Region:Middle East

Author(s):Dev

Product Code:KRAC4192

Pages:88

Published On:October 2025

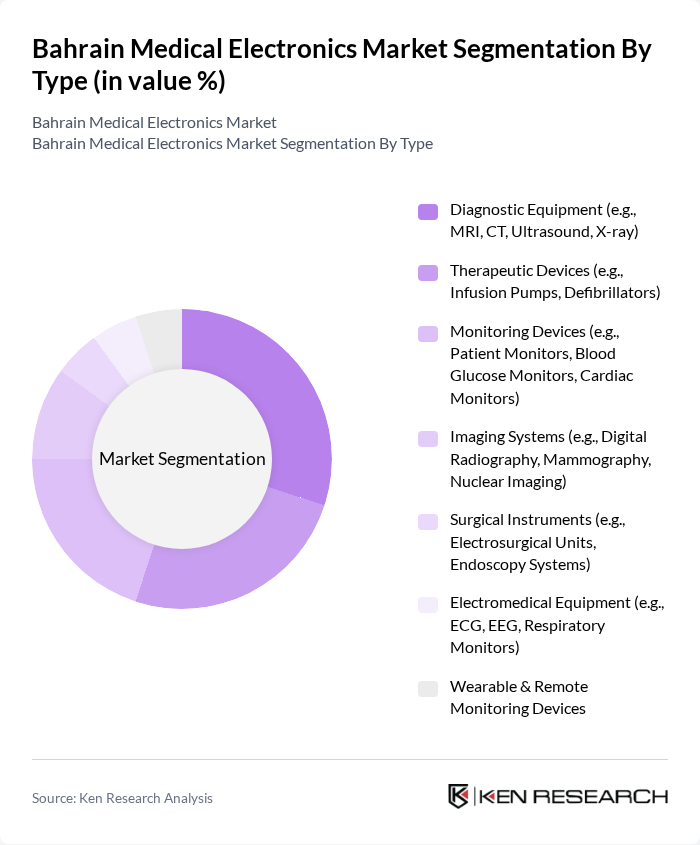

By Type:The market is segmented into various types of medical electronics, including diagnostic equipment, therapeutic devices, monitoring devices, imaging systems, surgical instruments, electromedical equipment, and wearable & remote monitoring devices. Each of these segments plays a crucial role in enhancing patient care and improving healthcare outcomes. The largest shares are held by diagnostic and monitoring equipment, reflecting the region’s focus on early disease detection and chronic disease management .

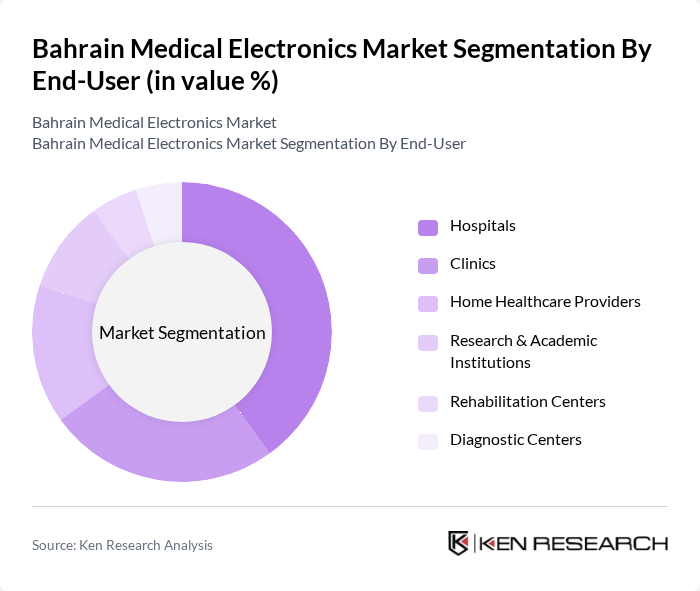

By End-User:The end-user segmentation includes hospitals, clinics, home healthcare providers, research & academic institutions, rehabilitation centers, and diagnostic centers. Each segment has unique requirements and contributes to the overall growth of the medical electronics market. Hospitals and clinics are the primary adopters, driven by the need for advanced diagnostics and patient monitoring .

The Bahrain Medical Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, GE HealthCare Technologies Inc., Medtronic plc, Johnson & Johnson Services, Inc., Abbott Laboratories, Boston Scientific Corporation, Stryker Corporation, B. Braun Melsungen AG, Canon Medical Systems Corporation, Olympus Corporation, Hitachi Medical Corporation, Fujifilm Holdings Corporation, Hologic, Inc., Varian Medical Systems, Inc., Smith+Nephew plc, Coloplast Corp., Saudi Mais Co., Zimmer Biomet, F. Hoffmann-La Roche Ltd., Becton, Dickinson and Company, Novartis AG, Cardinal Health contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Bahrain medical electronics market appears promising, driven by ongoing technological innovations and supportive government policies. As the healthcare sector continues to embrace digital transformation, the integration of AI and telemedicine is expected to enhance patient care significantly. Furthermore, the increasing focus on personalized medicine will likely lead to the development of tailored medical devices, improving treatment outcomes. Overall, the market is poised for growth, with a strong emphasis on quality and accessibility in healthcare delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Equipment (e.g., MRI, CT, Ultrasound, X-ray) Therapeutic Devices (e.g., Infusion Pumps, Defibrillators) Monitoring Devices (e.g., Patient Monitors, Blood Glucose Monitors, Cardiac Monitors) Imaging Systems (e.g., Digital Radiography, Mammography, Nuclear Imaging) Surgical Instruments (e.g., Electrosurgical Units, Endoscopy Systems) Electromedical Equipment (e.g., ECG, EEG, Respiratory Monitors) Wearable & Remote Monitoring Devices |

| By End-User | Hospitals Clinics Home Healthcare Providers Research & Academic Institutions Rehabilitation Centers Diagnostic Centers |

| By Application | Cardiovascular Applications Neurological Applications Orthopedic Applications Respiratory Applications Diagnostic Imaging Remote Patient Monitoring Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Component | Hardware (Sensors, Processors, Displays) Software (Health IT, Imaging Software, AI Algorithms) Services (Maintenance, Training, Integration) |

| By Policy Support | Subsidies for Medical Equipment Tax Incentives for Manufacturers Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 60 | Procurement Managers, Supply Chain Coordinators |

| Biomedical Engineering Teams | 50 | Biomedical Engineers, Technical Directors |

| Healthcare IT Specialists | 40 | IT Managers, Health Informatics Specialists |

| Medical Device Regulatory Bodies | 40 | Regulatory Affairs Managers, Compliance Officers |

| End-users of Medical Electronics | 70 | Doctors, Nurses, Healthcare Practitioners |

The Bahrain Medical Electronics Market is valued at approximately USD 95 million, reflecting growth driven by advancements in healthcare technology, increased demand for diagnostic and therapeutic devices, and a growing aging population requiring enhanced medical care.