Region:Middle East

Author(s):Rebecca

Product Code:KRAD8434

Pages:97

Published On:December 2025

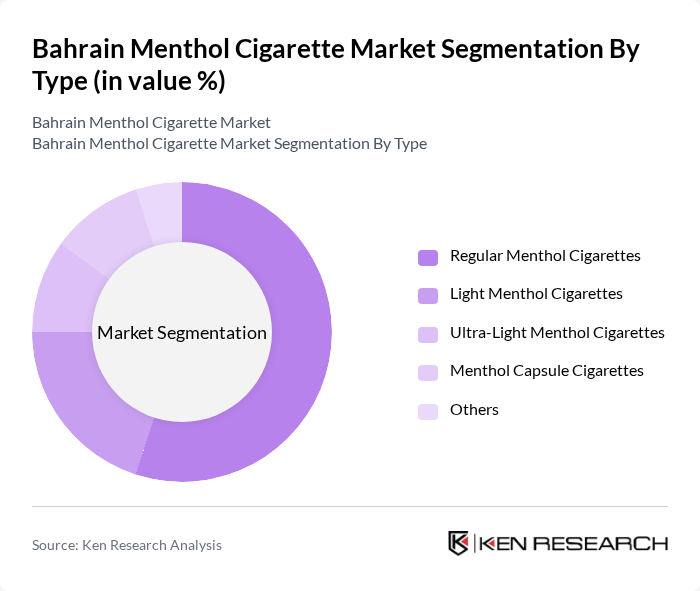

By Type:The market is segmented into various types of menthol cigarettes, including Regular Menthol Cigarettes, Light Menthol Cigarettes, Ultra-Light Menthol Cigarettes, Menthol Capsule Cigarettes, and Others. Among these, Regular Menthol Cigarettes dominate the market due to their widespread acceptance and preference among smokers. The appeal of menthol flavor, which provides a cooling sensation, has made these cigarettes particularly popular among both new and experienced smokers. Light and Ultra-Light variants are also gaining traction, especially among health-conscious consumers looking for lower tar options.

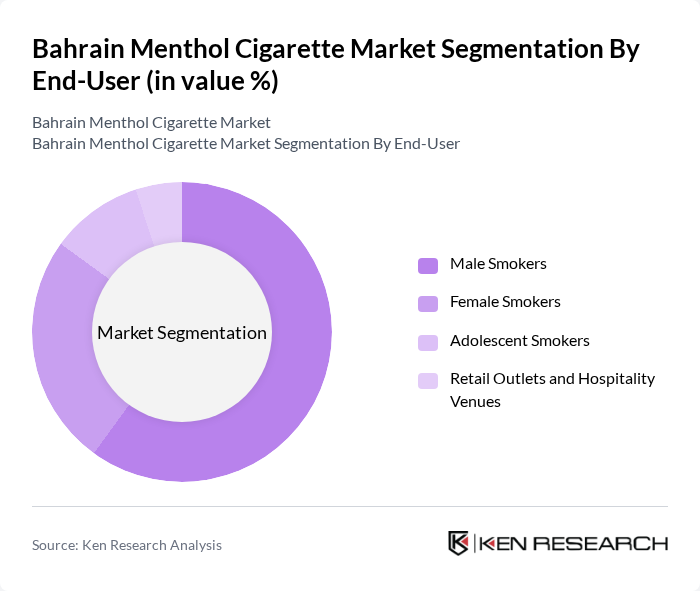

By End-User:The end-user segmentation includes Male Smokers, Female Smokers, Adolescent Smokers, and Retail Outlets and Hospitality Venues. Male Smokers represent the largest segment, driven by traditional smoking habits and brand loyalty. However, the female segment is growing rapidly as more women are entering the smoking demographic, influenced by social trends and marketing strategies. Adolescent Smokers, while a smaller segment, are significant due to their potential for long-term brand loyalty if they start smoking at a young age.

The Bahrain Menthol Cigarette Market is characterized by a dynamic mix of regional and international players. Leading participants such as British American Tobacco, Philip Morris International, Japan Tobacco International, Imperial Brands, Altria Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain menthol cigarette market appears cautiously optimistic, driven by evolving consumer preferences and regulatory landscapes. As health awareness continues to shape purchasing decisions, manufacturers are likely to innovate with new flavors and marketing strategies. Additionally, the growth of e-commerce platforms will facilitate easier access to menthol products. However, ongoing regulatory scrutiny and health campaigns may challenge traditional sales channels, necessitating adaptive strategies from industry players to maintain market relevance.

| Segment | Sub-Segments |

|---|---|

| By Type | Regular Menthol Cigarettes Light Menthol Cigarettes Ultra-Light Menthol Cigarettes Menthol Capsule Cigarettes Others |

| By End-User | Male Smokers Female Smokers Adolescent Smokers Retail Outlets and Hospitality Venues |

| By Packaging Type | Soft Packs Hard Packs Cartons Others |

| By Distribution Channel | Store-Based Retailers (Supermarkets/Hypermarkets) Convenience Stores Specialty Tobacco Shops Online Retail Duty-Free and Travel Retail |

| By Consumer Demographics | Age Group (18-24, 25-40, 41-56, 57+) Gender (Male, Female, Unisex) Income Level (Luxury, Premium, Mass) Others |

| By Flavor Variants | Classic Menthol Mint Menthol Capsule Others |

| By Price Range | Luxury Premium Mid-Range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Distribution of Menthol Cigarettes | 100 | Store Managers, Tobacco Product Buyers |

| Consumer Preferences for Menthol Cigarettes | 120 | Regular Menthol Smokers, Occasional Smokers |

| Regulatory Impact Assessment | 80 | Public Health Officials, Tobacco Control Advocates |

| Market Trends Analysis | 70 | Market Analysts, Industry Experts |

| Distribution Channel Insights | 90 | Wholesalers, Distributors, Retail Chain Executives |

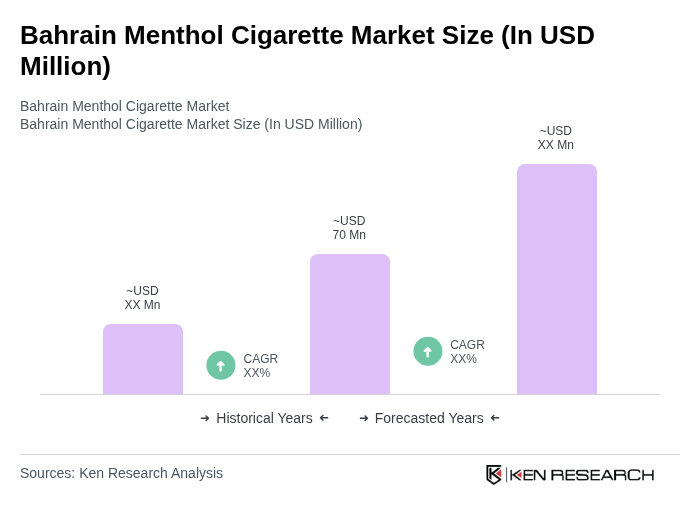

The Bahrain Menthol Cigarette Market is valued at approximately USD 70 million, reflecting a five-year historical analysis. This growth is attributed to the increasing popularity of menthol flavors, particularly among younger consumers, and lower taxation compared to other tobacco products.