Region:Middle East

Author(s):Rebecca

Product Code:KRAD4209

Pages:95

Published On:December 2025

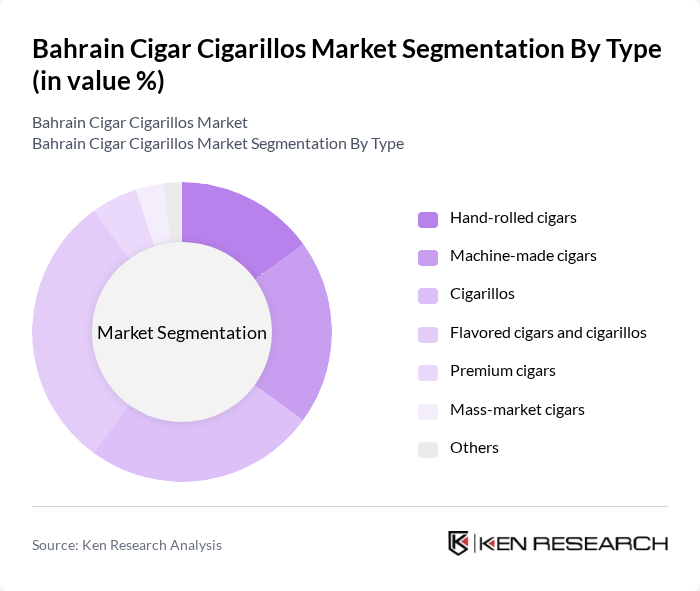

By Type:The market is segmented into various types, including hand-rolled cigars, machine-made cigars, cigarillos, flavored cigars and cigarillos, premium cigars, mass-market cigars, and others. Machine-made cigars and flavored cigars and cigarillos have gained significant popularity due to their affordability, accessibility, and variety, appealing to a broader base of occasional and younger adult smokers. The demand for premium cigars has also increased, driven by a growing trend of luxury consumption, gifting, and lounge-based experiences among affluent consumers and expatriates.

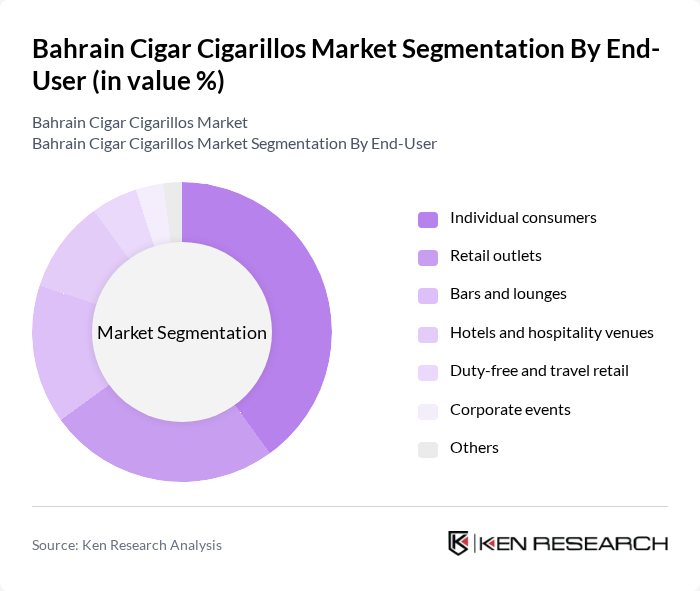

By End-User:The end-user segmentation includes individual consumers, retail outlets, bars and lounges, hotels and hospitality venues, duty-free and travel retail, corporate events, and others. Individual consumers and bars and lounges together represent the leading demand segments, reflecting the importance of social smoking occasions, private consumption, and premium lounge experiences in Bahrain’s cigar culture. Retail outlets, hotels, and duty-free and travel retail channels also play a crucial role in distribution, serving both local high-income buyers and international travelers transiting through Bahrain’s airports and luxury hospitality venues.

The Bahrain Cigar Cigarillos Market is characterized by a dynamic mix of regional and international players. Leading participants such as Habanos S.A., Scandinavian Tobacco Group A/S, Davidoff of Geneva (Oettinger Davidoff AG), Imperial Brands PLC, Al Fakher Tobacco Trading, Bahrain Duty Free Shop Complex B.S.C., Cigar Lounge Bahrain, Cigar World Bahrain, The Cigar Company Bahrain, Cigar Emporium Bahrain, The Cigar Bar Bahrain, Cigar Boutique Bahrain, Cigar Palace Bahrain, Cigar Society Bahrain, La Casa Del Habano Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain Cigar Cigarillos market is poised for dynamic growth, driven by increasing disposable incomes and a burgeoning tourism sector. As consumer preferences shift towards premium products, the market is likely to see a rise in demand for unique flavor profiles and artisanal offerings. Additionally, the emergence of online retail channels will facilitate broader access to cigar products, enhancing consumer engagement and market penetration. The overall outlook remains optimistic, despite regulatory challenges and health campaigns.

| Segment | Sub-Segments |

|---|---|

| By Type | Hand-rolled cigars Machine-made cigars Cigarillos Flavored cigars and cigarillos Premium cigars Mass-market cigars Others |

| By End-User | Individual consumers Retail outlets Bars and lounges Hotels and hospitality venues Duty-free and travel retail Corporate events Others |

| By Distribution Channel | Online retail Specialty cigar shops Supermarkets and hypermarkets Duty-free shops Hotel and lounge sales Others |

| By Packaging Type | Boxes Tins Pouches Singles and tubes Bulk packaging Others |

| By Flavor Profile | Natural Sweet Spicy Flavored (e.g., vanilla, chocolate, menthol) Others |

| By Price Range | Luxury cigars Premium cigars Mid-range cigars and cigarillos Budget cigars and cigarillos Others |

| By Occasion | Celebrations and gifting Social and casual smoking Business and corporate events Travel and duty-free purchases Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cigarillos Retail Market | 80 | Retail Managers, Store Owners |

| Consumer Preferences Survey | 120 | Cigar Enthusiasts, Casual Smokers |

| Distribution Channel Insights | 60 | Distributors, Wholesalers |

| Market Trend Analysis | 40 | Market Analysts, Industry Experts |

| Regulatory Impact Assessment | 40 | Policy Makers, Compliance Officers |

The Bahrain Cigar Cigarillos Market is valued at approximately USD 40 million, reflecting a steady demand for both traditional and innovative cigar products, driven by consumer interest in premium and flavored offerings.