Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1151

Pages:81

Published On:November 2025

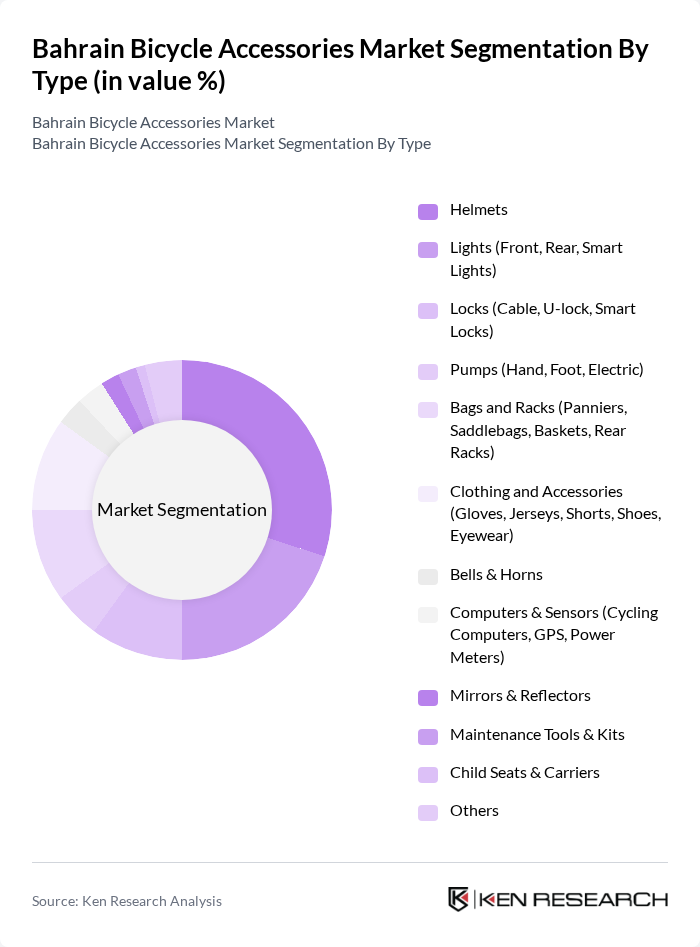

By Type:The market is segmented into various types of bicycle accessories, including helmets, lights, locks, pumps, bags and racks, clothing and accessories, bells and horns, computers and sensors, mirrors and reflectors, maintenance tools and kits, child seats and carriers, and others. Among these, helmets and lights are particularly popular due to increasing safety awareness among cyclists and the impact of recent regulatory measures. The market also reflects growing demand for smart lighting systems, digital cycling computers, and eco-sustainable accessory materials .

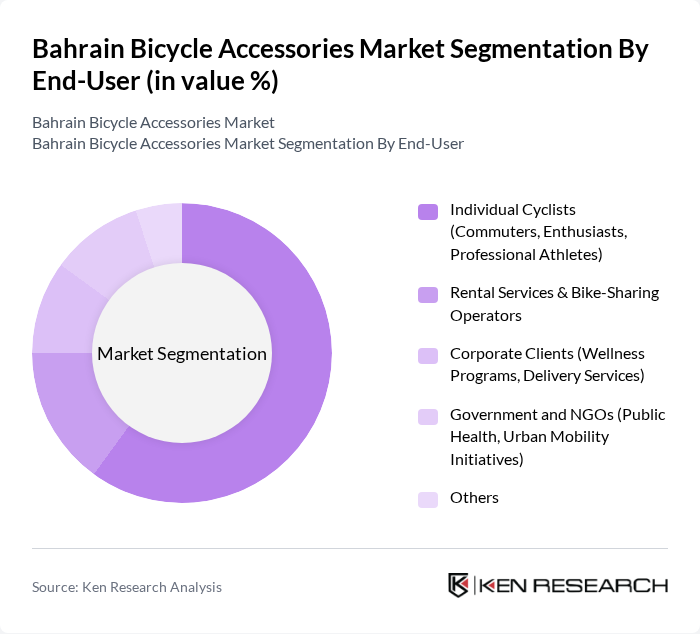

By End-User:The end-user segmentation includes individual cyclists, rental services and bike-sharing operators, corporate clients, government and NGOs, and others. Individual cyclists, including commuters and enthusiasts, represent the largest segment due to the growing trend of cycling for fitness and leisure. The segment is further supported by wellness programs and urban mobility initiatives, with rental and bike-sharing services gaining traction in urban centers .

The Bahrain Bicycle Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Bicycle Company, Almoayyed International Group, Gulf Cycles, Cycle World Bahrain, Bahrain Cycling Association, Al Hilal Group, Sports Corner Bahrain, The Bike Shop Bahrain, Adventure HQ Bahrain, Adventure Sports Bahrain, Decathlon Bahrain, Al Mohannad Bicycle Store, Bahrain Bike Rentals, Speedy Bikes Bahrain, Giant Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain bicycle accessories market appears promising, driven by increasing health consciousness and urbanization trends. As the government continues to invest in cycling infrastructure, the market is likely to see a rise in cycling participation. Additionally, the growing popularity of electric bicycles is expected to create new segments within the market. With a focus on sustainability and innovation, the industry is poised for significant growth, attracting both local and international players.

| Segment | Sub-Segments |

|---|---|

| By Type | Helmets Lights (Front, Rear, Smart Lights) Locks (Cable, U-lock, Smart Locks) Pumps (Hand, Foot, Electric) Bags and Racks (Panniers, Saddlebags, Baskets, Rear Racks) Clothing and Accessories (Gloves, Jerseys, Shorts, Shoes, Eyewear) Bells & Horns Computers & Sensors (Cycling Computers, GPS, Power Meters) Mirrors & Reflectors Maintenance Tools & Kits Child Seats & Carriers Others |

| By End-User | Individual Cyclists (Commuters, Enthusiasts, Professional Athletes) Rental Services & Bike-Sharing Operators Corporate Clients (Wellness Programs, Delivery Services) Government and NGOs (Public Health, Urban Mobility Initiatives) Others |

| By Distribution Channel | Online Retail (E-commerce, Brand Websites, Marketplaces) Specialty Bicycle Shops Sports Goods Stores Supermarkets and Hypermarkets Direct Sales Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand Preference | Local Brands International Brands (e.g., Shimano, Giant, Trek, Specialized, Decathlon) Emerging Brands Others |

| By Usage Frequency | Daily Users Weekly Users Occasional Users Others |

| By Customer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bicycle Retailers | 60 | Store Owners, Sales Managers |

| Online Bicycle Accessory Sellers | 50 | E-commerce Managers, Marketing Directors |

| Cycling Enthusiasts | 100 | Regular Cyclists, Club Members |

| Manufacturers of Bicycle Accessories | 40 | Product Development Managers, Supply Chain Executives |

| Local Cycling Event Organizers | 40 | Event Coordinators, Sponsorship Managers |

The Bahrain Bicycle Accessories Market is valued at approximately USD 15 million, driven by increasing urbanization, health consciousness, and government initiatives promoting cycling as a sustainable transportation option.