Region:Middle East

Author(s):Rebecca

Product Code:KRAB7388

Pages:91

Published On:October 2025

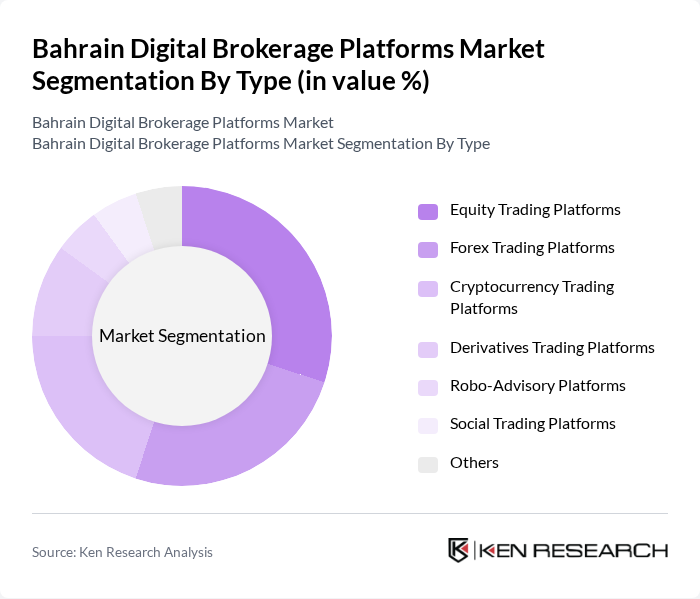

By Type:The market is segmented into various types of digital brokerage platforms, including Equity Trading Platforms, Forex Trading Platforms, Cryptocurrency Trading Platforms, Derivatives Trading Platforms, Robo-Advisory Platforms, Social Trading Platforms, and Others. Each of these sub-segments caters to different investor needs and preferences, with varying levels of complexity and user engagement.

By End-User:The end-user segmentation includes Individual Investors, Institutional Investors, Financial Advisors, and Corporates. Each group has distinct requirements and preferences, influencing the types of platforms they choose to engage with for trading and investment purposes.

The Bahrain Digital Brokerage Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Financial Exchange, Investcorp, SICO BSC, Al Salam Bank, Bahrain Islamic Bank, Gulf International Bank, Bank of Bahrain and Kuwait, Bahrain Stock Exchange, Arqaam Capital, EFG Hermes, Abu Dhabi Investment Authority, QInvest, BMB Investment Bank, KAMCO Investment Company, Al Baraka Banking Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of Bahrain's digital brokerage platforms market appears promising, driven by technological advancements and changing investor behaviors. The integration of artificial intelligence and machine learning is expected to enhance trading strategies and user experiences. Additionally, the growing interest in sustainable investing will likely lead to the emergence of platforms focused on environmental, social, and governance (ESG) criteria, catering to a more socially conscious investor base. These trends indicate a dynamic market landscape poised for innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Trading Platforms Forex Trading Platforms Cryptocurrency Trading Platforms Derivatives Trading Platforms Robo-Advisory Platforms Social Trading Platforms Others |

| By End-User | Individual Investors Institutional Investors Financial Advisors Corporates |

| By Investment Size | Small Investments Medium Investments Large Investments |

| By User Experience | Basic User Interface Advanced User Interface Mobile-Optimized Platforms |

| By Customer Support | /7 Support Business Hours Support Community Support |

| By Payment Method | Credit/Debit Cards Bank Transfers E-Wallets |

| By Regulatory Compliance | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Investors, Retail Traders |

| Institutional Brokerage Services | 100 | Institutional Investors, Fund Managers |

| Regulatory Compliance Feedback | 80 | Compliance Officers, Legal Advisors |

| Technology Adoption in Brokerage | 70 | IT Managers, Digital Transformation Leads |

| Market Trends and Challenges | 90 | Financial Analysts, Market Researchers |

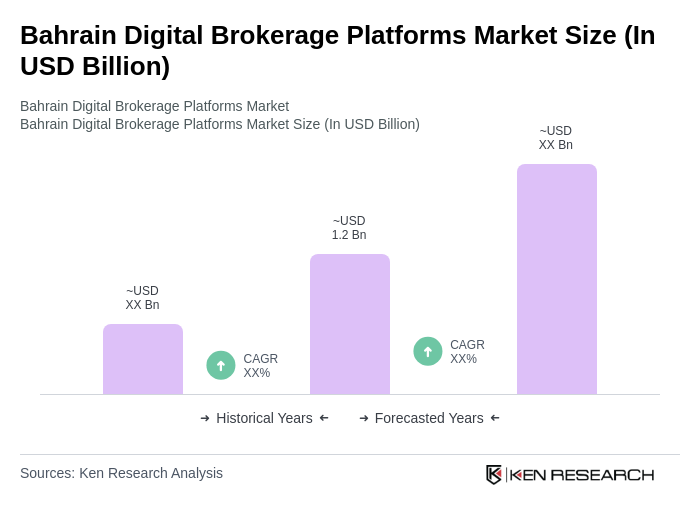

The Bahrain Digital Brokerage Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased adoption of digital trading solutions and advancements in technology that enhance trading efficiency and accessibility.