Region:Middle East

Author(s):Shubham

Product Code:KRAD3582

Pages:100

Published On:November 2025

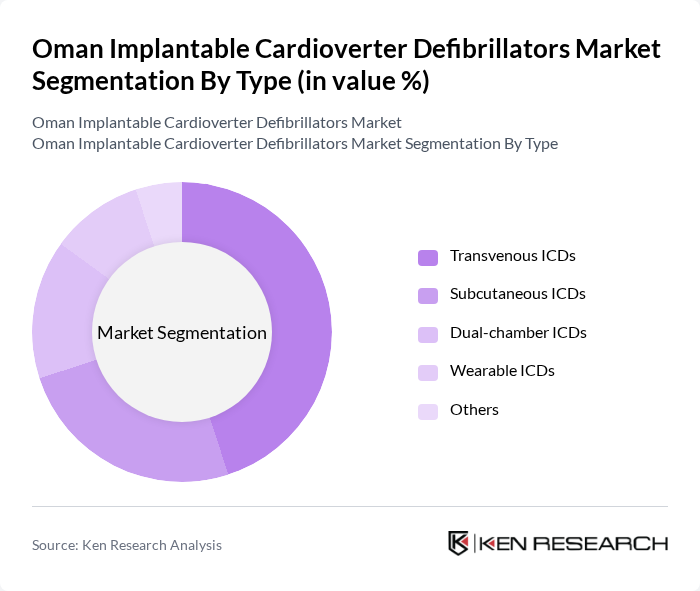

By Type:The market is segmented into Transvenous ICDs, Subcutaneous ICDs, Dual-chamber ICDs, Wearable ICDs, and Others. Transvenous ICDs hold the largest share due to their proven clinical efficacy, reliability, and broad acceptance among cardiologists. Subcutaneous ICDs are gaining traction for patients unsuitable for transvenous systems, while dual-chamber and wearable ICDs serve specific clinical needs. The preference for transvenous devices is supported by robust clinical data and their established role in preventing sudden cardiac death .

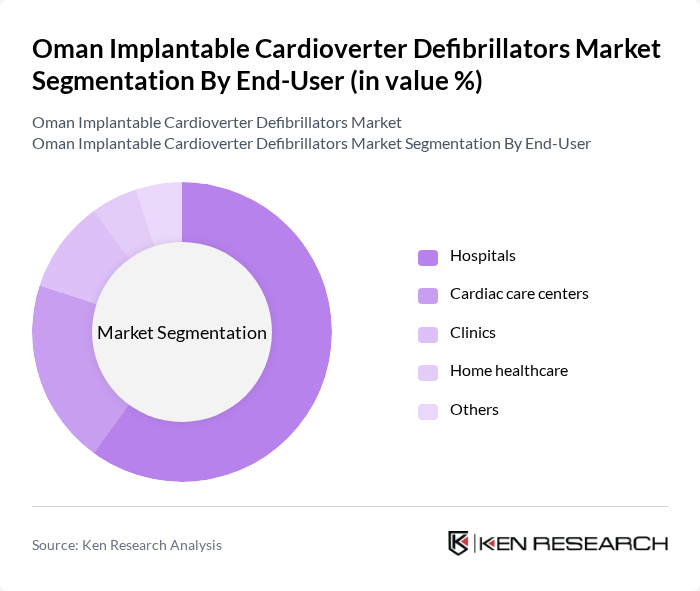

By End-User:The end-user segmentation includes Hospitals, Cardiac care centers, Clinics, Home healthcare, and Others. Hospitals are the leading end-users, accounting for the majority of ICD implantations due to their capacity for advanced cardiac procedures, specialized cardiac teams, and the infrastructure required for device management and follow-up. Cardiac care centers and clinics contribute to the market through outpatient management and follow-up services, while home healthcare adoption remains limited but is gradually increasing with the introduction of remote monitoring technologies .

The Oman Implantable Cardioverter Defibrillators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, BIOTRONIK SE & Co. KG, MicroPort Scientific Corporation, LivaNova PLC, Philips Healthcare, Zoll Medical Corporation, Nihon Kohden Corporation, Terumo Corporation, GE HealthCare, Stryker Corporation, Cardiac Science Corporation, AtriCure, Inc., Edwards Lifesciences Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Oman Implantable Cardioverter Defibrillators market is poised for significant growth, driven by technological advancements and an increasing focus on patient-centric care. As healthcare infrastructure expands, more patients will gain access to these devices. Additionally, the integration of digital health technologies will enhance remote monitoring capabilities, improving patient outcomes. The collaboration between healthcare providers and device manufacturers will further facilitate the adoption of ICDs, ensuring that more patients receive timely and effective treatment for cardiovascular diseases.

| Segment | Sub-Segments |

|---|---|

| By Type | Transvenous ICDs Subcutaneous ICDs Dual-chamber ICDs Wearable ICDs Others |

| By End-User | Hospitals Cardiac care centers Clinics Home healthcare Others |

| By Patient Demographics | Adults Pediatric Geriatric Others |

| By Distribution Channel | Direct sales Distributors Online sales Others |

| By Region | Muscat Salalah Sohar Others |

| By Technology | Conventional ICDs MRI-compatible ICDs Remote monitoring-enabled ICDs Leadless ICDs Others |

| By Policy Support | Government subsidies Tax incentives Health insurance coverage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiology Departments in Hospitals | 100 | Cardiologists, Electrophysiologists |

| Medical Device Distributors | 60 | Sales Managers, Product Specialists |

| Healthcare Procurement Managers | 70 | Procurement Officers, Supply Chain Managers |

| Patient Advocacy Groups | 40 | Patient Representatives, Health Advocates |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Policy Makers |

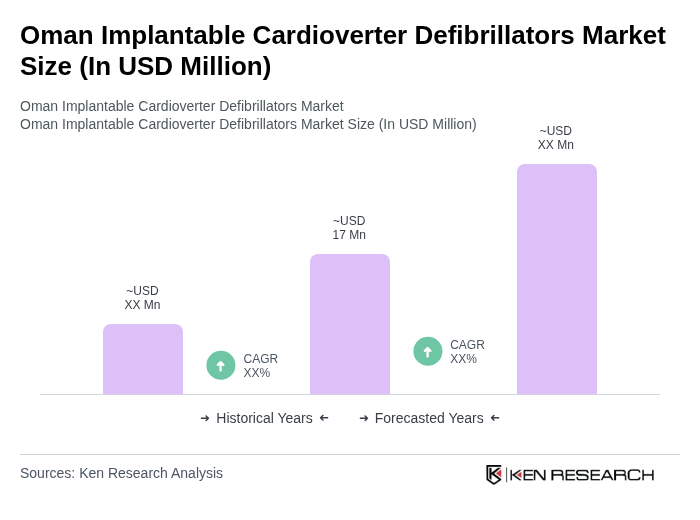

The Oman Implantable Cardioverter Defibrillators Market is valued at approximately USD 17 million, reflecting a significant segment of the cardiology devices market, driven by the high prevalence of cardiovascular diseases and advancements in cardiac technology.