Region:Middle East

Author(s):Rebecca

Product Code:KRAD2892

Pages:84

Published On:November 2025

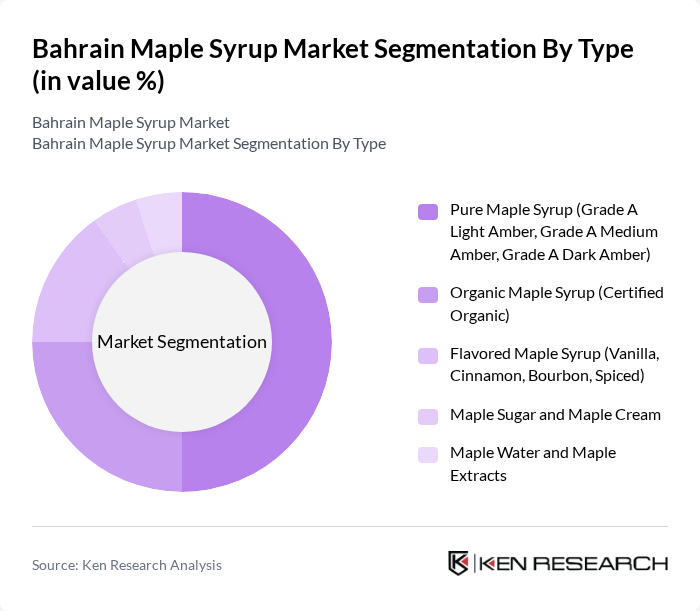

By Type:The market is segmented into various types of maple syrup, including Pure Maple Syrup, Organic Maple Syrup, Flavored Maple Syrup, Maple Sugar and Maple Cream, and Maple Water and Maple Extracts. Among these, Pure Maple Syrup, which includes Grade A Light Amber, Grade A Medium Amber, and Grade A Dark Amber, is the most popular due to its versatility and natural flavor. Organic Maple Syrup is gaining traction as health-conscious consumers seek certified organic options. Flavored varieties are also becoming increasingly popular, especially among younger demographics looking for unique taste experiences.

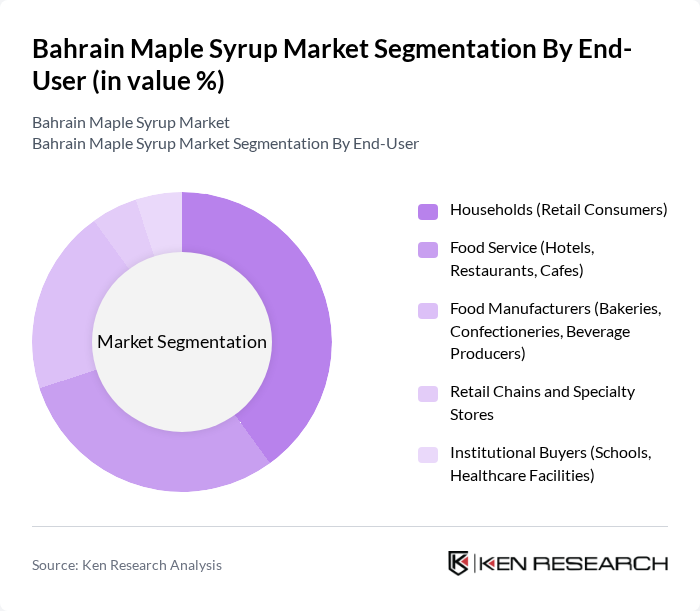

By End-User:The end-user segmentation includes Households, Food Service, Food Manufacturers, Retail Chains and Specialty Stores, and Institutional Buyers. Households represent the largest segment, driven by the increasing trend of using natural sweeteners in everyday cooking and baking. The Food Service sector, including hotels and restaurants, is also significant as they incorporate maple syrup into various dishes and beverages. Food Manufacturers are increasingly using maple syrup as a natural ingredient in products like snacks and beverages, further driving market growth.

