Region:Middle East

Author(s):Shubham

Product Code:KRAD6631

Pages:96

Published On:December 2025

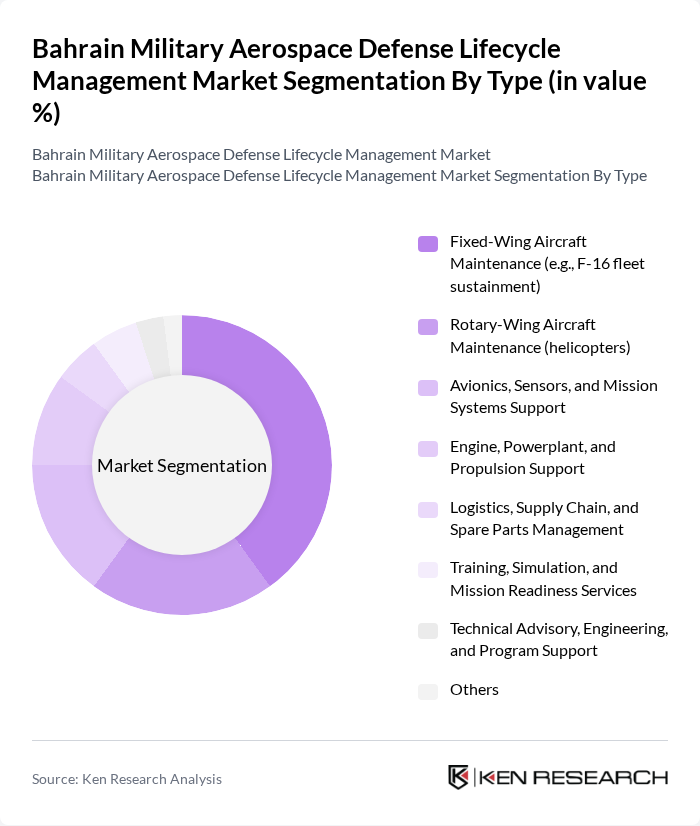

By Type:The market is segmented into various types of services that cater to the lifecycle management of military aerospace assets. The subsegments include Fixed-Wing Aircraft Maintenance, Rotary-Wing Aircraft Maintenance, Avionics, Sensors, and Mission Systems Support, Engine, Powerplant, and Propulsion Support, Logistics, Supply Chain, and Spare Parts Management, Training, Simulation, and Mission Readiness Services, Technical Advisory, Engineering, and Program Support, and Others. Among these, Fixed-Wing Aircraft Maintenance is currently the leading subsegment due to the significant investment in maintaining and upgrading fighter jets like the F-16 Block 70 fleet.

