Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4787

Pages:92

Published On:December 2025

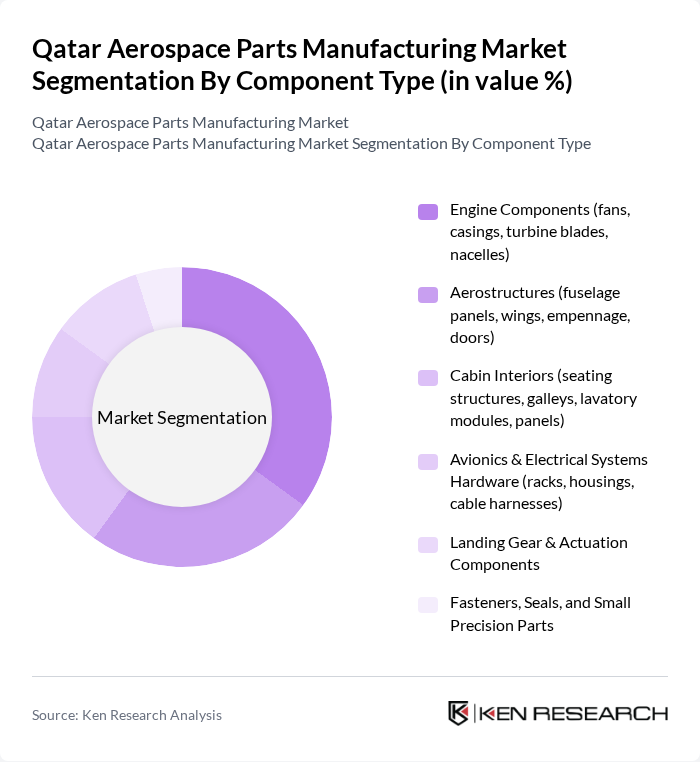

By Component Type:The component type segmentation includes various subsegments such as engine components, aerostructures, cabin interiors, avionics and electrical systems hardware, landing gear and actuation components, and fasteners, seals, and small precision parts. This structure is consistent with global aerospace parts manufacturing classifications, where major part families are typically grouped into engines, aerostructures, avionics, interiors, and landing gear/actuation systems. At a global level, aerostructures currently hold the largest share of the parts market, driven by extensive use of advanced composites and large structural assemblies; however, engine components remain a critical value?intensive subsegment due to high technology content and ongoing investment in fuel?efficient propulsion systems. In Qatar, the component mix is influenced by the country’s role as an aviation hub, the presence of engine and component logistics and repair flows via Qatar Airways Cargo’s Aerospace product, and incentives for advanced manufacturing, supporting activity across both engine?related parts and aerostructures, as well as high?specification interiors and avionics hardware.

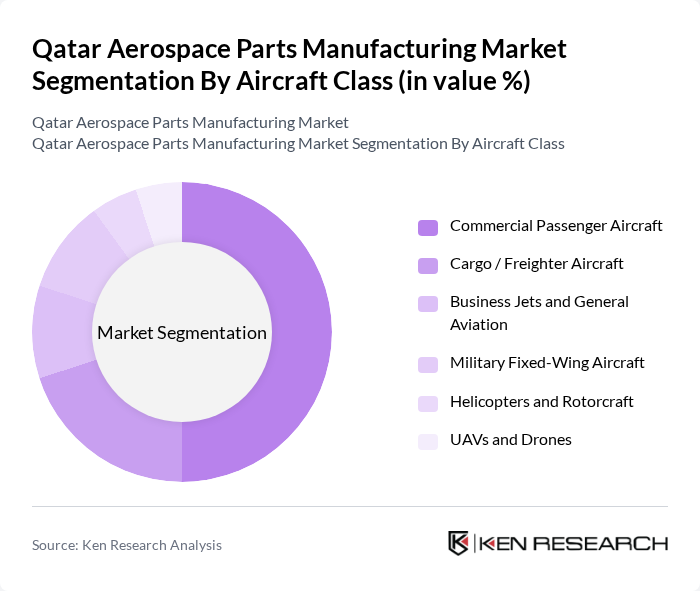

By Aircraft Class:The aircraft class segmentation encompasses commercial passenger aircraft, cargo/freighter aircraft, business jets and general aviation, military fixed-wing aircraft, helicopters and rotorcraft, and UAVs and drones. This segmentation aligns with global aerospace parts demand patterns in which commercial and cargo aircraft account for the majority of parts consumption, followed by military platforms and rotorcraft. In Qatar, the commercial passenger aircraft segment is leading the market, driven by the strong rebound and continued growth of international air travel through Hamad International Airport, Qatar Airways’ ongoing fleet optimization, and the country’s positioning as a long?haul transit hub. This segment's growth is further supported by the global shift toward more fuel?efficient and environmentally friendly aircraft, which increases demand for next?generation parts, lightweight materials, and upgraded systems supplied into fleets operating in and through Qatar.

