Region:Middle East

Author(s):Shubham

Product Code:KRAD1039

Pages:92

Published On:November 2025

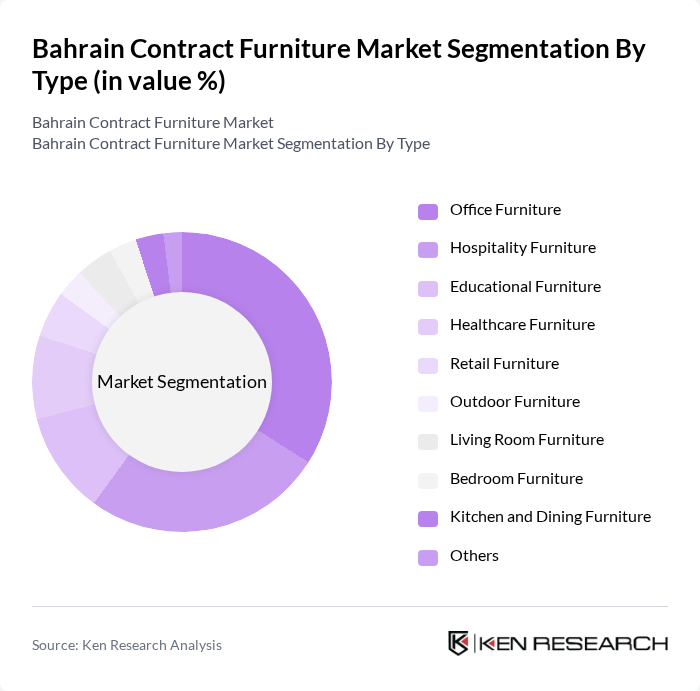

By Type:The market is segmented into various types of furniture, including office furniture, hospitality furniture, educational furniture, healthcare furniture, retail furniture, outdoor furniture, living room furniture, bedroom furniture, kitchen and dining furniture, and others. Among these, office furniture is the leading segment, driven by the increasing number of corporate offices and the demand for ergonomic and functional designs. Hospitality furniture follows closely, fueled by the growth in the tourism sector and the establishment of new hotels and restaurants. The educational and healthcare segments are also expanding, supported by investments in institutional infrastructure and modernization initiatives .

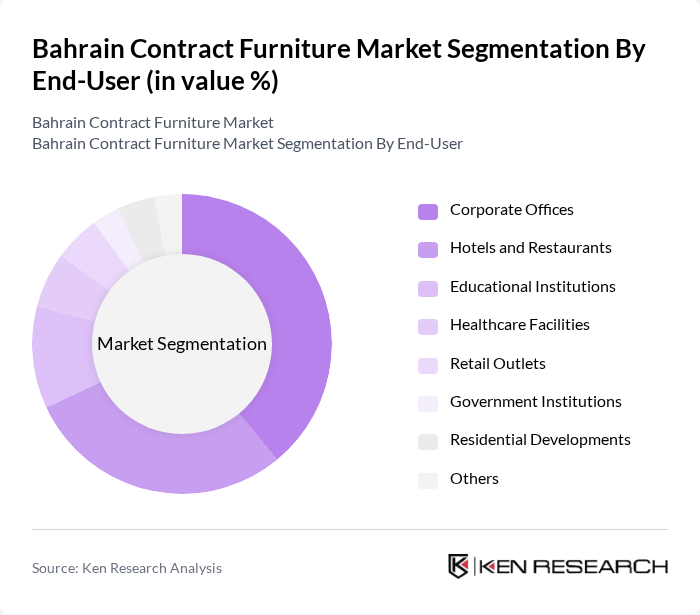

By End-User:The end-user segmentation includes corporate offices, hotels and restaurants, educational institutions, healthcare facilities, retail outlets, government institutions, residential developments, and others. Corporate offices represent the largest share, driven by the increasing focus on workplace design, employee well-being, and the adoption of flexible workspaces. Hotels and restaurants also contribute significantly, reflecting the growth in the tourism sector and the need for stylish and functional furniture. Educational and healthcare facilities are seeing increased investment, supporting demand for specialized contract furniture .

The Bahrain Contract Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almoayyed Furniture, Al Haddad Commercial Center, IKEA Bahrain, Royal Furniture Bahrain, Home Centre Bahrain, Al-Futtaim Group, Almoayyed International Group, Al Salam Furniture, Al Bahar Furniture, Al Mansoori Furniture, Muharraq Furniture, Qudra Furniture, Al Waha Furniture, Al Zayani Furniture, Al Mahroos Furniture, Western Furniture Bahrain, Pan Emirates Bahrain, United Furniture Bahrain, Gautier Bahrain, BoConcept Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain contract furniture market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues to rise, the demand for innovative and space-efficient furniture solutions is expected to grow. Additionally, the integration of smart technology into furniture design will likely enhance functionality and appeal. Local manufacturers are encouraged to invest in sustainable practices and eco-friendly materials, aligning with global trends towards environmental responsibility, which will further bolster market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Furniture Hospitality Furniture Educational Furniture Healthcare Furniture Retail Furniture Outdoor Furniture Living Room Furniture Bedroom Furniture Kitchen and Dining Furniture Others |

| By End-User | Corporate Offices Hotels and Restaurants Educational Institutions Healthcare Facilities Retail Outlets Government Institutions Residential Developments Others |

| By Material | Wood Metal Plastic Upholstered Glass Bamboo Others |

| By Design Style | Modern Traditional Contemporary Industrial Minimalist Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Project-Based (B2B Contracts) Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospitality Sector Furniture Procurement | 50 | Procurement Managers, Hotel Operations Managers |

| Corporate Office Furniture Solutions | 40 | Office Managers, Facilities Managers |

| Educational Institution Furniture Needs | 40 | School Administrators, Facility Managers |

| Healthcare Facility Furniture Requirements | 40 | Healthcare Administrators, Procurement Officers |

| Retail Space Furniture Trends | 40 | Store Managers, Visual Merchandisers |

The Bahrain Contract Furniture Market is valued at approximately USD 330 million, reflecting a significant growth driven by increasing demand for modern and functional furniture solutions across various sectors, including corporate, hospitality, and healthcare.