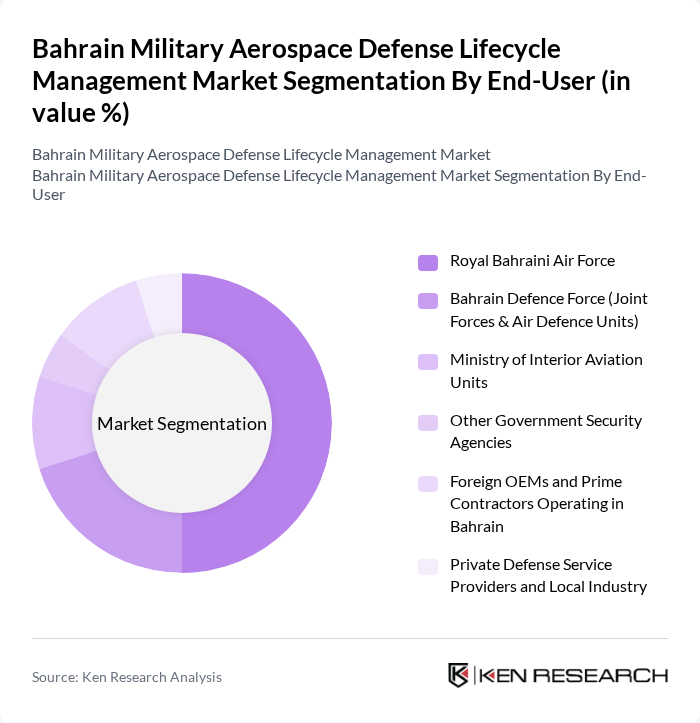

By End-User:The end-user segmentation includes various military and defense organizations that utilize aerospace defense lifecycle management services. The primary end-users are the Royal Bahraini Air Force, Bahrain Defence Force (Joint Forces & Air Defence Units), Ministry of Interior Aviation Units, Other Government Security Agencies, Foreign OEMs and Prime Contractors Operating in Bahrain, and Private Defense Service Providers and Local Industry. The Royal Bahraini Air Force is the dominant end-user, driven by its extensive fleet and operational requirements.

The Bahrain Military Aerospace Defense Lifecycle Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lockheed Martin Aeronautics, General Electric Aerospace, BAE Systems plc, Boeing Defense, Space & Security, Northrop Grumman Corporation, L3Harris Technologies, Inc., Raytheon Technologies (RTX Corporation), Rolls-Royce plc, Thales Group, Leonardo S.p.A., Elbit Systems Ltd., Saab AB, Rheinmetall AG, Bahrain Defence Force – Royal Bahraini Air Force (End-User & Strategic Partner), Gulf Aerospace Co. W.L.L. (Local MRO and Support Provider) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Bahrain's military aerospace defense lifecycle management market appears promising, driven by ongoing investments in modernization and strategic partnerships. As the government continues to prioritize defense spending, particularly in advanced technologies, the market is expected to witness significant growth. Additionally, the emphasis on cybersecurity and digitalization will shape future defense strategies, ensuring that Bahrain remains resilient against emerging threats while enhancing operational capabilities and efficiency in military operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Wing Aircraft Maintenance (e.g., F-16 fleet sustainment) Rotary-Wing Aircraft Maintenance (helicopters) Avionics, Sensors, and Mission Systems Support Engine, Powerplant, and Propulsion Support Logistics, Supply Chain, and Spare Parts Management Training, Simulation, and Mission Readiness Services Technical Advisory, Engineering, and Program Support Others |

| By End-User | Royal Bahraini Air Force Bahrain Defence Force (Joint Forces & Air Defence Units) Ministry of Interior Aviation Units Other Government Security Agencies Foreign OEMs and Prime Contractors Operating in Bahrain Private Defense Service Providers and Local Industry |

| By Application | Air Superiority and Combat Operations Intelligence, Surveillance, and Reconnaissance (ISR) Air Mobility, Transport, and Airlift Support Airborne Training, Exercises, and Joint Operations Support Maritime Patrol and Coastal Defense Support Others |

| By Service Model | Full Lifecycle Performance-Based Logistics (PBL) Maintenance, Repair, and Overhaul (MRO) Contracts Integrated Logistics Support (ILS) & Sustainment Engineering Training-as-a-Service and Contractor Logistics Support (CLS) Others |

| By Technology | Advanced Materials and Structural Health Monitoring Artificial Intelligence and Predictive Maintenance Analytics Internet of Things (IoT) and Connected Fleet Management Digital Twin, Simulation, and Virtual Maintenance Training Cybersecurity for Aerospace Platforms and Ground Systems Others |

| By Procurement Type | Foreign Military Sales (FMS) and Government-to-Government Deals Direct Commercial Sales (DCS) with OEMs and Primes Public-Private Partnerships and Offset-Linked Contracts Local Subcontracting and Vendor Support Others |

| By Policy Support | Government Defense Modernization Programs Industrial Participation and Offset Policies Regulatory and Export Control Framework Tax, Fee, and Customs Concession Schemes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Strategies | 110 | Procurement Officers, Defense Analysts |

| Aerospace Component Manufacturing | 85 | Operations Managers, Production Supervisors |

| Defense Technology Innovations | 75 | R&D Managers, Technology Officers |

| Military Training Programs | 55 | Training Coordinators, Military Educators |

| Logistics and Supply Chain Management | 95 | Logistics Managers, Supply Chain Analysts |

The Bahrain Military Aerospace Defense Lifecycle Management Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased defense spending and modernization initiatives, particularly in advanced military aircraft maintenance and lifecycle management services.