Region:North America

Author(s):Dev

Product Code:KRAC3477

Pages:87

Published On:October 2025

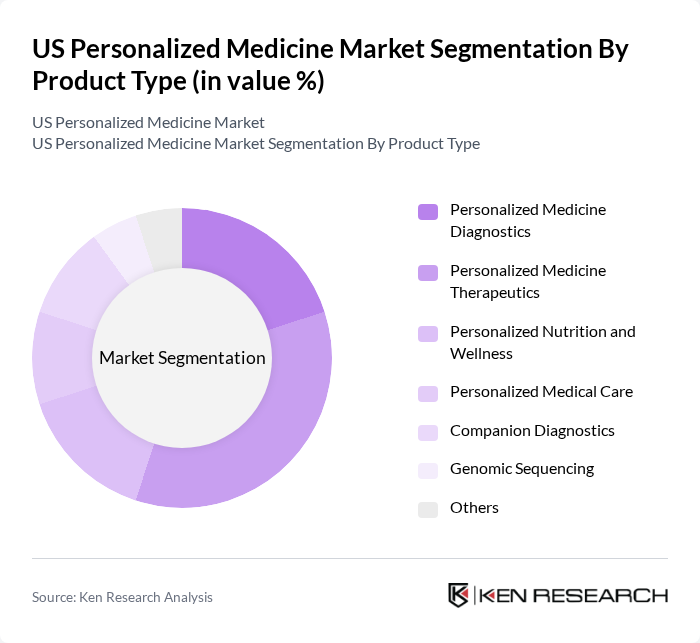

By Product Type:The product type segmentation includes various subsegments such as Personalized Medicine Diagnostics, Personalized Medicine Therapeutics, Personalized Nutrition and Wellness, Personalized Medical Care, Companion Diagnostics, Genomic Sequencing, and Others. Among these, Personalized Medicine Therapeutics is currently the leading subsegment, driven by the increasing demand for targeted therapies that cater to individual patient profiles. The rise in chronic diseases and the need for effective treatment options have further fueled the growth of this segment. Personalized Nutrition and Wellness is also expanding rapidly, reflecting consumer demand for individualized health and lifestyle solutions .

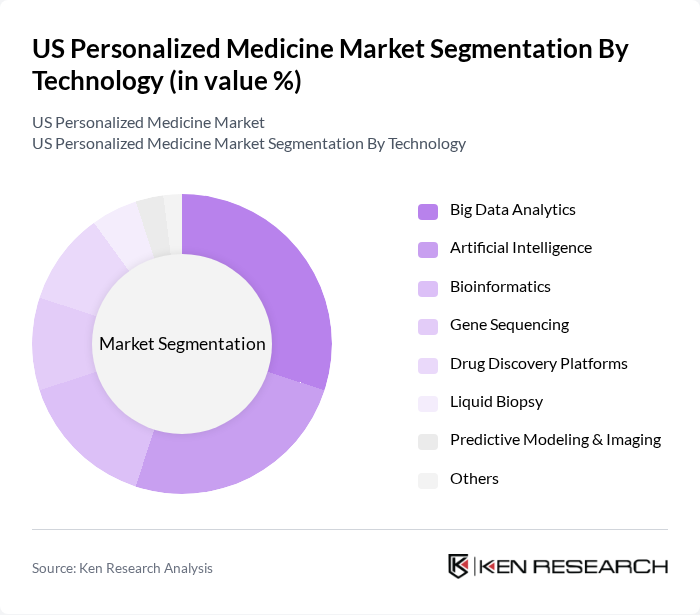

By Technology:The technology segmentation encompasses Big Data Analytics, Artificial Intelligence, Bioinformatics, Gene Sequencing, Drug Discovery Platforms, Liquid Biopsy, Predictive Modeling & Imaging, and Others. Big Data Analytics is the dominant technology in this market, as it enables healthcare providers to analyze vast amounts of patient data to derive insights that lead to personalized treatment plans. The increasing reliance on data-driven decision-making in healthcare is propelling the growth of this segment. Artificial Intelligence is also rapidly gaining adoption, supporting clinical decision-making and accelerating drug discovery processes .

The US Personalized Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illumina, Inc., Thermo Fisher Scientific Inc., Danaher Corporation (Cepheid Inc.), Foundation Medicine, Inc., Myriad Genetics, Inc., Exact Sciences Corporation, Guardant Health, Inc., Genentech, Inc., Pfizer Inc., Roche Holding AG, Novartis AG, GSK plc, AstraZeneca PLC, Merck & Co., Inc., Regeneron Pharmaceuticals, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US personalized medicine market appears promising, driven by ongoing technological advancements and a growing emphasis on patient-centric care. As healthcare systems increasingly adopt value-based care models, personalized medicine is expected to play a pivotal role in improving patient outcomes and reducing overall healthcare costs. Furthermore, the integration of artificial intelligence in treatment planning and diagnostics is anticipated to enhance the precision and efficiency of personalized therapies, paving the way for innovative solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Personalized Medicine Diagnostics Personalized Medicine Therapeutics Personalized Nutrition and Wellness Personalized Medical Care Companion Diagnostics Genomic Sequencing Others |

| By Technology | Big Data Analytics Artificial Intelligence Bioinformatics Gene Sequencing Drug Discovery Platforms Liquid Biopsy Predictive Modeling & Imaging Others |

| By Application | Oncology Central Nervous System (CNS) Disorders Immunology Cardiovascular Diseases Infectious Diseases Respiratory Diseases Liver Diseases Rheumatology Others |

| By End-User | Hospitals Diagnostic Centers/Laboratories Research & Academic Institutes Pharmaceutical & Biotechnology Companies Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Pharmacies Others |

| By Region | Northeast Midwest South West Others |

| By Patient Demographics | Age Group Gender Socioeconomic Status Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Personalized Treatments | 120 | Oncologists, Clinical Researchers |

| Genomic Testing Services | 90 | Laboratory Directors, Genetic Counselors |

| Patient Experience in Personalized Medicine | 60 | Patients, Caregivers |

| Pharmaceutical Development for Rare Diseases | 50 | Pharmaceutical Executives, R&D Managers |

| Healthcare Policy Impact on Personalized Medicine | 40 | Healthcare Policy Analysts, Government Officials |

The US Personalized Medicine Market is valued at approximately USD 65 billion, driven by advancements in genomics, targeted therapies, and a focus on individualized patient care. This valuation is based on a comprehensive five-year historical analysis.