The Qatar Aerospace Parts Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Airways Group (including Qatar Airways and Qatar Airways Cargo – AEROSPACE product), Qatar Aviation Services, Gulf Helicopters Company, Qatar Aircraft Catering Company (QACC), Hamad International Airport (MATAR), Qatar Free Zones Authority (Ras Bufontas and Umm Alhoul), Qatar Science & Technology Park (QSTP), Qatar Development Bank (including Industrial and SME Support Programs), Qatar Civil Aviation Authority, Qatar Armed Forces / Barzan Holdings (defence and aerospace industrial initiatives), Milaha – Qatar Navigation Q.P.S.C. (industrial logistics and project cargo), GWC (Gulf Warehousing Company Q.P.S.C.), Qatar Industrial Manufacturing Company Q.P.S.C. (QIMC), Doha Cables / local precision metal and cable manufacturers serving aerospace projects, Selected International Aerospace OEMs and Tier?1s with Operations or Partnerships in Qatar (e.g., Collins Aerospace, Rolls?Royce, GE Aerospace – where present via service or JV structures) contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Qatar aerospace parts manufacturing market appears promising, driven by ongoing advancements in technology and increasing regional air travel. The shift towards additive manufacturing and digital transformation is expected to enhance production efficiency and reduce costs. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly materials, positioning Qatar as a competitive player in the global aerospace supply chain in future.

| Segment | Sub-Segments |

|---|---|

| By Component Type | Engine Components (fans, casings, turbine blades, nacelles) Aerostructures (fuselage panels, wings, empennage, doors) Cabin Interiors (seating structures, galleys, lavatory modules, panels) Avionics & Electrical Systems Hardware (racks, housings, cable harnesses) Landing Gear & Actuation Components Fasteners, Seals, and Small Precision Parts |

| By Aircraft Class | Commercial Passenger Aircraft Cargo / Freighter Aircraft Business Jets and General Aviation Military Fixed-Wing Aircraft Helicopters and Rotorcraft UAVs and Drones |

| By Production & Service Application | OEM Production (line-fit parts) Licensed Parts Production (PMAs, OEM-approved) Maintenance, Repair and Overhaul (MRO) Parts Supply Retrofit & Upgrade Programs Prototyping & Low-Volume Custom Parts |

| By Material | Aluminum and Aluminum Alloys Titanium and High-Temperature Alloys Carbon-Fiber and Glass-Fiber Composites Steel and Nickel-Based Alloys High-Performance Polymers and Other Advanced Materials |

| By Manufacturing Technology | CNC Machining and Precision Milling Additive Manufacturing / 3D Printing Casting and Metal Injection Molding Forging and Extrusion Surface Treatment, Coating and Finishing |

| By Customer Type / Distribution Channel | Direct Supply to Airlines (e.g., Qatar Airways, foreign carriers) Supply to Global OEMs and Tier?1 Integrators Supply to MRO Providers and Engineering Service Firms Distributors and Trading Companies E?procurement and Online Platforms |

| By Location of Production / Industrial Zone | Ras Bufontas Free Zone (Adjacent to Hamad International Airport) Umm Alhoul Free Zone Mesaieed Industrial Area Other Industrial Estates within Qatar |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Parts Manufacturing | 100 | Manufacturing Managers, Production Supervisors |

| Supply Chain Management in Aerospace | 80 | Supply Chain Directors, Logistics Coordinators |

| Quality Assurance in Aerospace Parts | 70 | Quality Control Managers, Compliance Officers |

| Research & Development in Aerospace | 60 | R&D Engineers, Product Development Managers |

| Regulatory Compliance in Aerospace Manufacturing | 40 | Regulatory Affairs Specialists, Legal Advisors |

The Qatar Aerospace Parts Manufacturing Market is valued at approximately USD 1.1 billion, reflecting the growth of the global aerospace industry and Qatar's expanding aviation sector, particularly driven by Qatar Airways and Hamad International Airport.