Region:Middle East

Author(s):Dev

Product Code:KRAD5127

Pages:88

Published On:December 2025

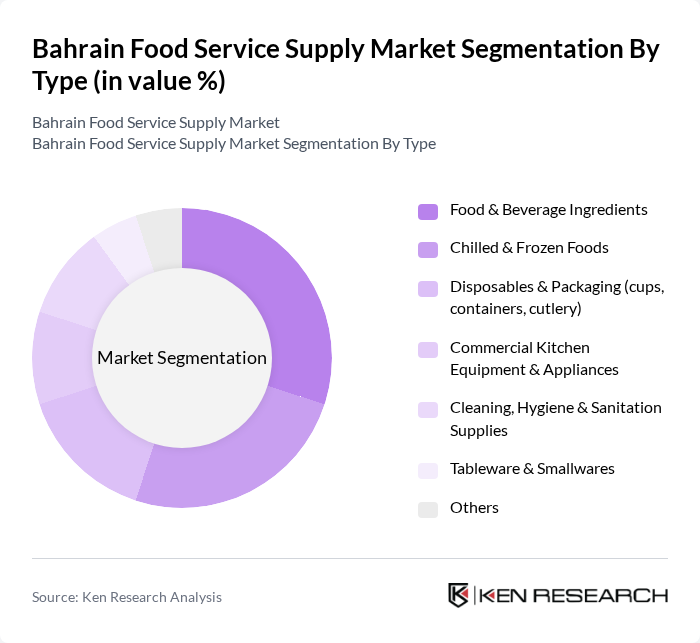

By Type:This segmentation includes various categories that cater to the diverse needs of the food service industry. The subsegments are Food & Beverage Ingredients, Chilled & Frozen Foods, Disposables & Packaging, Commercial Kitchen Equipment & Appliances, Cleaning, Hygiene & Sanitation Supplies, Tableware & Smallwares, and Others. Each of these subsegments plays a crucial role in the overall market dynamics.

The Food & Beverage Ingredients subsegment is currently dominating the market due to the increasing consumer preference for high-quality and diverse food options. This trend is driven by a growing awareness of health and nutrition, leading to a higher demand for organic and locally sourced ingredients. Additionally, the rise of gourmet dining experiences has further propelled the need for premium food products. As a result, this subsegment is expected to maintain its leadership position in the market.

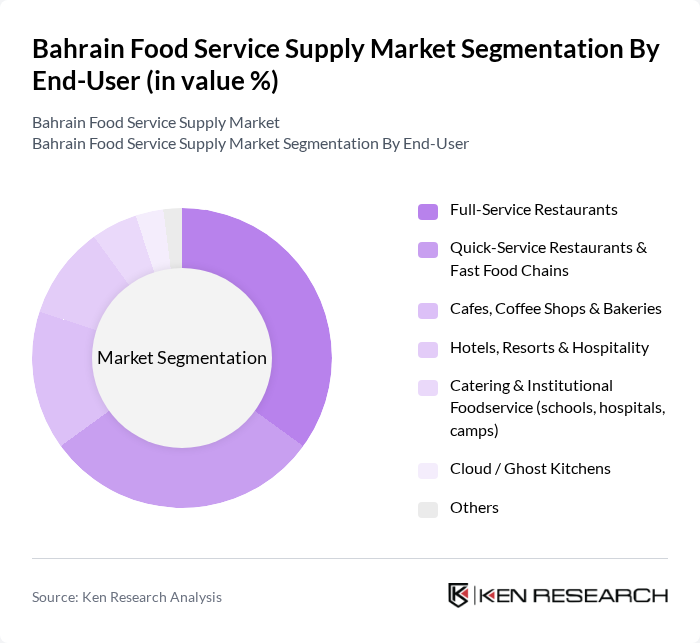

By End-User:This segmentation focuses on the various types of establishments that utilize food service supplies. The subsegments include Full-Service Restaurants, Quick-Service Restaurants & Fast Food Chains, Cafes, Coffee Shops & Bakeries, Hotels, Resorts & Hospitality, Catering & Institutional Foodservice, Cloud / Ghost Kitchens, and Others. Each end-user category has distinct requirements and purchasing behaviors.

