Region:Middle East

Author(s):Shubham

Product Code:KRAD3689

Pages:91

Published On:November 2025

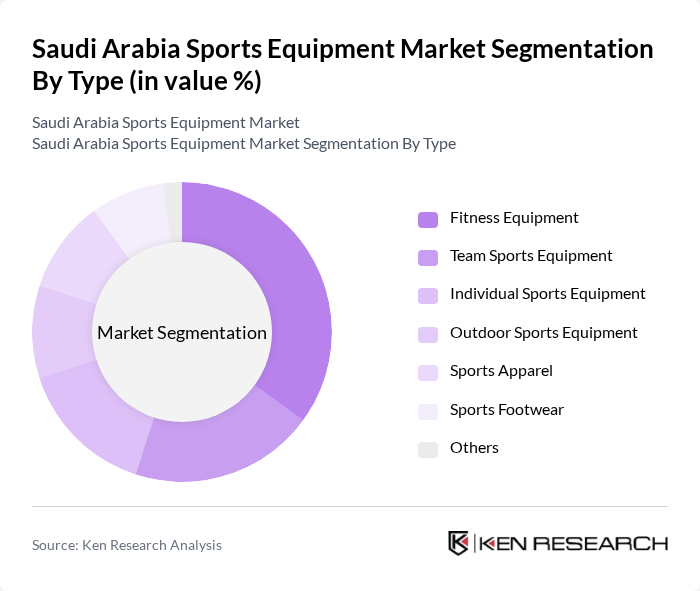

By Type:The market is segmented into various types of sports equipment, including fitness equipment, team sports equipment, individual sports equipment, outdoor sports equipment, sports apparel, sports footwear, and others. Among these, fitness equipment has emerged as a leading segment due to the growing trend of home workouts and fitness awareness. The demand for gym equipment, such as treadmills and weights, has significantly increased as consumers prioritize health and fitness.

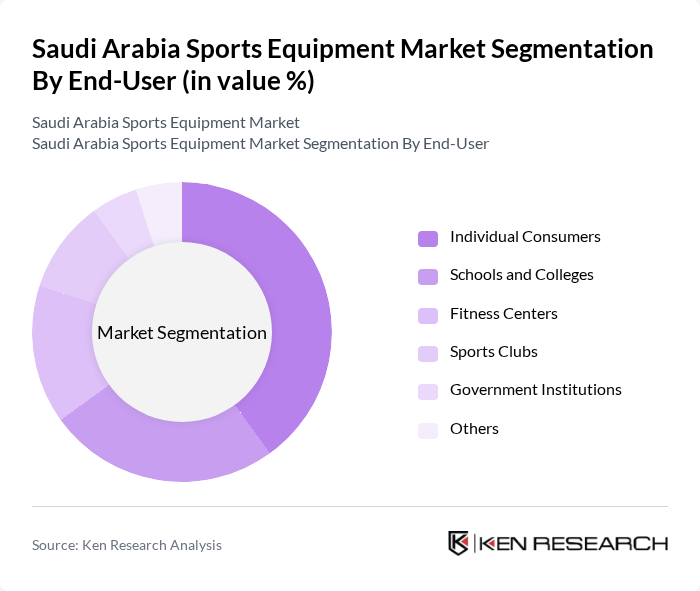

By End-User:The end-user segmentation includes individual consumers, schools and colleges, fitness centers, sports clubs, government institutions, and others. Individual consumers represent the largest segment, driven by the increasing trend of personal fitness and home workouts. Schools and colleges are also significant users, as they invest in sports equipment to promote physical education and extracurricular activities.

The Saudi Arabia Sports Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adidas, Nike, Puma, Under Armour, Decathlon, Wilson Sporting Goods, Mizuno, Asics, Reebok, New Balance, Kappa, The North Face, Salomon, Head, and Yonex contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia sports equipment market is poised for significant growth, driven by increasing health consciousness and government support for sports initiatives. As disposable incomes rise, consumers are expected to invest more in fitness-related products. Additionally, the expansion of e-commerce platforms will facilitate access to a wider range of sports equipment. The growing popularity of fitness trends, particularly among youth and women, will further enhance market dynamics, creating a vibrant environment for innovation and investment.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Team Sports Equipment Individual Sports Equipment Outdoor Sports Equipment Sports Apparel Sports Footwear Others |

| By End-User | Individual Consumers Schools and Colleges Fitness Centers Sports Clubs Government Institutions Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Price Range | Budget Mid-range Premium Others |

| By Brand Type | Domestic Brands International Brands Private Labels Others |

| By Age Group | Children Teenagers Adults Seniors Others |

| By Sport Type | Football Basketball Tennis Athletics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Equipment Sales | 150 | Store Managers, Sales Representatives |

| Consumer Preferences in Sports Equipment | 200 | Active Sports Participants, Fitness Enthusiasts |

| Distribution Channels for Sports Equipment | 100 | Logistics Managers, Supply Chain Coordinators |

| Market Trends in Fitness Equipment | 120 | Fitness Center Owners, Personal Trainers |

| Impact of Government Initiatives on Sports Participation | 80 | Policy Makers, Sports Administrators |

The Saudi Arabia Sports Equipment Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health consciousness, government initiatives, and the rising popularity of various sports activities among the population.