Region:Middle East

Author(s):Shubham

Product Code:KRAA8938

Pages:90

Published On:November 2025

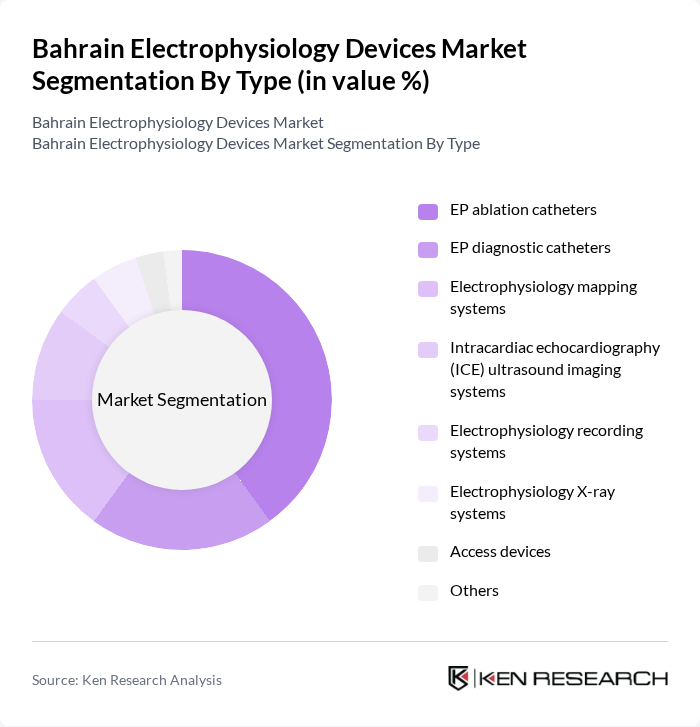

By Type:The market can be segmented into various types of electrophysiology devices, including EP ablation catheters, EP diagnostic catheters, electrophysiology mapping systems, intracardiac echocardiography (ICE) ultrasound imaging systems, electrophysiology recording systems, electrophysiology X-ray systems, access devices, and others. Among these, EP ablation catheters are currently leading the market due to their critical role in treating arrhythmias effectively. The increasing number of cardiac procedures and the growing preference for minimally invasive techniques are driving the demand for these devices. The introduction of advanced ablation technologies, such as cryoablation and laser ablation, further supports the growth of this segment .

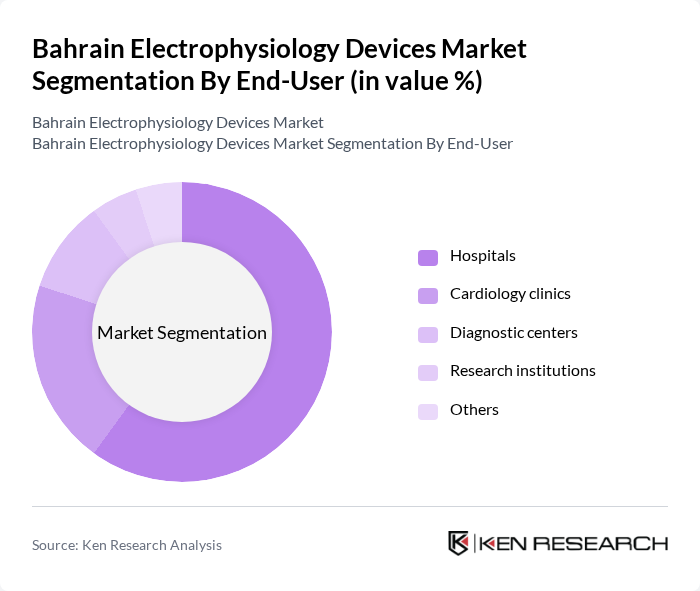

By End-User:The end-user segmentation includes hospitals, cardiology clinics, diagnostic centers, research institutions, and others. Hospitals are the dominant end-user segment, primarily due to their capacity to perform complex electrophysiological procedures and the availability of specialized cardiology departments. The increasing number of hospital admissions for cardiac issues, expansion of healthcare infrastructure, and the presence of advanced electrophysiology labs are contributing to the growth of this segment .

The Bahrain Electrophysiology Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Biotronik SE & Co. KG, Johnson & Johnson (Biosense Webster), Philips Healthcare (Koninklijke Philips N.V.), Siemens Healthineers AG, Stereotaxis, Inc., AtriCure, Inc., CardioFocus, Inc., Nihon Kohden Corporation, GE HealthCare, LivaNova PLC, Merit Medical Systems, Inc., Oscor, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Bahrain electrophysiology devices market appears promising, driven by technological advancements and an increasing focus on patient-centric healthcare solutions. As the healthcare infrastructure expands, the integration of artificial intelligence and remote monitoring technologies is expected to enhance device functionality and patient outcomes. Additionally, the growing trend towards minimally invasive procedures will likely encourage further investment in innovative electrophysiology devices, positioning Bahrain as a regional leader in cardiac care.

| Segment | Sub-Segments |

|---|---|

| By Type | EP ablation catheters EP diagnostic catheters Electrophysiology mapping systems Intracardiac echocardiography (ICE) ultrasound imaging systems Electrophysiology recording systems Electrophysiology X-ray systems Access devices Others |

| By End-User | Hospitals Cardiology clinics Diagnostic centers Research institutions Others |

| By Application | Arrhythmia management (e.g., atrial fibrillation, AVNRT, WPW syndrome, atrial flutter) Electrophysiological studies Cardiac resynchronization therapy Others |

| By Distribution Channel | Direct sales Distributors Online sales Others |

| By Technology | Radiofrequency ablation Cryoablation Laser ablation Microwave ablation Others |

| By Patient Demographics | Pediatric Adult Geriatric Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiac Electrophysiology Procedures | 100 | Cardiologists, Electrophysiologists |

| Device Procurement in Hospitals | 70 | Procurement Managers, Hospital Administrators |

| Patient Experience with Electrophysiology Devices | 50 | Patients, Caregivers |

| Market Trends in Electrophysiology Devices | 60 | Medical Device Distributors, Sales Representatives |

| Regulatory Impact on Device Usage | 40 | Healthcare Policy Experts, Regulatory Affairs Specialists |

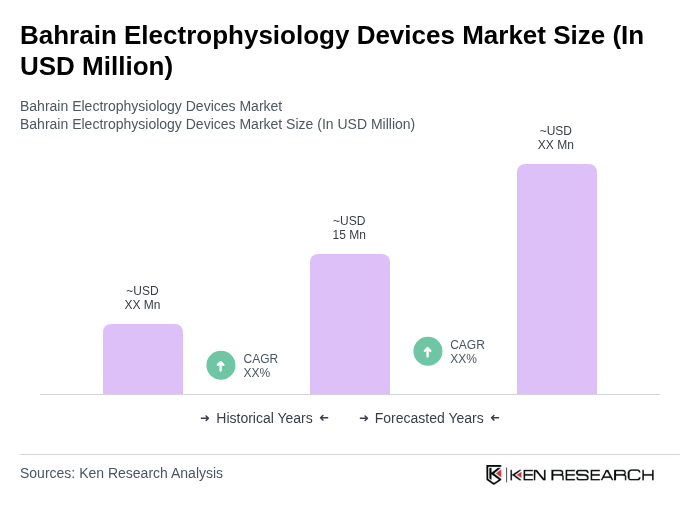

The Bahrain Electrophysiology Devices Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by the increasing prevalence of cardiovascular diseases and the adoption of advanced medical technologies.