Region:Middle East

Author(s):Rebecca

Product Code:KRAD7581

Pages:100

Published On:December 2025

Software Market.png)

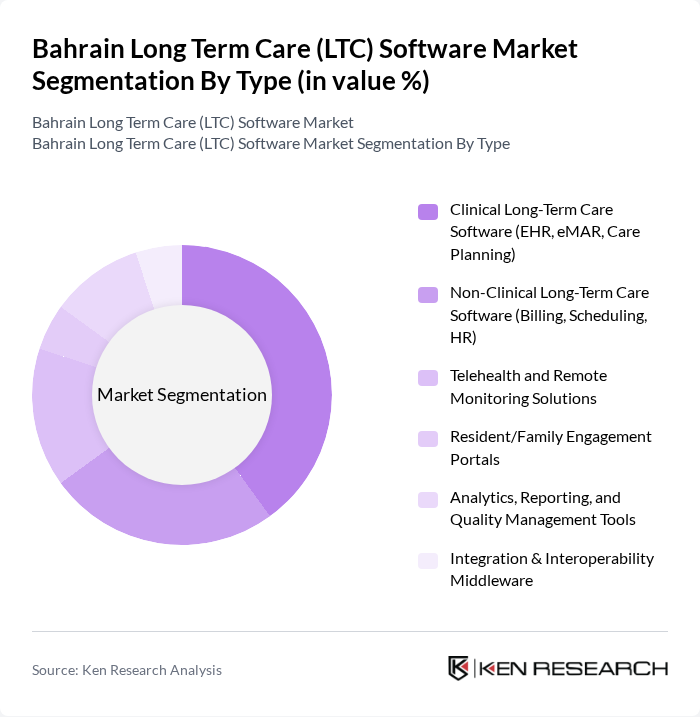

By Type:

The market is segmented into various types of software solutions, including Clinical Long-Term Care Software, Non-Clinical Long-Term Care Software, Telehealth and Remote Monitoring Solutions, Resident/Family Engagement Portals, Analytics, Reporting, and Quality Management Tools, and Integration & Interoperability Middleware. Among these, Clinical Long-Term Care Software is the leading segment, driven by the increasing need for electronic health records (EHR) and care planning tools. The demand for telehealth solutions has also surged, particularly in light of the recent global health challenges, as they provide essential remote care capabilities.

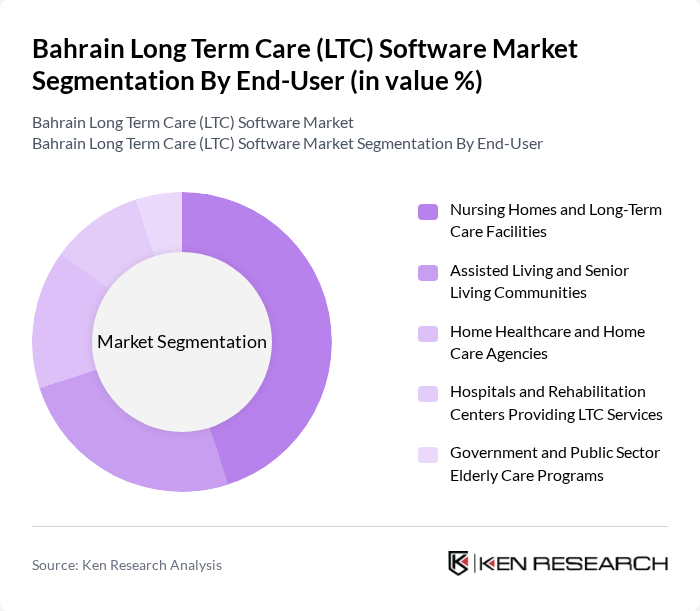

By End-User:

The end-user segmentation includes Nursing Homes and Long-Term Care Facilities, Assisted Living and Senior Living Communities, Home Healthcare and Home Care Agencies, Hospitals and Rehabilitation Centers Providing LTC Services, and Government and Public Sector Elderly Care Programs. Nursing Homes and Long-Term Care Facilities dominate this segment due to the high demand for comprehensive care management solutions that enhance operational efficiency and patient outcomes. Assisted Living Communities are also increasingly adopting LTC software to improve resident engagement and care coordination.

The Bahrain Long Term Care (LTC) Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cerner Corporation (Oracle Health), Epic Systems Corporation, InterSystems Corporation, Philips Healthcare (Philips Patient Monitoring & LTC Solutions), Tietoevry Care, PointClickCare Technologies Inc., Netsmart Technologies, Inc., MatrixCare, Kinnser Software (WellSky Home Health), Medisys Healthcare Solutions (GCC Healthcare IT Provider), Rhapsody Health (Corepoint & Rhapsody Integration for LTC), GE HealthCare (Healthcare Digital Solutions), Royal Bahrain Hospital – Digital & Homecare Solutions, KIMS Health Bahrain – Homecare & Chronic Care Programs, Alsalama Healthcare – Home Healthcare & Elderly Care Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain LTC software market appears promising, driven by the increasing integration of technology in healthcare. As the aging population grows, the demand for efficient, patient-centered care solutions will rise. Innovations in telehealth and mobile applications will further enhance service delivery. Additionally, partnerships between software providers and healthcare institutions will likely foster the development of tailored solutions, ensuring that the LTC sector can meet evolving patient needs effectively and sustainably.

| Segment | Sub-Segments |

|---|---|

| By Type | Clinical Long-Term Care Software (EHR, eMAR, Care Planning) Non-Clinical Long-Term Care Software (Billing, Scheduling, HR) Telehealth and Remote Monitoring Solutions Resident/Family Engagement Portals Analytics, Reporting, and Quality Management Tools Integration & Interoperability Middleware |

| By End-User | Nursing Homes and Long-Term Care Facilities Assisted Living and Senior Living Communities Home Healthcare and Home Care Agencies Hospitals and Rehabilitation Centers Providing LTC Services Government and Public Sector Elderly Care Programs |

| By Deployment Model | On-Premise Cloud-Based / Software-as-a-Service (SaaS) Hybrid Hosted by Local IT / Telecom Providers |

| By Functionality | Care and Patient/Resident Management Staff and Workforce Management Revenue Cycle, Billing, and Claims Management Compliance, Accreditation, and Risk Management Clinical Decision Support & Outcome Tracking |

| By Region | Capital Governorate (Manama) Northern Governorate Southern Governorate Muharraq Governorate |

| By Customer Type | Private Healthcare Providers and Operators Government and Semi-Government Institutions Non-Profit and Community-Based Organizations IT & Outsourced Managed Service Providers |

| By Pricing Model | Subscription-Based (Per User / Per Facility / Per Bed) One-Time License Fee Pay-Per-Use / Transaction-Based Outcome- or Value-Based Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Long-Term Care Facility Administrators | 100 | Facility Managers, Operations Directors |

| Healthcare IT Professionals | 80 | IT Managers, Software Developers |

| Caregivers and Nursing Staff | 70 | Nurses, Care Coordinators |

| Healthcare Policy Makers | 50 | Government Officials, Health Policy Analysts |

| Software Vendors and Service Providers | 60 | Sales Executives, Product Managers |

The Bahrain Long Term Care (LTC) Software Market is valued at approximately USD 10 million, reflecting its share of the Middle East & Africa LTC software market, which generated around USD 154 million in revenue.