Region:Middle East

Author(s):Dev

Product Code:KRAA8305

Pages:91

Published On:November 2025

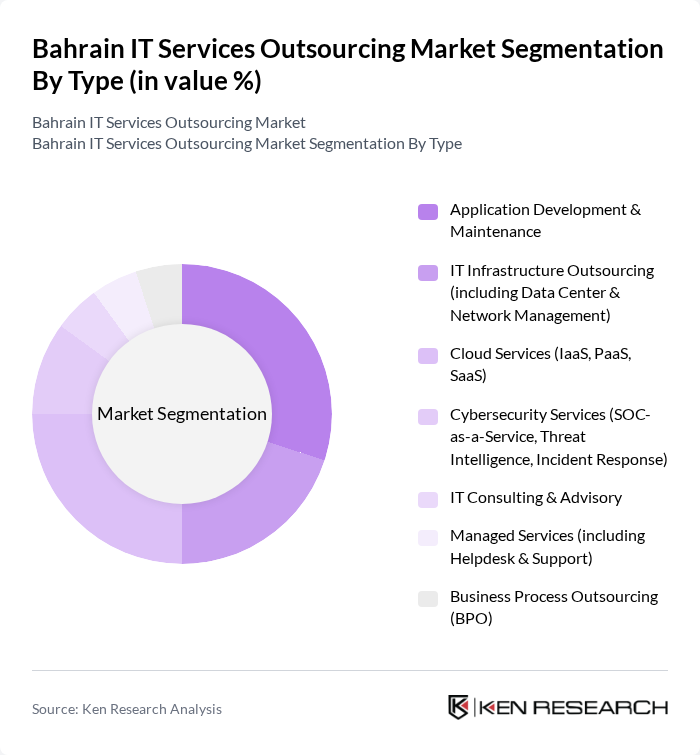

By Type:The market is segmented into Application Development & Maintenance, IT Infrastructure Outsourcing (including Data Center & Network Management), Cloud Services (IaaS, PaaS, SaaS), Cybersecurity Services (SOC-as-a-Service, Threat Intelligence, Incident Response), IT Consulting & Advisory, Managed Services (including Helpdesk & Support), and Business Process Outsourcing (BPO). Application Development & Maintenance and Cloud Services remain dominant, reflecting the region’s prioritization of scalable digital platforms, automation, and secure cloud migration. Cybersecurity Services and IT Infrastructure Outsourcing are also experiencing rapid growth due to heightened regulatory requirements and the proliferation of remote work environments .

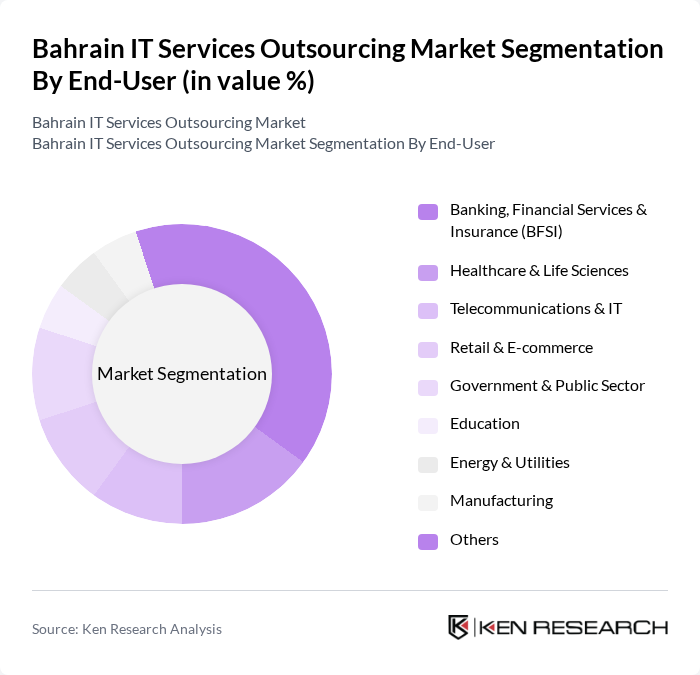

By End-User:The market serves Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, Telecommunications & IT, Retail & E-commerce, Government & Public Sector, Education, Energy & Utilities, Manufacturing, and Others. BFSI is the largest segment, driven by advanced fintech adoption, open banking APIs, and stringent cybersecurity directives. Retail & E-commerce and Government & Public Sector are also expanding rapidly, supported by omnichannel strategies, citizen-service digitization, and secure payment infrastructure .