Full-Service Restaurants are the leading end-user segment, driven by the growing trend of dining out and the increasing number of establishments offering diverse cuisines. This segment benefits from a higher average spend per customer compared to quick-service outlets, making it a lucrative market. The demand for unique dining experiences and high-quality service further solidifies the position of full-service restaurants as a dominant player in the food service supply market.

The Bahrain Food Service Supply Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banader Hotels Company BSC (Food & Catering Operations), Trafco Group BSC (Bahrain Foodservice Distribution Division), Bahrain Livestock Company (BLC), Bahrain Flour Mills Company BSC, Delmon Bakery & Foodstuff Company, Sayed Kadhem Al Durazi & Sons BSC (Food Import & Distribution), Nasser Abd Mohammed (NAM) Group – Food Service & Distribution, Awal Dairy Company, Al Jazira Group – Supermarkets & Food Distribution, LuLu Group International – Bahrain Foodservice & Wholesale Division, Americana Restaurants (KFC, Pizza Hut and other QSR brands in Bahrain), Al Abraaj Restaurants Group, YumYum Tree Food Court Company, Zayani Foods (exclusive franchisee & distributor for selected QSR brands), Kitopi – Cloud Kitchen & Foodservice Operator in Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain food service supply market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. The integration of digital platforms for food ordering and delivery is expected to enhance operational efficiency. Additionally, the increasing focus on health and sustainability will likely shape product offerings, encouraging suppliers to innovate. As the tourism sector continues to rebound, the demand for diverse culinary experiences will further stimulate market expansion, creating a vibrant landscape for food service suppliers.

| Segment | Sub-Segments |

|---|---|

| By Type | Food & Beverage Ingredients Chilled & Frozen Foods Disposables & Packaging (cups, containers, cutlery) Commercial Kitchen Equipment & Appliances Cleaning, Hygiene & Sanitation Supplies Tableware & Smallwares Others |

| By End-User | Full-Service Restaurants Quick-Service Restaurants & Fast Food Chains Cafes, Coffee Shops & Bakeries Hotels, Resorts & Hospitality Catering & Institutional Foodservice (schools, hospitals, camps) Cloud / Ghost Kitchens Others |

| By Distribution Channel | Direct Contracts with HoReCa Operators Foodservice Distributors & Wholesalers Cash & Carry / Wholesale Retail (hypermarkets, wholesale clubs) Online B2B Platforms & e-Procurement Portals Importers & Trading Companies Others |

| By Product Category | Fresh Produce, Meat & Seafood Frozen & Chilled Convenience Foods Dry & Packaged Foods (grains, sauces, condiments) Beverages (hot, cold & specialty drinks) Bakery & Confectionery Inputs Non-Food Consumables (packaging, disposables) Others |

| By Service Type | Contract Foodservice & Catering On-demand Delivery Fulfilment for HoReCa Storage, Cold Chain & Logistics Services Equipment Installation & Maintenance Services Value-Added Services (menu development, private label, repacking) Others |

| By Customer Type | Independent Outlets Chained Outlets (local & international) Government & Institutional Buyers Industrial, Oil & Gas and Labor Camps Catering Management Companies Others |

| By Region | Capital Governorate (Manama) Muharraq Governorate Northern Governorate Southern Governorate Other Key Cities & Industrial Zones |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Restaurant Supply Chain Insights | 120 | Restaurant Owners, Purchasing Managers |

| Catering Services Procurement | 90 | Catering Managers, Event Coordinators |

| Food Distributor Feedback | 70 | Distribution Managers, Sales Representatives |

| Consumer Preferences in Food Services | 110 | Food Service Customers, Regular Diners |

| Market Trends in Food Supply | 80 | Industry Analysts, Market Researchers |

The Bahrain Food Service Supply Market is valued at approximately USD 1.4 billion, reflecting a robust growth driven by increasing demand for diverse food options, the hospitality sector's expansion, and a growing population favoring dining out.