Region:Asia

Author(s):Geetanshi

Product Code:KRAD3703

Pages:80

Published On:November 2025

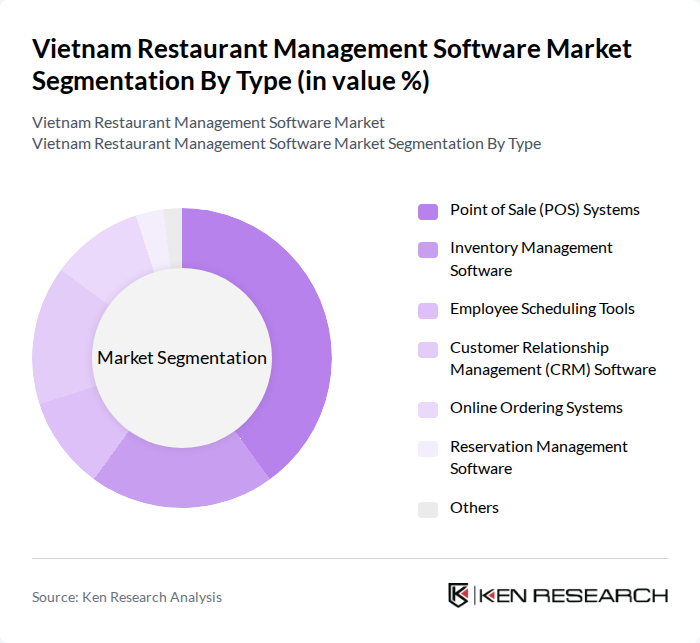

By Type:The market is segmented into various types of software solutions that cater to different operational needs of restaurants. The primary subsegments include Point of Sale (POS) Systems, Inventory Management Software, Employee Scheduling Tools, Customer Relationship Management (CRM) Software, Online Ordering Systems, Reservation Management Software, and Others. Among these, POS systems are leading the market due to their essential role in transaction processing and sales tracking.

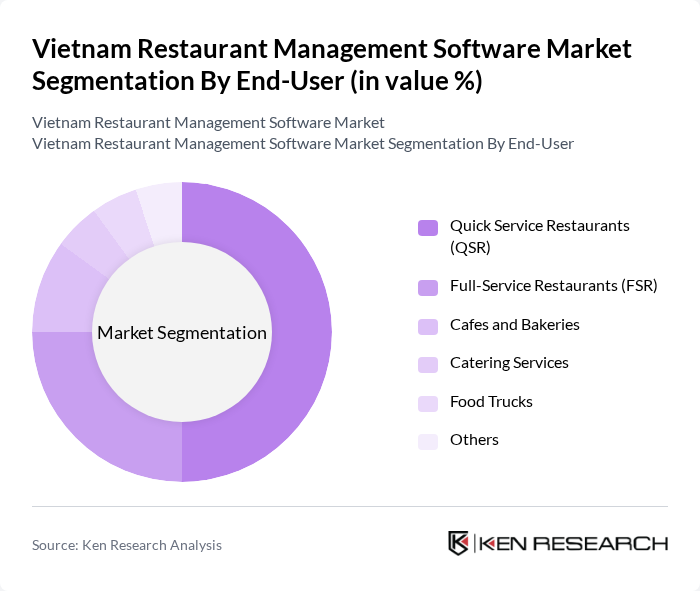

By End-User:The end-user segmentation includes Quick Service Restaurants (QSR), Full-Service Restaurants, Cafes and Bakeries, Catering Services, Food Trucks, and Others. Quick Service Restaurants are the dominant segment, driven by the increasing demand for fast and efficient service, which necessitates the use of advanced management software to streamline operations and enhance customer satisfaction.

The Vietnam restaurant management software market is characterized by a dynamic mix of regional and international players. Leading participants such as Misa JSC, KiotViet, Sapo, Haravan, Voso.vn, Tiki.vn, FastFood Vietnam, Nhanh.vn, VnPay, ZaloPay, MoMo, TPay, Payoo, Beeketing, Tamsu contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam restaurant management software market appears promising, driven by technological advancements and changing consumer behaviors. As more restaurants recognize the importance of digital solutions, the adoption of cloud-based systems and mobile applications is expected to rise. Additionally, the integration of AI and machine learning will enhance operational efficiency and customer experience, positioning software providers to capitalize on emerging trends and meet evolving market demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Point of Sale (POS) Systems Inventory Management Software Employee Scheduling Tools Customer Relationship Management (CRM) Software Online Ordering Systems Reservation Management Software Others |

| By End-User | Quick Service Restaurants (QSR) Full-Service Restaurants Cafes and Bakeries Catering Services Food Trucks Others |

| By Business Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Deployment Model | On-Premise Solutions Cloud-Based Solutions Hybrid Solutions Others |

| By Payment Model | Subscription-Based One-Time License Fee Pay-Per-Use Others |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas Others |

| By Customer Segment | Individual Consumers Corporate Clients Government Institutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fast Food Chains | 100 | Franchise Owners, Operations Managers |

| Fine Dining Restaurants | 80 | Restaurant Managers, IT Directors |

| Cafés and Bakeries | 70 | Business Owners, Customer Experience Managers |

| Food Delivery Services | 60 | Logistics Managers, Software Developers |

| Food Trucks and Street Vendors | 50 | Owner-Operators, Marketing Managers |

The Vietnam restaurant management software market is valued at approximately USD 150 million, reflecting significant growth driven by technological adoption in the food service industry and increasing demand for efficient management solutions among restaurant operators.