Region:Europe

Author(s):Shubham

Product Code:KRAB6249

Pages:83

Published On:October 2025

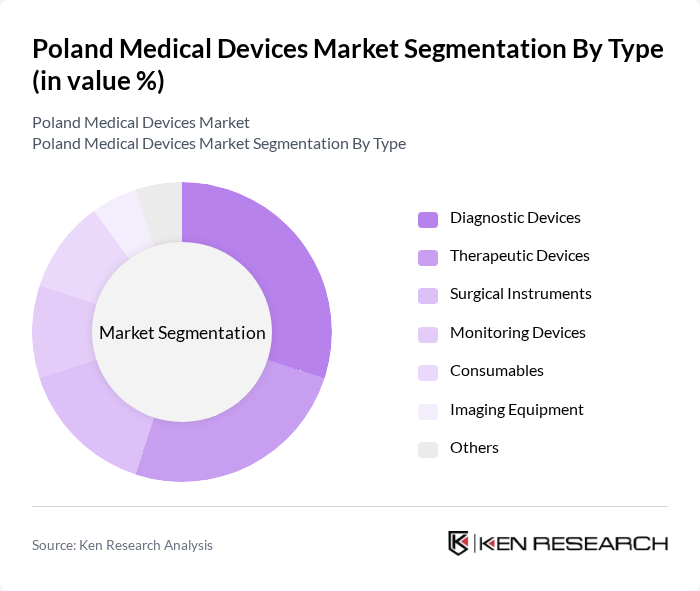

By Type:The market is segmented into various types of medical devices, including diagnostic devices, therapeutic devices, surgical instruments, monitoring devices, consumables, imaging equipment, and others. Each of these subsegments plays a crucial role in the healthcare system, catering to different medical needs and patient care requirements.

The diagnostic devices subsegment is currently dominating the market due to the increasing demand for early disease detection and monitoring. Innovations in point-of-care testing and home diagnostics have significantly contributed to this growth. The rise in chronic diseases, coupled with a focus on preventive healthcare, has led to a surge in the adoption of diagnostic devices across various healthcare settings. This trend is expected to continue as healthcare providers increasingly prioritize accurate and timely diagnostics to improve patient outcomes.

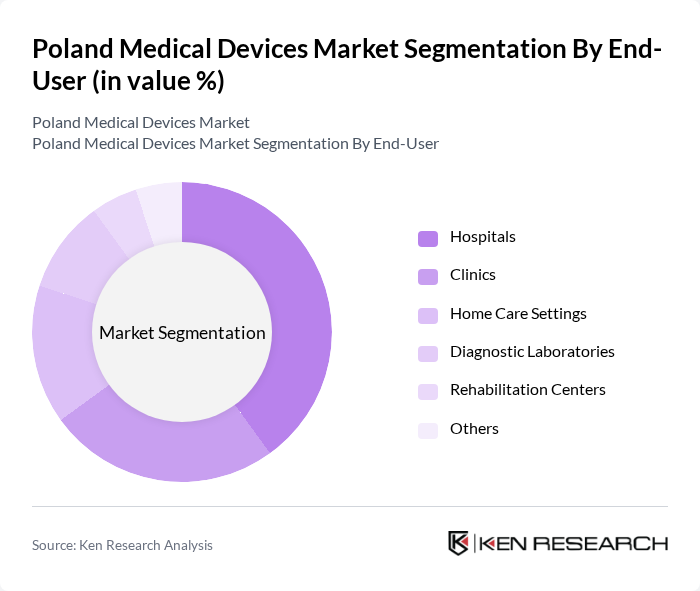

By End-User:The market is categorized based on end-users, including hospitals, clinics, home care settings, diagnostic laboratories, rehabilitation centers, and others. Each end-user segment has unique requirements and preferences, influencing the types of medical devices utilized.

Hospitals are the leading end-user segment in the market, primarily due to their extensive use of various medical devices for patient care and treatment. The increasing number of hospital admissions, along with the growing complexity of medical procedures, drives the demand for advanced medical technologies. Additionally, hospitals are investing in upgrading their medical equipment to enhance operational efficiency and improve patient outcomes, further solidifying their position as the dominant end-user in the medical devices market.

The Poland Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic, Siemens Healthineers, Philips Healthcare, GE Healthcare, B.Braun, Johnson & Johnson, Stryker Corporation, Abbott Laboratories, Boston Scientific, Zimmer Biomet, Olympus Corporation, Terumo Corporation, 3M Health Care, Canon Medical Systems, Hologic, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland medical devices market appears promising, driven by ongoing technological innovations and a growing emphasis on preventive healthcare. As the healthcare system evolves, there will be a greater focus on integrating digital health solutions, including telemedicine and remote monitoring technologies. Additionally, the increasing demand for personalized medicine will likely spur further advancements in medical devices, enabling tailored treatment options that enhance patient outcomes and overall healthcare efficiency in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Devices Therapeutic Devices Surgical Instruments Monitoring Devices Consumables Imaging Equipment Others |

| By End-User | Hospitals Clinics Home Care Settings Diagnostic Laboratories Rehabilitation Centers Others |

| By Application | Cardiovascular Orthopedic Neurology Ophthalmology Dental Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Regulatory Compliance | CE Marking ISO Certification FDA Approval |

| By Technology | Digital Health Technologies Robotics D Printing Bioprinting Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Diagnostic Imaging Devices | 100 | Radiologists, Imaging Technologists |

| Cardiovascular Devices | 80 | Cardiologists, Cardiac Surgeons |

| Orthopedic Implants | 70 | Orthopedic Surgeons, Hospital Administrators |

| Patient Monitoring Systems | 90 | Nurses, Clinical Engineers |

| Home Healthcare Devices | 60 | Home Care Providers, Patients |

The Poland Medical Devices Market is valued at approximately USD 4.5 billion, reflecting significant growth driven by factors such as an aging population, increased healthcare expenditure, and advancements in medical technology.