Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5996

Pages:90

Published On:December 2025

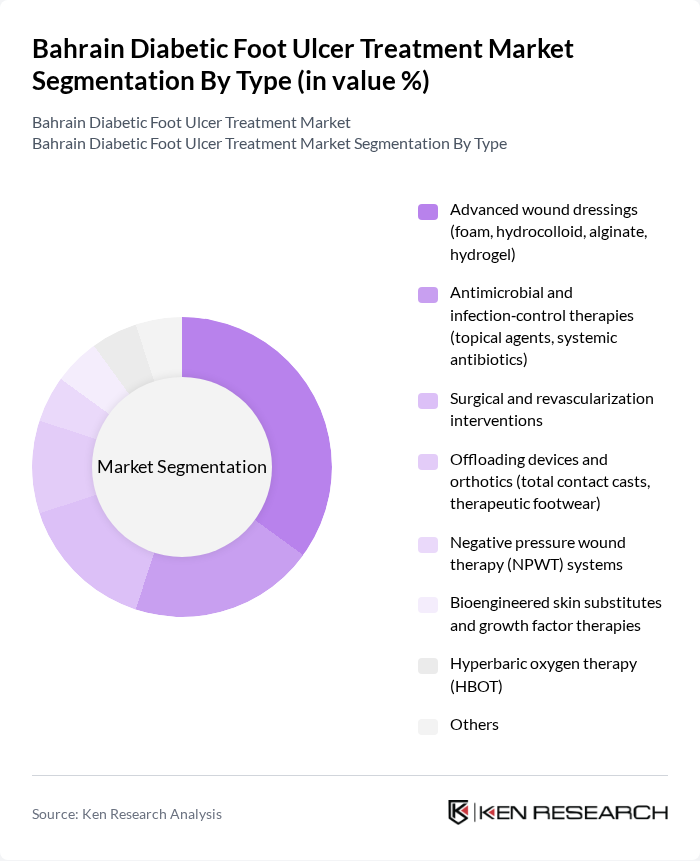

By Type:The market is segmented into various types of treatments, including advanced wound dressings, antimicrobial therapies, surgical interventions, offloading devices, negative pressure wound therapy, bioengineered skin substitutes, hyperbaric oxygen therapy, and others. Among these, advanced wound dressings are currently the leading subsegment due to their effectiveness in maintaining a moist wound environment, promoting granulation and re?epithelialization, and helping reduce infection risk, in line with international diabetic foot management guidelines.

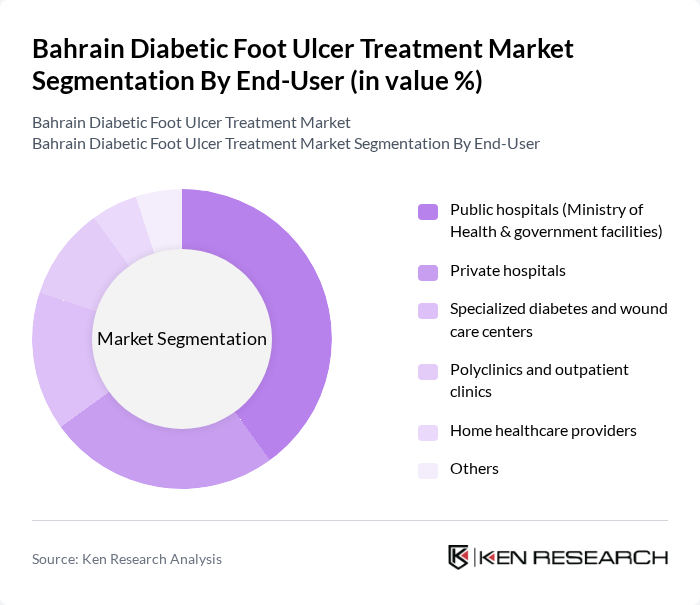

By End-User:The end-user segmentation includes public hospitals, private hospitals, specialized diabetes and wound care centers, polyclinics, outpatient clinics, and home healthcare providers. Public hospitals are the dominant segment due to their extensive reach, central role of Ministry of Health facilities in delivering diabetes and foot-care services, and government funding for advanced wound-care products and multidisciplinary management of diabetic complications.

