Region:Middle East

Author(s):Rebecca

Product Code:KRAC2760

Pages:97

Published On:January 2026

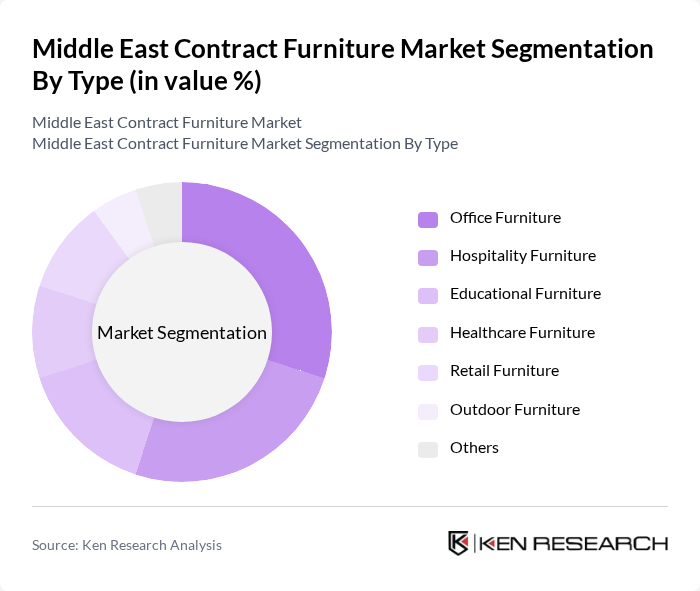

By Type:The market is segmented into various types of furniture, including office furniture, hospitality furniture, educational furniture, healthcare furniture, retail furniture, outdoor furniture, and others. Among these, office furniture is the leading segment, driven by the increasing number of corporate offices and the demand for ergonomic and stylish office solutions. Hospitality furniture follows closely, fueled by the booming tourism sector and the need for high-quality furnishings in hotels and restaurants.

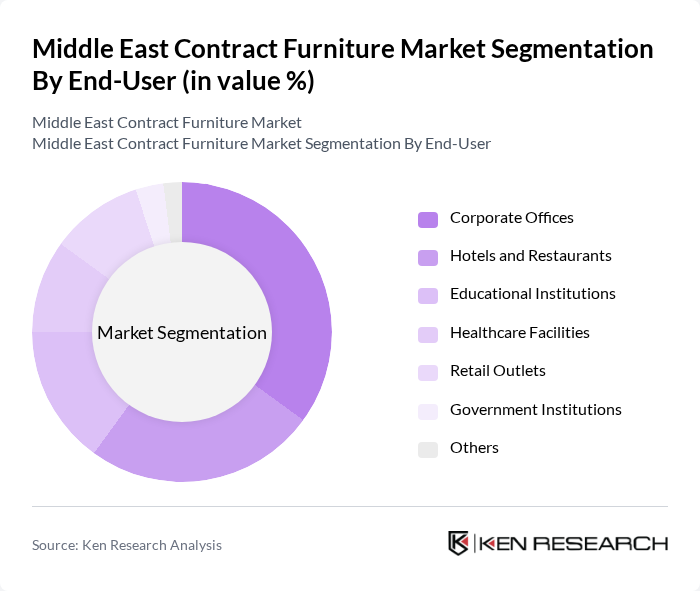

By End-User:The end-user segmentation includes corporate offices, hotels and restaurants, educational institutions, healthcare facilities, retail outlets, government institutions, and others. Corporate offices represent the largest segment, driven by the increasing demand for modern and functional office spaces. Hotels and restaurants also contribute significantly, as they require stylish and durable furniture to enhance guest experiences.

The Middle East Contract Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Steelcase, Herman Miller, Haworth, Teknion, HNI Corporation, Kimball International, Kinnarps, Vitra, OFS Brands, Global Furniture Group, Allermuir, Boss Design, Teknion, Nucraft contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East contract furniture market appears promising, driven by ongoing urbanization and a strong focus on sustainability. As the region continues to invest in infrastructure and hospitality, demand for innovative and eco-friendly furniture solutions will rise. Additionally, the integration of technology in furniture design is expected to enhance user experience, making smart furniture a key trend. Companies that adapt to these changes will likely thrive in this evolving landscape, capitalizing on emerging consumer preferences and market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Furniture Hospitality Furniture Educational Furniture Healthcare Furniture Retail Furniture Outdoor Furniture Others |

| By End-User | Corporate Offices Hotels and Restaurants Educational Institutions Healthcare Facilities Retail Outlets Government Institutions Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Material | Wood Metal Plastic Upholstered Glass Others |

| By Design Style | Modern Contemporary Traditional Industrial Minimalist Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Functionality | Fixed Furniture Modular Furniture Multi-functional Furniture Customizable Furniture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Office Furniture Procurement | 120 | Procurement Managers, Office Administrators |

| Hospitality Sector Furniture Supply | 100 | Hotel Managers, Interior Designers |

| Educational Institution Furniture Needs | 80 | Facility Managers, School Administrators |

| Healthcare Furniture Requirements | 70 | Healthcare Facility Managers, Procurement Officers |

| Government Contract Furniture Projects | 60 | Government Procurement Officers, Project Managers |

The Middle East Contract Furniture Market is valued at approximately USD 6.8 billion, driven by urbanization, rising disposable incomes, and growth in the hospitality and corporate sectors, alongside a demand for sustainable furniture solutions.