Region:Middle East

Author(s):Dev

Product Code:KRAD5283

Pages:97

Published On:December 2025

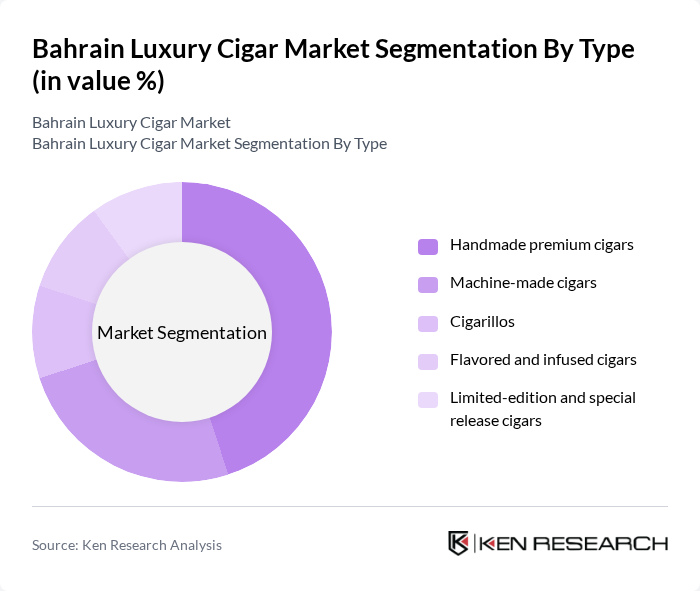

By Type:The market is segmented into various types of cigars, including handmade premium cigars, machine-made cigars, cigarillos, flavored and infused cigars, and limited-edition and special release cigars. Among these, handmade premium cigars dominate the market due to their artisanal quality and the growing preference for unique smoking experiences. Consumers are increasingly drawn to the craftsmanship and exclusivity associated with handmade cigars, which enhances their appeal in the luxury segment.

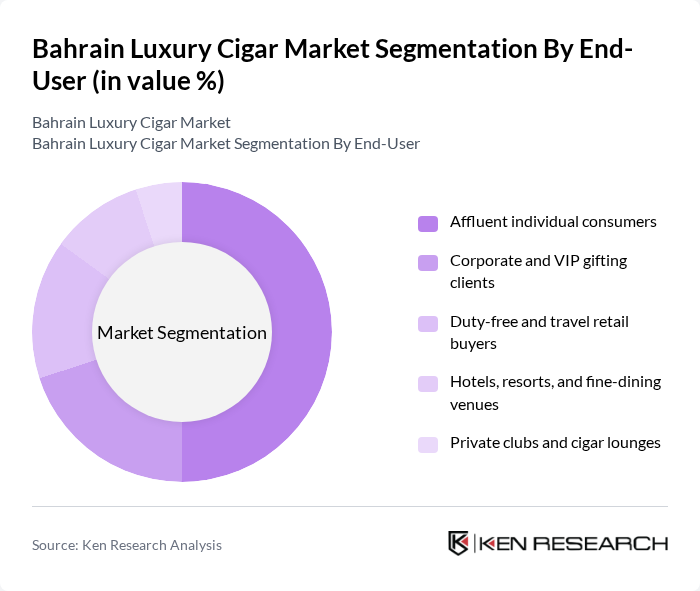

By End-User:The end-user segmentation includes affluent individual consumers, corporate and VIP gifting clients, duty-free and travel retail buyers, hotels, resorts, and fine-dining venues, as well as private clubs and cigar lounges. Affluent individual consumers represent the largest segment, driven by a growing culture of luxury consumption and the desire for premium experiences. This demographic is increasingly investing in high-quality cigars as a status symbol and a means of personal enjoyment.