The Bahrain Diabetic Foot Ulcer Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smith & Nephew plc, 3M Health Care (including former Acelity/KCI), Mölnlycke Health Care AB, ConvaTec Group plc, Coloplast A/S, B. Braun Melsungen AG, Paul Hartmann AG (HARTMANN GROUP), Baxter International Inc., Medtronic plc, Organogenesis Holdings Inc., Integra LifeSciences Holdings Corporation, Ethicon, Inc. (Johnson & Johnson MedTech), Derma Sciences Inc. (a Integra LifeSciences company), BSN medical GmbH (an Essity company), Gulf Medical Company Ltd. (regional distributor for wound-care and DFU solutions) are active suppliers of advanced dressings, negative pressure wound therapy systems, and adjunctive wound-healing technologies across the Gulf region and contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain diabetic foot ulcer treatment market appears promising, driven by ongoing advancements in healthcare technology and increasing public awareness. The integration of digital health solutions is expected to enhance patient engagement and monitoring, while preventive care initiatives will likely reduce the incidence of complications. Furthermore, the expansion of healthcare facilities and services will improve access to specialized care, fostering a more robust market environment for diabetic foot ulcer treatments in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Advanced wound dressings (foam, hydrocolloid, alginate, hydrogel) Antimicrobial and infection?control therapies (topical agents, systemic antibiotics) Surgical and revascularization interventions Offloading devices and orthotics (total contact casts, therapeutic footwear) Negative pressure wound therapy (NPWT) systems Bioengineered skin substitutes and growth factor therapies Hyperbaric oxygen therapy (HBOT) Others |

| By End-User | Public hospitals (Ministry of Health & government facilities) Private hospitals Specialized diabetes and wound care centers Polyclinics and outpatient clinics Home healthcare providers Others |

| By Patient Demographics | Age groups (Adults 18–59, Seniors 60+) Gender Nationality (Bahraini nationals vs. expatriates) Co?morbidities (peripheral arterial disease, neuropathy, obesity) Others |

| By Treatment Stage | Prevention and early?stage ulcer management Treatment of infected/non?healing chronic ulcers Limb?salvage and pre?amputation care Post?surgical and post?amputation care Others |

| By Distribution Channel | Direct hospital procurement (tenders and group purchasing) Retail pharmacies Hospital & clinic pharmacies Online and e?pharmacy platforms Medical device and wound?care distributors Others |

| By Geographic Distribution | Capital Governorate (Manama) Muharraq Governorate Northern Governorate Southern Governorate Others |

| By Policy Support | Government?funded diabetes and foot?care programs Public health insurance coverage (NHRA & government schemes) Private insurance and employer?sponsored coverage Subsidies for essential wound?care products and devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 80 | Endocrinologists, Podiatrists, Wound Care Specialists |

| Hospital Administrators | 60 | Chief Medical Officers, Health Services Managers |

| Patients with Diabetic Foot Ulcers | 120 | Diabetes Patients, Caregivers |

| Pharmaceutical Representatives | 50 | Sales Managers, Product Specialists |

| Health Insurance Providers | 40 | Claims Analysts, Policy Underwriters |

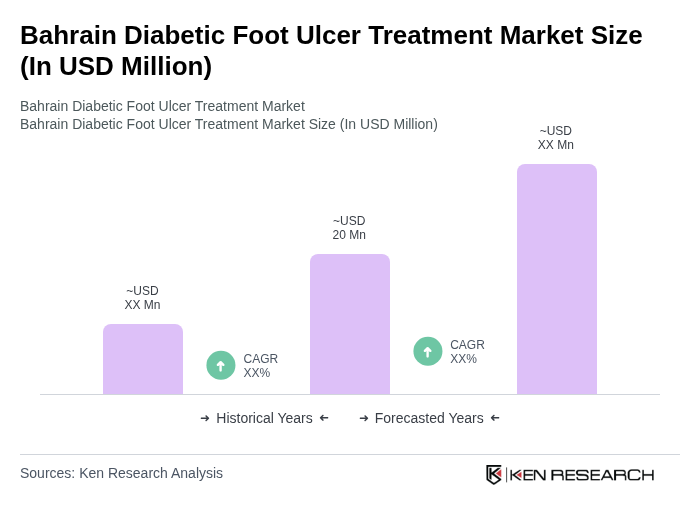

The Bahrain Diabetic Foot Ulcer Treatment Market is valued at approximately USD 20 million, reflecting the increasing prevalence of diabetes and the demand for effective treatment options in the region.