The Bahrain Maple Syrup Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maple Grove Farms (Vermont, USA), Butternut Mountain Farm (Vermont, USA), Crown Maple (New York, USA), Fédération des producteurs acéricoles du Québec (Quebec, Canada), Shady Maple Farms (Pennsylvania, USA), Maple Valley Cooperative (Wisconsin, USA), Citadelle Maple Syrup (Quebec, Canada), Escuminac Maple Syrup (New Brunswick, Canada), Coombs Family Farms (Vermont, USA), Runamok Maple (Vermont, USA), Acer Groves (Ontario, Canada), Bascom Family Farms (Massachusetts, USA), Maple Leaf Farms (Ontario, Canada), Sugarbush Farm (Vermont, USA), Organic Maple Syrup Producers Association (Multi-regional) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain maple syrup market appears promising, driven by increasing health consciousness and a growing preference for natural sweeteners. As consumers continue to seek healthier alternatives, the demand for maple syrup is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility to maple syrup products, allowing for increased market penetration. The trend towards gourmet food experiences will further enhance the market's growth potential, creating opportunities for innovative product offerings and collaborations.

| Segment | Sub-Segments |

|---|---|

| By Type | Pure Maple Syrup (Grade A Light Amber, Grade A Medium Amber, Grade A Dark Amber) Organic Maple Syrup (Certified Organic) Flavored Maple Syrup (Vanilla, Cinnamon, Bourbon, Spiced) Maple Sugar and Maple Cream Maple Water and Maple Extracts |

| By End-User | Households (Retail Consumers) Food Service (Hotels, Restaurants, Cafes) Food Manufacturers (Bakeries, Confectioneries, Beverage Producers) Retail Chains and Specialty Stores Institutional Buyers (Schools, Healthcare Facilities) |

| By Packaging Type | Glass Bottles (250ml, 500ml, 1L) Plastic Containers (PET, HDPE) Squeeze Bottles and Dispensers Bulk Packaging (5L, 10L, 20L for Commercial Use) Premium Gift Sets and Specialty Packaging |

| By Distribution Channel | Online Retail (E-commerce Platforms, Direct-to-Consumer) Supermarkets and Hypermarkets Specialty Stores (Gourmet, Health Food, Organic) Direct Sales (Farmers Markets, Brand Outlets) Wholesale and Distributor Networks |

| By Region | Northern Governorate Southern Governorate Capital Governorate (Manama) Muharraq Governorate Riffa and Western Governorate |

| By Consumer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Income Level (Low, Medium, High, Ultra-High) Lifestyle Preferences (Health-conscious, Gourmet Enthusiasts, Eco-conscious, Premium Seekers) Nationality (Bahraini Nationals, Expatriate Communities) |

| By Usage Occasion | Breakfast Use (Pancakes, Waffles, Oatmeal) Baking and Cooking (Desserts, Sauces, Marinades) Beverage Additive (Coffee, Tea, Smoothies) Specialty Applications (Cosmetics, Wellness Products) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 150 | Health-Conscious Consumers, Organic Food Shoppers |

| Distribution Channel Analysis | 80 | Distributors, Importers |

| Market Trend Evaluation | 60 | Food Industry Analysts, Market Researchers |

| Product Availability Assessment | 70 | Retail Staff, Inventory Managers |

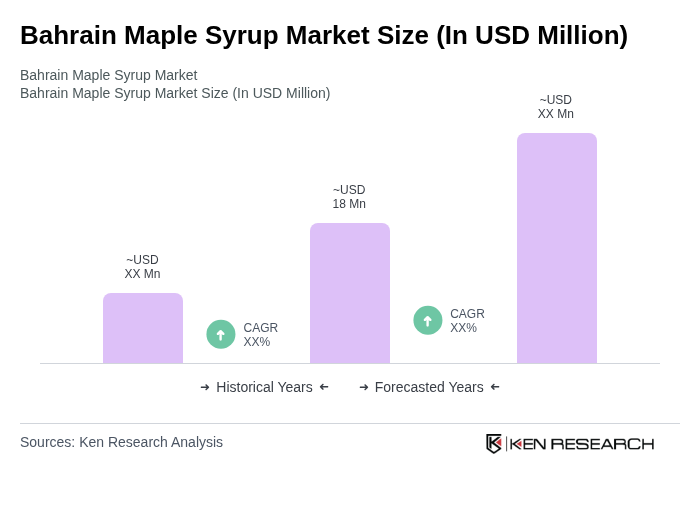

The Bahrain Maple Syrup Market is valued at approximately USD 18 million, reflecting a growing consumer preference for natural sweeteners and organic products over the past five years.