Region:Middle East

Author(s):Shubham

Product Code:KRAD6680

Pages:91

Published On:December 2025

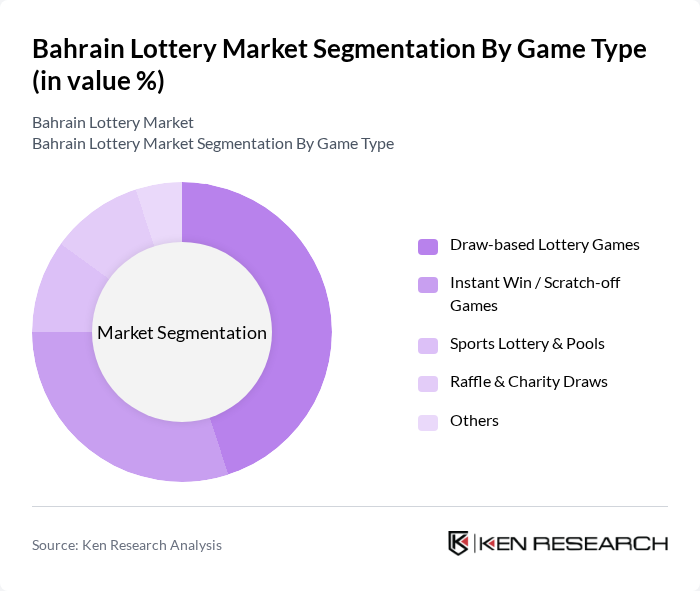

By Game Type:The market is segmented into various game types, including Draw-based Lottery Games, Instant Win / Scratch-off Games, Sports Lottery & Pools, Raffle & Charity Draws, and Others. Draw-based Lottery Games, including numerical draws and regional jackpot schemes accessed online from neighbouring jurisdictions, represent a major share due to their traditional appeal and the attraction of sizeable prizes. Instant Win / Scratch-off style games and digital instant-win formats see growing engagement globally, particularly among younger, mobile?first players who value immediacy and simple gameplay, and similar preferences are reflected in the uptake of fast-result charity and promotional draws among Bahrain’s tech?savvy population.

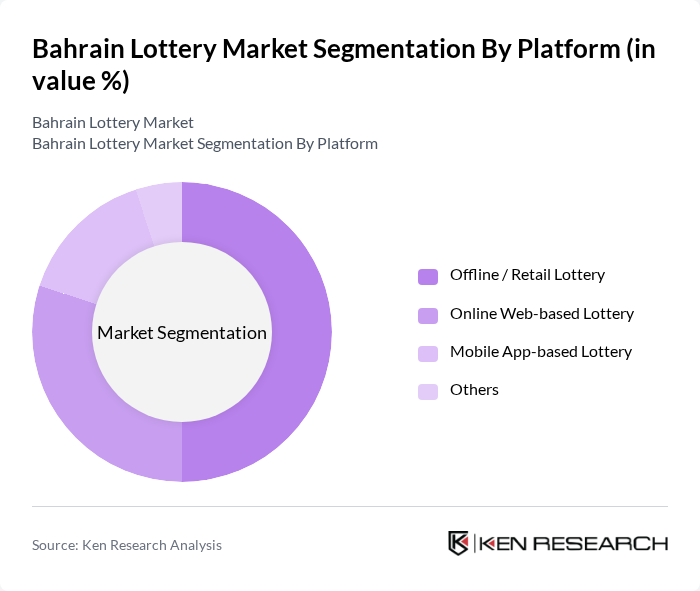

By Platform:The lottery market is also segmented by platform, including Offline / Retail Lottery, Online Web-based Lottery, Mobile App-based Lottery, and Others. The Offline / Retail Lottery, encompassing physical raffle tickets and duty?free prize draw coupons, remains an important channel in line with global patterns where offline retail continues to account for the largest share of lottery sales. However, Online Web-based and Mobile App-based Lottery platforms are rapidly gaining traction, supported by rising internet and smartphone penetration in Bahrain and the wider Gulf region, and by regional operators that allow Bahrain residents to participate digitally in cross?border draws with secure payment and identity verification features.

The Bahrain Lottery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Charity Organisation (raffle & fundraising draws), Bahrain Red Crescent Society (charity raffle activities), Bahrain Cancer Society (fundraising raffle initiatives), INTRALOT S.A., International Game Technology PLC (IGT), Scientific Games LLC (Light & Wonder Inc.), Jumbo Interactive Ltd., Emirates Draw (UAE-based draw accessed by Bahrain residents), Mahzooz (UAE-based draw accessed by Bahrain residents), Qatar Duty Free Raffles, Dubai Duty Free Millennium Millionaire & Finest Surprise, Bahrain Duty Free Shop Complex BSC (raffles & prize draws), National Lottery PLC (regional online lottery operator), Lotto247, Lottoland contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain lottery market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital platforms gain traction, operators are likely to enhance user experiences through innovative game formats and mobile applications. Furthermore, the government's commitment to responsible gaming will shape regulatory frameworks, ensuring consumer protection while fostering a sustainable market environment. This dynamic landscape presents opportunities for growth and collaboration, particularly in integrating local businesses into the lottery ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Game Type | Draw-based Lottery Games Instant Win / Scratch-off Games Sports Lottery & Pools Raffle & Charity Draws Others |

| By Platform | Offline / Retail Lottery Online Web-based Lottery Mobile App-based Lottery Others |

| By Game Purpose | Government-authorised Fundraising & Public Benefit Charity & Non-profit Lotteries Commercial / Private Lotteries (Offshore-accessed) Others |

| By Ticket Price Band | Low-value Tickets (? BHD 1) Mid-value Tickets (BHD 1–5) High-value Tickets (> BHD 5) Others |

| By Prize Structure | Fixed Jackpot Games Progressive Jackpot Games Secondary / Consolation Prize Games Others |

| By Player Profile | Resident Bahraini Players Expatriate Residents Visitors & Tourists Others |

| By Distribution / Sales Channel | Convenience Stores & Supermarkets Dedicated Lottery Kiosks & Booths Online Lottery Portals & Agents Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Lottery Participation | 140 | Regular Lottery Players, Occasional Players |

| Scratch Card Preferences | 100 | Frequent Scratch Card Buyers, Retailers |

| Online Lottery Engagement | 80 | Online Gamblers, Tech-Savvy Consumers |

| Demographic Insights | 120 | Young Adults, Middle-Aged Participants |

| Consumer Attitudes Towards Lottery | 90 | Potential Players, Non-Players |

The Bahrain Lottery Market is valued at approximately USD 140 million, reflecting a historical analysis of raffle, charity draws, and online lottery participation, driven by increasing consumer interest and access to diverse gaming options.