Region:Middle East

Author(s):Dev

Product Code:KRAB7422

Pages:85

Published On:October 2025

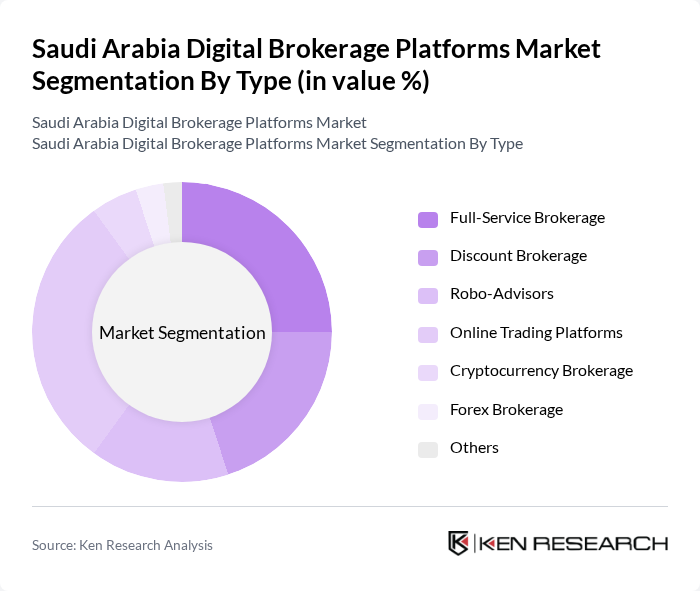

By Type:The market is segmented into various types of brokerage services, including Full-Service Brokerage, Discount Brokerage, Robo-Advisors, Online Trading Platforms, Cryptocurrency Brokerage, Forex Brokerage, and Others. Each of these segments caters to different investor needs and preferences, with varying levels of service and cost structures.

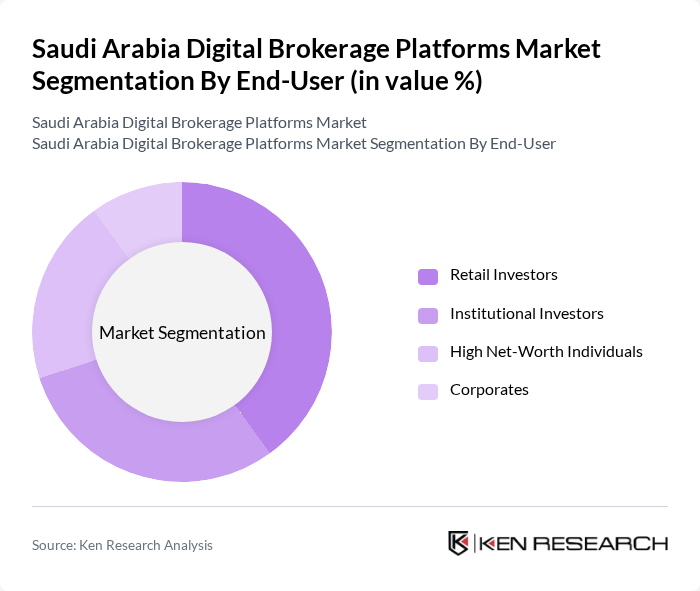

By End-User:The end-user segmentation includes Retail Investors, Institutional Investors, High Net-Worth Individuals, and Corporates. Each group has distinct investment strategies and requirements, influencing their choice of brokerage services.

The Saudi Arabia Digital Brokerage Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Rajhi Capital, NCB Capital, Samba Capital, Riyad Capital, Alinma Investment, Aljazira Capital, Emirates NBD Securities, HSBC Saudi Arabia, Arab National Bank, Maan Financial Services, Al-Etihad Cooperative Insurance, Al-Bilad Investment, BMG Financial Group, Al-Faisal Holding, Amlak International contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital brokerage platforms in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance trading experiences, providing personalized insights and automated trading options. Additionally, the growing trend of sustainable investing will likely influence platform offerings, as investors increasingly seek ethical investment opportunities. These developments will shape a dynamic market landscape, fostering innovation and attracting a broader user base.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Brokerage Discount Brokerage Robo-Advisors Online Trading Platforms Cryptocurrency Brokerage Forex Brokerage Others |

| By End-User | Retail Investors Institutional Investors High Net-Worth Individuals Corporates |

| By Investment Type | Equities Bonds Mutual Funds ETFs Derivatives Others |

| By Service Model | Commission-Based Fee-Based Hybrid Model |

| By Customer Segment | Millennials Gen X Baby Boomers |

| By Geographic Coverage | Urban Areas Rural Areas |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Investors, Retail Traders |

| Institutional Brokerage Services | 100 | Institutional Investors, Fund Managers |

| Regulatory Compliance Feedback | 80 | Compliance Officers, Legal Advisors |

| Technology Adoption in Brokerage | 70 | IT Managers, Digital Transformation Leads |

| Market Trends and Forecasts | 90 | Financial Analysts, Market Researchers |

The Saudi Arabia Digital Brokerage Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased adoption of digital trading solutions and retail investor participation.