Region:Asia

Author(s):Geetanshi

Product Code:KRAC8239

Pages:94

Published On:November 2025

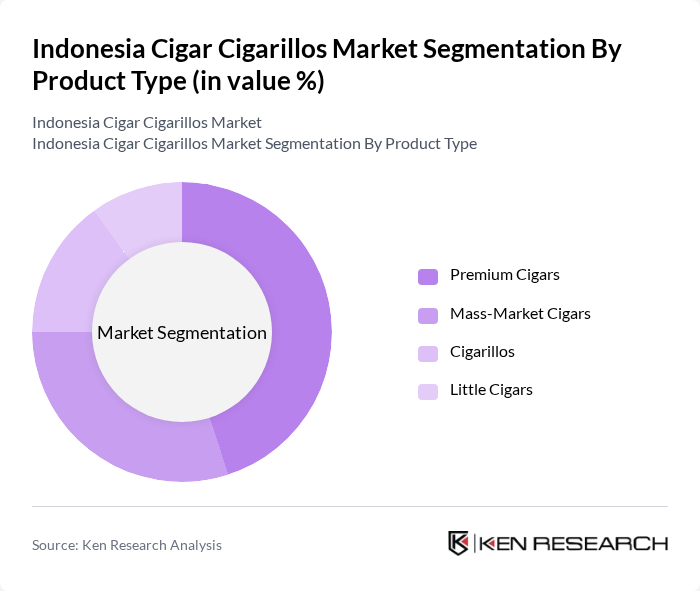

By Product Type:The product type segmentation includes Premium Cigars, Mass-Market Cigars, Cigarillos, and Little Cigars. Among these, Premium Cigars are gaining traction due to their association with luxury and quality, appealing to affluent consumers. Mass-Market Cigars cater to a broader audience, while Cigarillos and Little Cigars are popular for their convenience and lower price points. The increasing trend of social smoking and gifting is driving the demand for Premium Cigars, making them the leading subsegment in this category. Premium cigars are expected to grow at a CAGR of 6% through the forecast period, driven by increased demand from luxury hotels and bars.

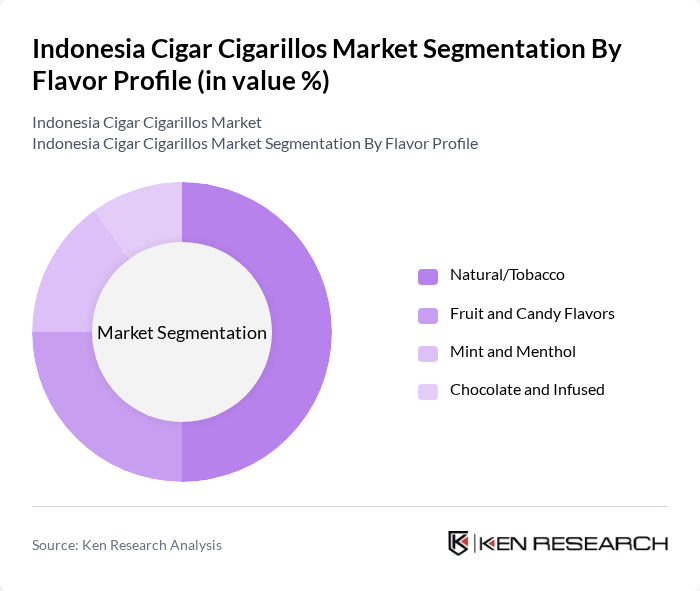

By Flavor Profile:The flavor profile segmentation includes Natural/Tobacco, Fruit and Candy Flavors, Mint and Menthol, and Chocolate and Infused. Natural/Tobacco flavors dominate the market as traditional preferences remain strong among cigar enthusiasts. However, there is a growing trend towards flavored options, particularly among younger consumers seeking unique experiences. The increasing popularity of Fruit and Candy Flavors is notable, making it a significant subsegment, while Mint and Menthol flavors cater to those looking for refreshing alternatives. The flavored segment is expected to grow at a CAGR of 9%, driven by increased popularity among young consumers and a growing number of female consumers who prefer flavored cigars, with sweet tobacco flavors like Swisher Sweet and White Owl maintaining strong market presence.

The Indonesia Cigar Cigarillos Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Gudang Garam Tbk, PT Djarum, PT HM Sampoerna Tbk, PT Bentoel International Investama, Altadis Indonesia (Imperial Brands subsidiary), Scandinavian Tobacco Group Indonesia, Taman Cigars Indonesia, Bali Premium Cigars, Surya Cigar Manufacturing, Tanjung Cigar Company, PT Cigar Lounge Indonesia, Cigar World Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia cigar cigarillos market appears promising, driven by evolving consumer preferences and increasing disposable incomes. The trend towards premiumization is expected to continue, with consumers seeking high-quality products. Additionally, the growth of e-commerce and retail channels will enhance accessibility. However, regulatory challenges and health campaigns will require manufacturers to adapt their strategies. Overall, the market is poised for growth, with opportunities for innovation and collaboration in product offerings.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Premium Cigars Mass-Market Cigars Cigarillos Little Cigars |

| By Flavor Profile | Natural/Tobacco Fruit and Candy Flavors Mint and Menthol Chocolate and Infused |

| By Distribution Channel | Specialty Tobacco Shops Supermarkets and Hypermarkets Convenience Stores E-Commerce Platforms Cigar Lounges and Hospitality Venues |

| By Price Segment | Premium (High-end imported) Mid-Range Budget/Mass-Market |

| By Consumer Segment | Individual Consumers Hospitality and Retail Trade Tourism and Expatriate Communities |

| By Geography | Java (Jakarta, Surabaya, Bandung) Bali Sumatra Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cigar Retail Market | 100 | Retail Managers, Store Owners |

| Cigarillo Consumer Preferences | 80 | Regular Cigarillo Consumers, Occasional Smokers |

| Distribution Channel Insights | 60 | Distributors, Wholesalers |

| Market Trends Analysis | 50 | Market Analysts, Industry Experts |

| Regulatory Impact Assessment | 40 | Policy Makers, Tobacco Regulatory Authorities |

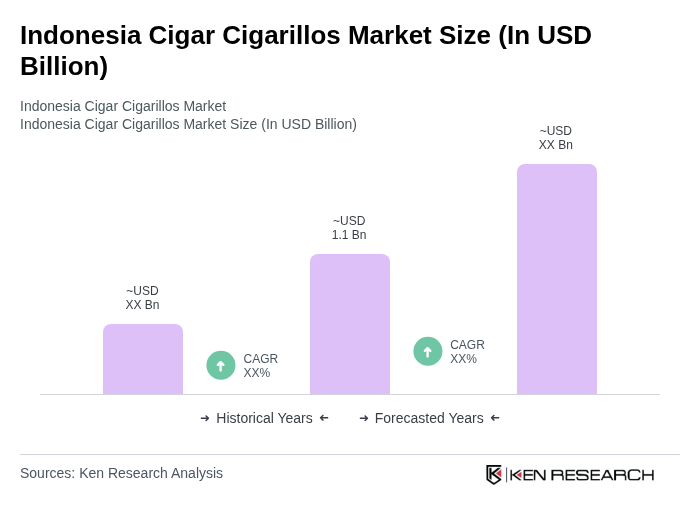

The Indonesia Cigar Cigarillos Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing consumer demand for premium tobacco products and the cultural significance of cigars in Indonesia.