The Bahrain Luxury Cigar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Habanos S.A. (Cuban cigar brands distributed in Bahrain), Oettinger Davidoff AG (Davidoff and associated brands), Scandinavian Tobacco Group A/S (STG), Imperial Brands PLC (Premium cigar portfolio, incl. Montecristo, Romeo y Julieta via subsidiaries), Plasencia Cigars S.A., Casdagli Cigars (through Luxury Tobacco World WLL in Bahrain), Luxury Tobacco World WLL (Bahrain-based premium cigar distributor and retailer), Bahrain Duty Free Shop Complex B.S.C. (cigar retail operations), Ritz-Carlton Bahrain – Cigar Lounge & retail humidor, The Domain Hotel & Spa – Cigar and whisky lounge, Sheraton Bahrain Hotel – Cigar bar & premium cigar program, Gulf Hotel Bahrain – Cigar lounge and premium cigar offering, Diplomat Radisson Blu Hotel – Cigar lounge and bar, Jumeirah Gulf of Bahrain Resort & Spa – Premium cigar and shisha venues, Four Seasons Hotel Bahrain Bay – High-end lounge with curated cigar selection contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain luxury cigar market is poised for growth, driven by increasing disposable incomes and a burgeoning interest in luxury lifestyle products. As tourism continues to rise, the demand for premium cigars is expected to expand, particularly in upscale hospitality venues. However, challenges such as stringent regulations and high taxation may temper growth. Companies that adapt to these challenges while leveraging emerging trends, such as online retail and personalized experiences, will likely thrive in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Handmade premium cigars Machine-made cigars Cigarillos Flavored and infused cigars Limited-edition and special release cigars |

| By End-User | Affluent individual consumers Corporate and VIP gifting clients Duty-free and travel retail buyers Hotels, resorts, and fine-dining venues Private clubs and cigar lounges |

| By Occasion | Weddings and family celebrations Corporate and business networking events Leisure and personal enjoyment Tourism and hospitality experiences Festive seasons and special gifting |

| By Packaging Type | Wooden and luxury presentation boxes Bundles and cabinet packs Tubes and single-stick packaging Sampler packs and gift sets |

| By Distribution Channel | Airport and seaport duty-free shops Specialty cigar and tobacco boutiques Luxury hotels, lounges, and clubs Online and e-commerce platforms Supermarkets, hypermarkets, and other retail |

| By Price Range | Ultra-premium (above BHD 10 per stick) Premium (BHD 5–10 per stick) Mid-range (BHD 2–5 per stick) Entry-level premium (below BHD 2 per stick) |

| By Brand Origin | Cuban brands Dominican Republic brands Nicaraguan and Honduran brands Other international brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Cigar Retailers | 40 | Store Owners, Sales Managers |

| Affluent Consumers | 150 | High-Income Individuals, Luxury Lifestyle Enthusiasts |

| Cigar Lounge Operators | 40 | Managers, Event Coordinators |

| Importers and Distributors | 40 | Supply Chain Managers, Business Development Executives |

| Market Analysts and Experts | 30 | Industry Analysts, Economic Researchers |

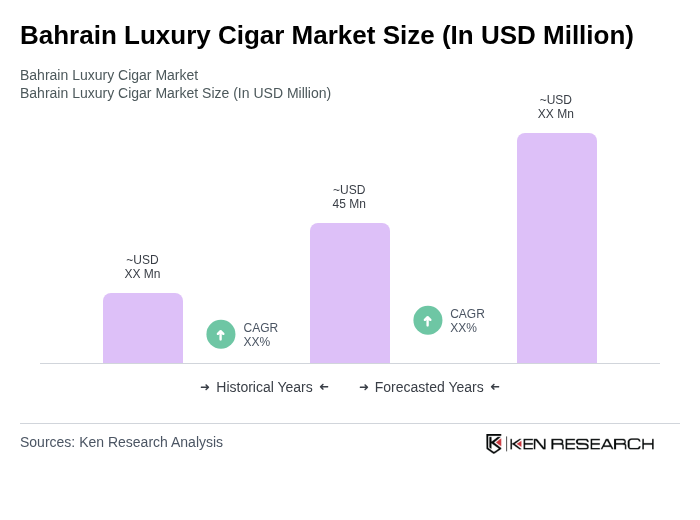

The Bahrain Luxury Cigar Market is valued at approximately USD 45 million, reflecting a five-year historical analysis. This growth is driven by increasing disposable incomes, luxury gifting trends, and demand from tourism and hospitality sectors.