The Bahrain IT Services Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Business Machines (GBM Bahrain), Bahrain Telecommunications Company (Batelco), Zain Bahrain, stc Bahrain, Beyon Cyber, Kalaam Telecom, Inovar, ITQAN Global for Cloud & Digital Computing Systems, MenaITech, Information & eGovernment Authority (iGA), Almoayyed Computers, Arab Financial Services (AFS), Almoayyed International Group, KPMG Fakhro (KPMG Bahrain), Deloitte & Touche Middle East (Bahrain) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain IT services outsourcing market appears promising, driven by ongoing digital transformation and increased investment in technology. As businesses continue to embrace remote work and cloud solutions, the demand for innovative IT services is expected to rise. Additionally, the government's commitment to fostering a technology-driven economy will likely create a conducive environment for growth, encouraging local firms to enhance their service offerings and explore new markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Application Development & Maintenance IT Infrastructure Outsourcing (including Data Center & Network Management) Cloud Services (IaaS, PaaS, SaaS) Cybersecurity Services (SOC-as-a-Service, Threat Intelligence, Incident Response) IT Consulting & Advisory Managed Services (including Helpdesk & Support) Business Process Outsourcing (BPO) |

| By End-User | Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Telecommunications & IT Retail & E-commerce Government & Public Sector Education Energy & Utilities Manufacturing Others |

| By Industry Vertical | Financial Services Manufacturing Energy and Utilities Transportation and Logistics Media and Entertainment Healthcare Retail & E-commerce Others |

| By Service Model | On-Premise Services Cloud-Based Services Hybrid Services Managed Services |

| By Delivery Model | Onshore Outsourcing Offshore Outsourcing Nearshore Outsourcing Others |

| By Client Size | Large Enterprises Small and Medium Enterprises (SMEs) Others |

| By Geographic Presence | Local Providers Regional Providers International Providers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services IT Outsourcing | 45 | IT Managers, Compliance Officers |

| Healthcare IT Services | 55 | Healthcare Administrators, IT Directors |

| Telecommunications Support Services | 40 | Operations Managers, Network Engineers |

| SME IT Outsourcing Solutions | 40 | Business Owners, IT Consultants |

| Cloud Services Adoption | 40 | CTOs, Cloud Architects |

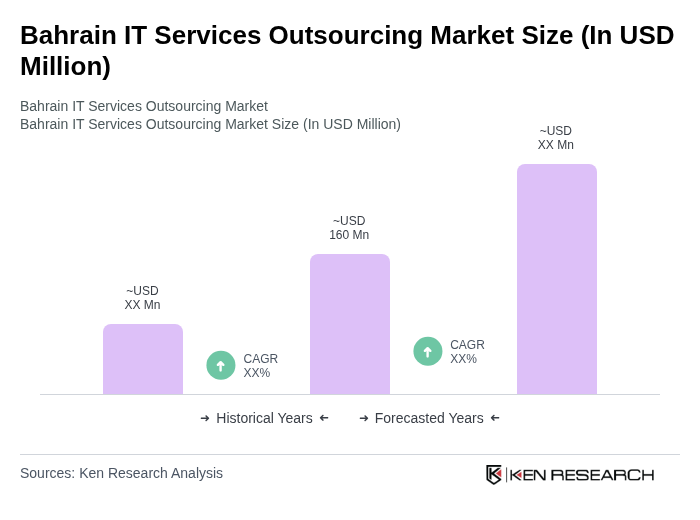

The Bahrain IT Services Outsourcing Market is valued at approximately USD 160 million, reflecting a significant growth driven by the demand for digital transformation, cloud computing, and cybersecurity solutions among enterprises.