Region:Middle East

Author(s):Shubham

Product Code:KRAB7431

Pages:98

Published On:October 2025

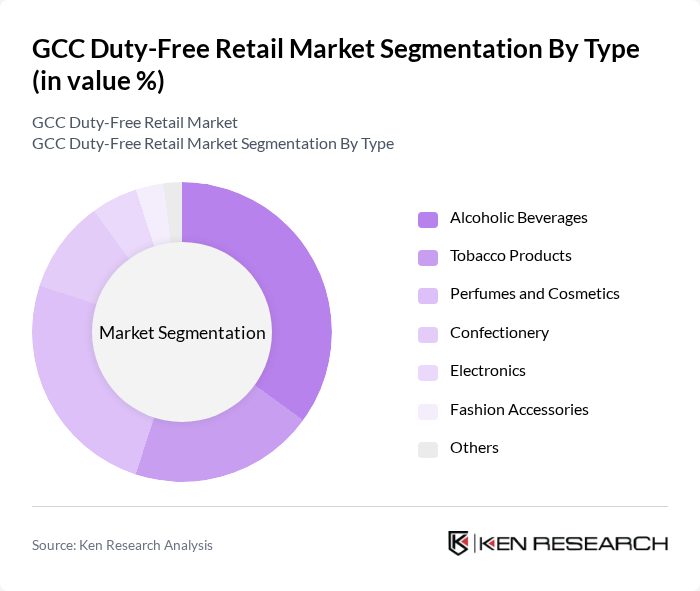

By Type:The duty-free retail market is segmented into various types, including Alcoholic Beverages, Tobacco Products, Perfumes and Cosmetics, Confectionery, Electronics, Fashion Accessories, and Others. Among these, Alcoholic Beverages and Perfumes and Cosmetics are particularly dominant due to their high demand among international travelers seeking luxury items at competitive prices. The trend of gifting and personal indulgence also drives sales in these categories.

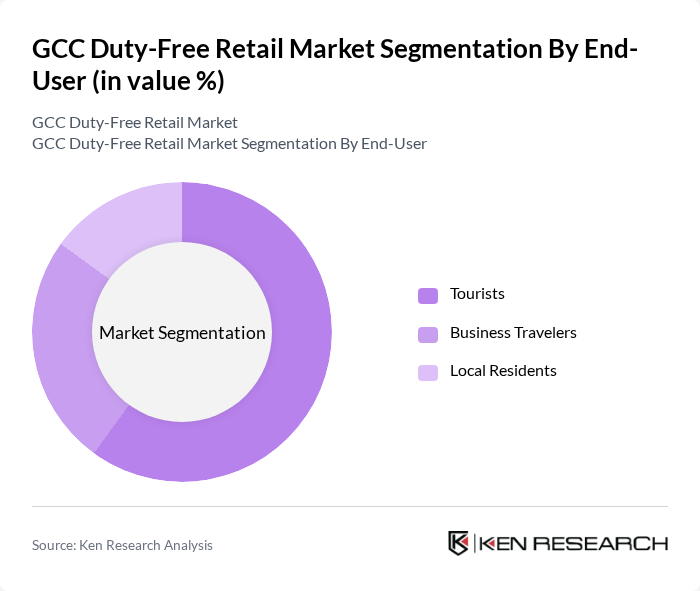

By End-User:The end-user segmentation includes Tourists, Business Travelers, and Local Residents. Tourists represent the largest segment, driven by the influx of international visitors to the GCC region, particularly in the UAE and Saudi Arabia. Business travelers also contribute significantly, as they often purchase luxury items as gifts or for personal use during their travels. Local residents are increasingly engaging in duty-free shopping due to the growing availability of products and competitive pricing.

The GCC Duty-Free Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dubai Duty Free, Qatar Duty Free, Abu Dhabi Duty Free, Bahrain Duty Free, Muscat Duty Free, Kuwait Duty Free, Dufry AG, Lagardère Travel Retail, DFS Group, Heinemann Duty Free, Aer Rianta International, Duty Free Americas, World Duty Free Group, Travel Retail Norway, and The Nuance Group contribute to innovation, geographic expansion, and service delivery in this space.

The GCC duty-free retail market is poised for dynamic growth, driven by increasing international travel and rising disposable incomes. As airport infrastructure continues to expand, retailers will have opportunities to enhance their product offerings and customer experiences. Additionally, the integration of digital payment solutions and personalized shopping experiences will likely become essential in attracting tech-savvy consumers. The focus on sustainability and health-conscious products will also shape future retail strategies, ensuring that duty-free shops remain competitive and relevant in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Alcoholic Beverages Tobacco Products Perfumes and Cosmetics Confectionery Electronics Fashion Accessories Others |

| By End-User | Tourists Business Travelers Local Residents |

| By Sales Channel | Airport Duty-Free Shops Border Shops Cruise Ship Retail Online Duty-Free Retail |

| By Product Category | Luxury Goods Everyday Items Specialty Products |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand-Conscious Shoppers Price-Sensitive Shoppers Impulse Buyers |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Duty-Free Retail Managers | 100 | Store Managers, Operations Directors |

| Frequent Travelers | 150 | Business Travelers, Tourists |

| Airport Authority Officials | 50 | Airport Operations Managers, Regulatory Officers |

| Luxury Goods Suppliers | 70 | Brand Managers, Sales Directors |

| Market Analysts | 30 | Industry Analysts, Economic Researchers |

The GCC Duty-Free Retail Market is valued at approximately USD 20 billion, driven by increased international travel, rising disposable incomes, and expanded airport infrastructure, particularly in the UAE and Saudi Arabia.