Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1267

Pages:85

Published On:November 2025

By Type:The market is segmented into various types of automation testing, including Functional Testing, Performance Testing, Security Testing, Regression Testing, Load Testing, API Testing, Compatibility Testing, and Others. Each of these sub-segments plays a crucial role in ensuring the quality and reliability of software applications. The adoption of functional and performance testing is particularly strong, reflecting the need for robust validation of business-critical applications and user experience .

The Functional Testing sub-segment is currently dominating the market due to its critical role in validating that software applications perform their intended functions correctly. As organizations increasingly prioritize user experience and software reliability, the demand for functional testing solutions has surged. This trend is further fueled by the growing complexity of software applications, necessitating comprehensive testing strategies to ensure quality and compliance with user requirements. Consequently, functional testing is expected to maintain its leadership position in the automation testing market .

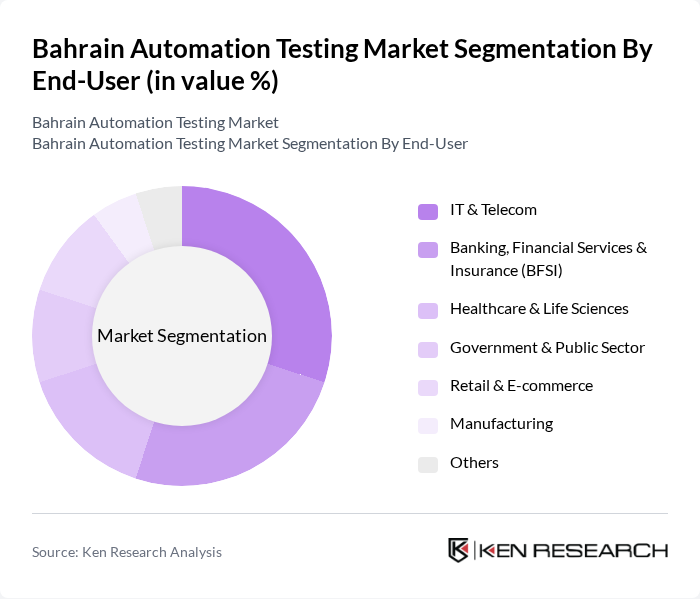

By End-User:The market is segmented by end-user industries, including IT & Telecom, Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, Government & Public Sector, Retail & E-commerce, Manufacturing, and Others. Each sector has unique requirements and challenges that drive the adoption of automation testing solutions. The IT & Telecom and BFSI sectors are leading due to their high volume of digital transactions and stringent compliance requirements .

The IT & Telecom sector is the leading end-user of automation testing solutions, driven by the rapid pace of technological advancements and the need for high-quality software applications. As companies in this sector strive to enhance their service offerings and improve customer satisfaction, the demand for automation testing has increased significantly. Additionally, the BFSI sector follows closely, as stringent regulatory requirements and the need for secure and reliable financial applications necessitate robust testing solutions. This trend is expected to continue as both sectors evolve and adapt to changing market dynamics .

The Bahrain Automation Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Technology Companies Society (BTECH), Gulf Business Machines (GBM Bahrain), Axiom Telecom, BMC Software, Micro Focus, Eggplant (now part of Keysight Technologies), Tricentis, SmartBear Software, Selenium (Open Source Community), QASymphony (now part of Tricentis), Accenture, Infosys, Wipro, Capgemini, Cognizant contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain automation testing market appears promising, driven by technological advancements and an increasing emphasis on software quality. As organizations continue to embrace Agile and DevOps methodologies, the demand for continuous testing will rise. Furthermore, the integration of AI and machine learning into testing processes is expected to enhance efficiency and accuracy, paving the way for innovative solutions that address the evolving needs of the software development landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Functional Testing Performance Testing Security Testing Regression Testing Load Testing API Testing Compatibility Testing Others |

| By End-User | IT & Telecom Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Government & Public Sector Retail & E-commerce Manufacturing Others |

| By Industry Vertical | Banking and Financial Services Retail Manufacturing Government Oil & Gas Utilities Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Testing Type | Manual Testing Automated Testing Others |

| By Service Type | Consulting Services Implementation Services Support and Maintenance Services Training & Education Services Others |

| By Policy Support | Government Initiatives Industry Standards Financial Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Automation Testing | 60 | IT Managers, QA Leads |

| Telecommunications Software Testing | 50 | Network Engineers, Software Developers |

| Healthcare Application Testing | 40 | Compliance Officers, IT Directors |

| Government Digital Services Testing | 45 | Project Managers, System Analysts |

| Retail E-commerce Testing | 55 | eCommerce Managers, UX Designers |

The Bahrain Automation Testing Market is valued at approximately USD 20 million, reflecting a significant growth trend driven by digital transformation initiatives across various sectors, including banking, telecom, and government.