treatments are propelling the growth of these segments.

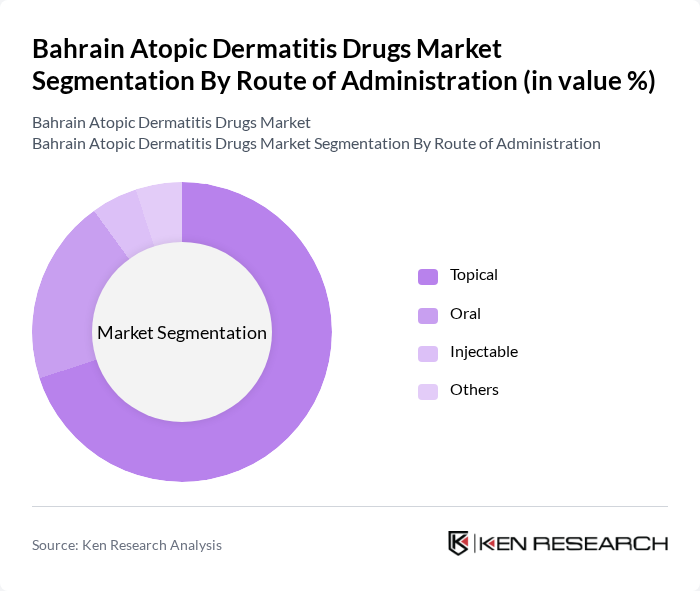

By Route of Administration:The route of administration for atopic dermatitis drugs includes topical, oral, and injectable options. Topical administration remains the most prevalent due to its direct application to affected areas, providing quick relief. Oral medications are also significant, particularly for systemic treatments, while injectable therapies are emerging as effective options for severe cases. The preference for topical treatments is driven by their ease of use and lower side effects compared to systemic alternatives.

The Bahrain Atopic Dermatitis Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as AbbVie Inc., Sanofi S.A., Regeneron Pharmaceuticals, Inc., Pfizer Inc., Novartis AG, GlaxoSmithKline plc (GSK plc), Eli Lilly and Company, Leo Pharma A/S, Galderma S.A., Astellas Pharma Inc., UCB S.A., Amgen Inc., Takeda Pharmaceutical Company Limited, Sandoz Group AG, Julphar Gulf Pharmaceutical Industries PSC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the atopic dermatitis drugs market in Bahrain appears promising, driven by ongoing advancements in treatment options and increasing public awareness. The integration of telemedicine is expected to enhance patient access to dermatological care, allowing for timely consultations and follow-ups. Additionally, the growing trend towards personalized medicine will likely lead to more tailored treatment plans, improving patient outcomes and satisfaction. As the healthcare landscape evolves, stakeholders must adapt to these changes to meet the rising demand effectively.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Topical Corticosteroids Topical Calcineurin Inhibitors Topical Phosphodiesterase-4 (PDE-4) Inhibitors Biologic Therapies (e.g. IL-4/IL-13, IL-13, JAK pathway) Systemic Immunosuppressants Emollients and Moisturizers Antihistamines Others |

| By Route of Administration | Topical Oral Injectable Others |

| By Patient Demographics | Pediatric Adult Geriatric Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Government & Institutional Tenders Others |

| By Geography | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate Others |

| By Treatment Type | Acute Flare Management Maintenance / Long-term Control Adjunctive and Preventive Skin Care Others |

| By Market Segment | Prescription Drugs Over-the-Counter Products Biologic / Specialty Drugs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 60 | Dermatologists, Clinic Managers |

| Pharmacies | 50 | Pharmacists, Pharmacy Managers |

| Patient Advocacy Groups | 40 | Patient Representatives, Health Advocates |

| Healthcare Providers | 70 | General Practitioners, Family Physicians |

| Research Institutions | 40 | Clinical Researchers, Academic Professors |

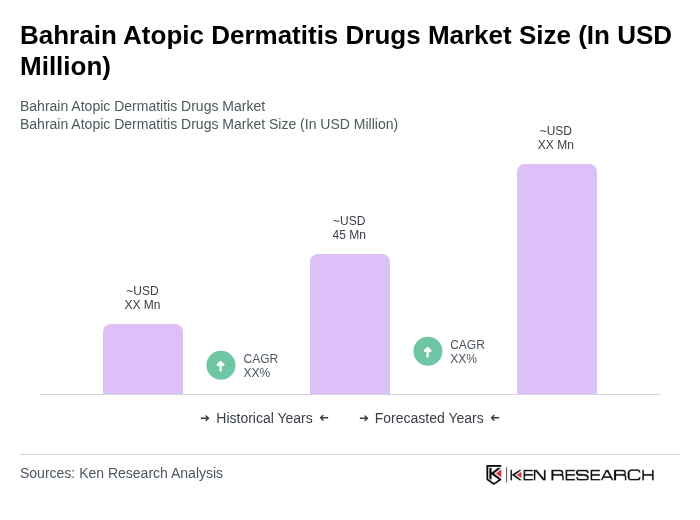

The Bahrain Atopic Dermatitis Drugs Market is valued at approximately USD 45 million, reflecting a five-year historical analysis. This valuation is influenced by the rising prevalence of atopic dermatitis and the introduction of advanced therapeutic options.