Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9045

Pages:100

Published On:November 2025

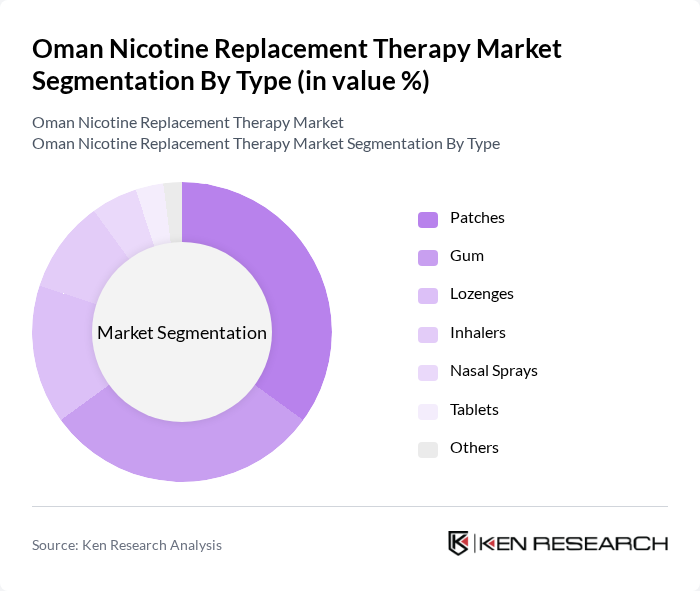

By Type:The market is segmented into various types of nicotine replacement therapies, including patches, gum, lozenges, inhalers, nasal sprays, tablets, and others. Patches and gum remain the most popular due to their convenience and proven effectiveness in managing withdrawal symptoms. The demand for lozenges and inhalers is increasing as consumers seek alternative and personalized methods to aid in smoking cessation, supported by the growing availability of these products in pharmacies and clinics .

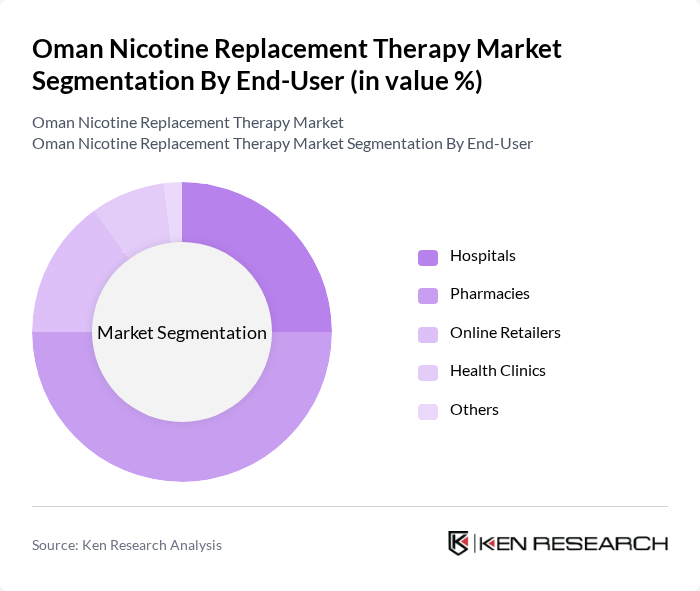

By End-User:The end-user segmentation includes hospitals, pharmacies, online retailers, health clinics, and others. Pharmacies are the leading end-user segment, reflecting the strong role of retail channels in providing easy access to nicotine replacement products. Hospitals and health clinics also play a vital role in promoting these therapies through structured smoking cessation programs and patient education, while online retailers are gaining traction due to increased digital adoption and convenience .

The Oman Nicotine Replacement Therapy Market is characterized by a dynamic mix of regional and international players. Leading participants such as GlaxoSmithKline, Johnson & Johnson, Pfizer, Novartis, Sanofi, Cipla, Teva Pharmaceutical Industries, Reckitt Benckiser, Dr. Reddy's Laboratories, Aurobindo Pharma contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman nicotine replacement therapy market appears promising, driven by increasing digital health solutions and a growing emphasis on personalized cessation programs. As more smokers turn to technology for support, the integration of telehealth services is expected to enhance accessibility to NRT products. Additionally, the trend towards natural and organic NRT formulations is likely to gain traction, appealing to health-conscious consumers and further expanding the market landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Patches Gum Lozenges Inhalers Nasal Sprays Tablets Others |

| By End-User | Hospitals Pharmacies Online Retailers Health Clinics Others |

| By Distribution Channel | Direct Sales Retail Pharmacies E-commerce Platforms Hospitals and Clinics Others |

| By Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender (Male, Female) Socioeconomic Status (Low, Middle, High) Others |

| By Product Formulation | Standard Formulations Customized Formulations Combination Therapies Others |

| By Packaging Type | Single-use Packaging Multi-use Packaging Bulk Packaging Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 80 | Doctors, Pharmacists, Smoking Cessation Counselors |

| Patients Using NRT | 120 | Individuals who have purchased NRT products in the last year |

| Public Health Officials | 40 | Health Policy Makers, Tobacco Control Advocates |

| Retailers of NRT Products | 60 | Pharmacy Owners, Store Managers |

| Market Analysts | 20 | Industry Analysts, Research Consultants |

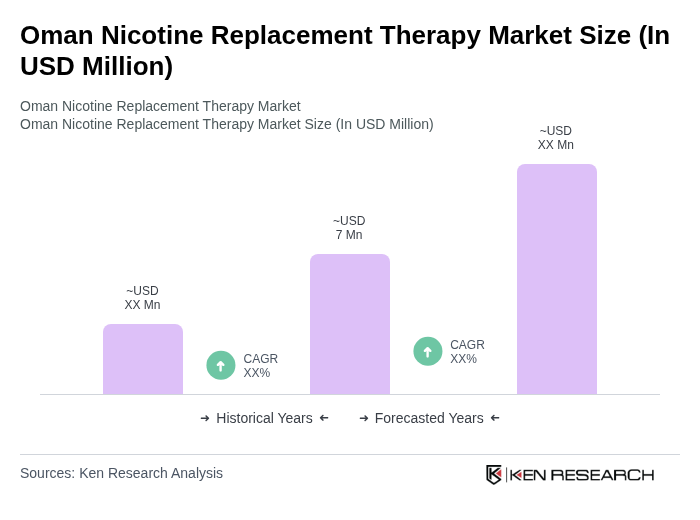

The Oman Nicotine Replacement Therapy market is valued at approximately USD 7 million, reflecting a growing trend in smoking cessation efforts driven by increased awareness of health risks and government initiatives promoting healthier lifestyles.