Region:Middle East

Author(s):Shubham

Product Code:KRAD1946

Pages:94

Published On:December 2025

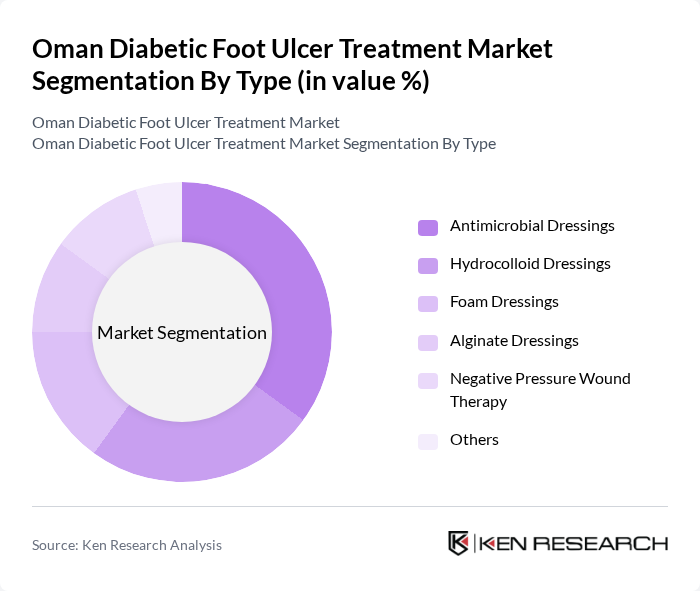

By Type:The market is segmented into various types of treatments, including antimicrobial dressings, hydrocolloid dressings, foam dressings, alginate dressings, negative pressure wound therapy, and others. Among these, antimicrobial dressings are leading the market due to their effectiveness in preventing infections and promoting faster healing. The increasing incidence of diabetic foot ulcers has heightened the demand for these advanced dressings, which are favored by healthcare professionals for their clinical efficacy.

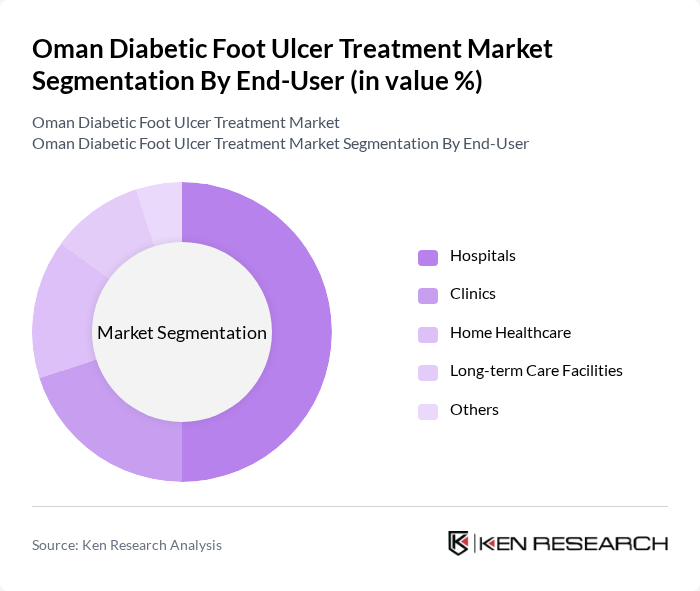

By End-User:The end-user segmentation includes hospitals, clinics, home healthcare, long-term care facilities, and others. Hospitals are the dominant end-user segment, accounting for a significant share of the market. This is attributed to the high volume of diabetic patients receiving treatment in hospital settings, where advanced wound care technologies and specialized medical staff are readily available to manage complex cases effectively.

The Oman Diabetic Foot Ulcer Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smith & Nephew, Medtronic, Acelity, ConvaTec, Molnlycke Health Care, 3M Health Care, Baxter International, Coloplast, B. Braun Melsungen AG, Integra LifeSciences, Derma Sciences, Organogenesis, Hollister Incorporated, Ethicon, Systagenix contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman diabetic foot ulcer treatment market appears promising, driven by significant investments in healthcare infrastructure and a focus on innovative treatment solutions. With national projects valued at RO 1.6 billion aimed at expanding healthcare facilities, access to specialized services is expected to improve. Additionally, the government's commitment to enhancing fiscal credibility through credit rating upgrades will likely facilitate further investments in healthcare innovation, ultimately benefiting diabetic care and treatment outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Antimicrobial Dressings Hydrocolloid Dressings Foam Dressings Alginate Dressings Negative Pressure Wound Therapy Others |

| By End-User | Hospitals Clinics Home Healthcare Long-term Care Facilities Others |

| By Severity of Ulcer | Mild Ulcers Moderate Ulcers Severe Ulcers Others |

| By Treatment Method | Surgical Treatment Non-surgical Treatment Others |

| By Distribution Channel | Direct Sales Online Sales Retail Pharmacies Hospitals and Clinics Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Patient Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Diabetes Care Clinics | 100 | Endocrinologists, Podiatrists |

| Hospitals with Diabetic Foot Care Units | 80 | Surgeons, Wound Care Specialists |

| Pharmaceutical Companies (Wound Care Products) | 60 | Product Managers, Sales Representatives |

| Patient Advocacy Groups | 50 | Patient Representatives, Health Educators |

| Health Insurance Providers | 70 | Claims Analysts, Policy Underwriters |

The Oman Diabetic Foot Ulcer Treatment Market is valued at approximately USD 1.7 million, reflecting a five-year historical analysis. This valuation is influenced by the rising prevalence of diabetes and advancements in wound care technologies.