Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7726

Pages:94

Published On:October 2025

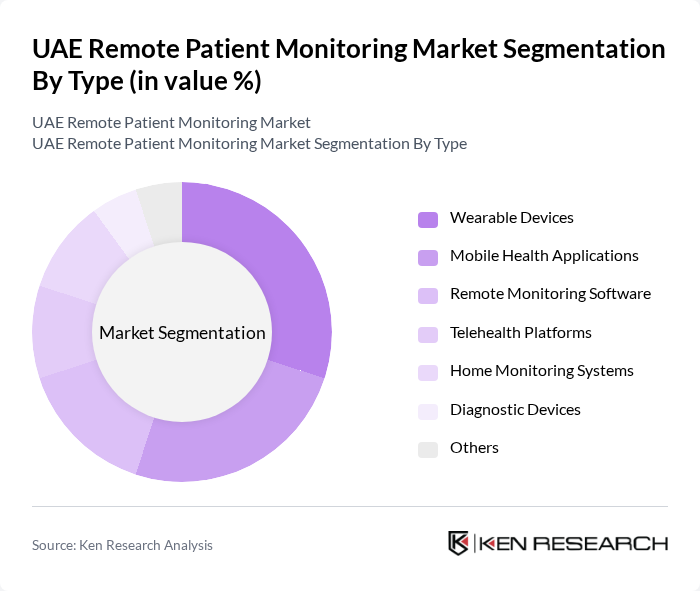

By Type:The market can be segmented into various types, including wearable devices, mobile health applications, remote monitoring software, telehealth platforms, home monitoring systems, diagnostic devices, and others. Each of these segments plays a crucial role in enhancing patient engagement and improving health outcomes.

The wearable devices segment is currently dominating the market due to the increasing consumer preference for health tracking and fitness monitoring. These devices, such as smartwatches and fitness bands, provide real-time health data, which is crucial for chronic disease management and preventive healthcare. The trend towards personalized health management and the integration of advanced technologies like AI and machine learning in wearables further enhance their appeal, driving significant adoption among consumers.

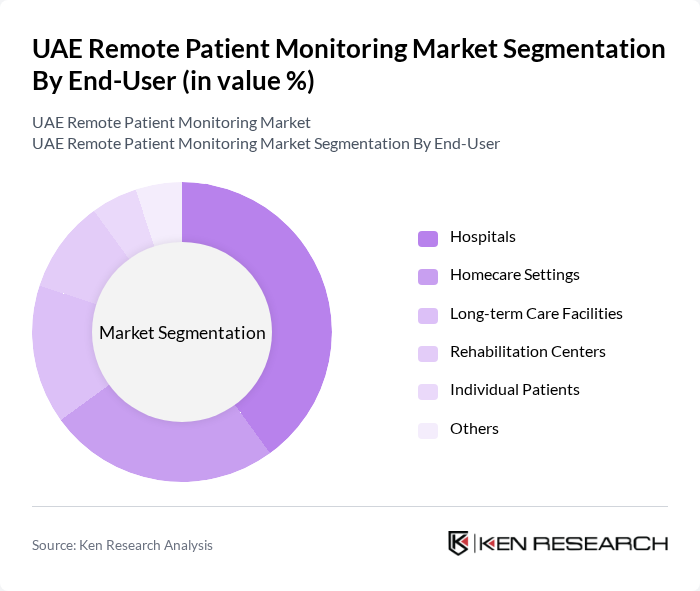

By End-User:The market is also segmented by end-users, which include hospitals, homecare settings, long-term care facilities, rehabilitation centers, individual patients, and others. Each end-user category has unique needs and preferences that influence the adoption of remote patient monitoring solutions.

Hospitals are the leading end-user segment, primarily due to their need for efficient patient management and monitoring solutions. The integration of remote monitoring technologies allows hospitals to enhance patient care, reduce readmission rates, and optimize resource allocation. Additionally, the increasing focus on value-based care and patient outcomes drives hospitals to adopt these technologies, further solidifying their position in the market.

The UAE Remote Patient Monitoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Medtronic, Abbott Laboratories, Siemens Healthineers, GE Healthcare, Honeywell Life Sciences, Biotronik, Omron Healthcare, Cerner Corporation, ResMed, Medtronic, iHealth Labs, Withings, DarioHealth, Tunstall Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE remote patient monitoring market appears promising, driven by technological advancements and a growing emphasis on patient-centric care. As healthcare providers increasingly adopt telehealth solutions, the integration of AI and machine learning will enhance monitoring capabilities, leading to improved patient outcomes. Furthermore, government initiatives aimed at promoting digital health will likely facilitate wider adoption, ensuring that remote monitoring becomes a standard practice in managing chronic diseases and elderly care in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Wearable Devices Mobile Health Applications Remote Monitoring Software Telehealth Platforms Home Monitoring Systems Diagnostic Devices Others |

| By End-User | Hospitals Homecare Settings Long-term Care Facilities Rehabilitation Centers Individual Patients Others |

| By Application | Chronic Disease Management Post-operative Monitoring Elderly Care Mental Health Monitoring Fitness and Wellness Tracking Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Healthcare Providers Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Device Type | Blood Pressure Monitors Glucose Monitors Heart Rate Monitors Pulse Oximeters Others |

| By Payment Model | Subscription-based Pay-per-use Bundled Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 150 | Doctors, Nurses, Healthcare Administrators |

| Technology Developers | 100 | Product Managers, Software Engineers, R&D Heads |

| Patients Using Remote Monitoring | 120 | Chronic Disease Patients, Elderly Patients |

| Healthcare Policy Makers | 80 | Health Ministry Officials, Regulatory Bodies |

| Insurance Providers | 70 | Claims Managers, Policy Underwriters |

The UAE Remote Patient Monitoring Market is valued at approximately USD 1.2 billion, driven by the rising prevalence of chronic diseases, an aging population, and advancements in telehealth technologies, which enhance patient care while reducing hospital visit costs.