Region:Asia

Author(s):Geetanshi

Product Code:KRAD4087

Pages:91

Published On:December 2025

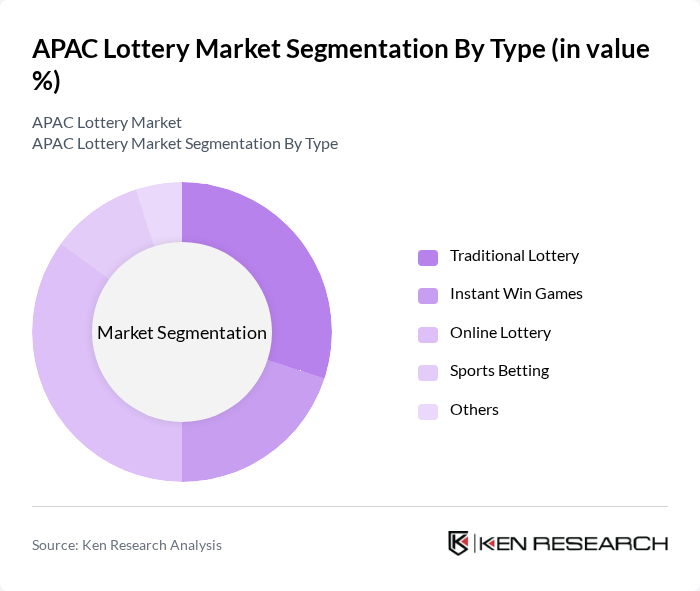

By Type:The APAC Lottery Market is segmented into various types, including Traditional Lottery, Instant Win Games, Online Lottery, Sports Betting, and Others. Among these, Online Lottery has gained significant traction due to the increasing penetration of smartphones and internet access, allowing players to participate conveniently from anywhere. Traditional Lottery remains popular, especially in regions with established practices, while Instant Win Games and Sports Betting are also witnessing growth due to changing consumer preferences.

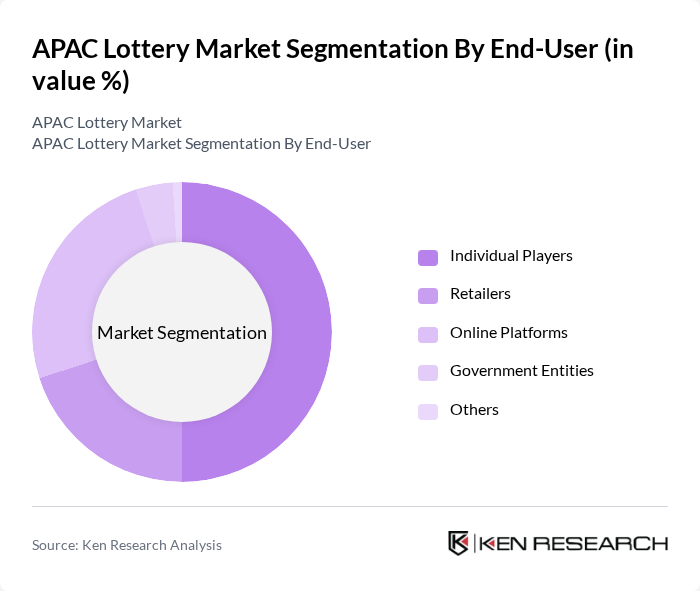

By End-User:The market is also segmented by end-users, which include Individual Players, Retailers, Online Platforms, Government Entities, and Others. Individual Players dominate the market as they represent the largest consumer base, driven by the increasing popularity of lottery games. Online Platforms are also gaining ground, providing a convenient way for players to engage with lottery games, while Government Entities play a crucial role in regulating and overseeing lottery operations.

The APAC Lottery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Singapore Pools, Tatts Group, Hong Kong Jockey Club, Intralot, Scientific Games, Camelot, Lottomatica, Veikkaus, Lotto NZ, Philippine Charity Sweepstakes Office, Malaysia Sports Toto, New Zealand Lotteries, Sugalaya, BCLC (British Columbia Lottery Corporation), Lotería Nacional de España contribute to innovation, geographic expansion, and service delivery in this space.

The APAC lottery market is poised for transformative growth, driven by technological innovations and evolving consumer preferences. As digital platforms gain traction, operators are likely to enhance user engagement through personalized experiences and gamification strategies. Additionally, the integration of blockchain technology may improve transparency and security, fostering consumer trust. With increasing government support for regulated lotteries, the market is expected to adapt to changing dynamics, creating a more robust and sustainable environment for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Lottery Instant Win Games Online Lottery Sports Betting Others |

| By End-User | Individual Players Retailers Online Platforms Government Entities Others |

| By Region | East Asia Southeast Asia South Asia Oceania |

| By Game Format | Number Draw Games Scratch-Off Games Keno Others |

| By Distribution Channel | Retail Outlets Online Platforms Mobile Applications Others |

| By Prize Structure | Fixed Prize Progressive Jackpot Others |

| By Marketing Strategy | Digital Marketing Traditional Advertising Promotions and Discounts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| National Lottery Participation | 120 | Lottery Players, Marketing Managers |

| Online Lottery Engagement | 100 | Digital Marketing Specialists, Online Players |

| Instant Win Games | 80 | Retail Managers, Game Developers |

| Regulatory Impact Assessment | 60 | Regulatory Officials, Compliance Officers |

| Consumer Behavior Analysis | 90 | Lottery Enthusiasts, Market Researchers |

The APAC Lottery Market is valued at approximately USD 105 billion, reflecting significant growth driven by increasing disposable incomes, urbanization, and the rising popularity of online gaming platforms in the region.