Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9350

Pages:83

Published On:November 2025

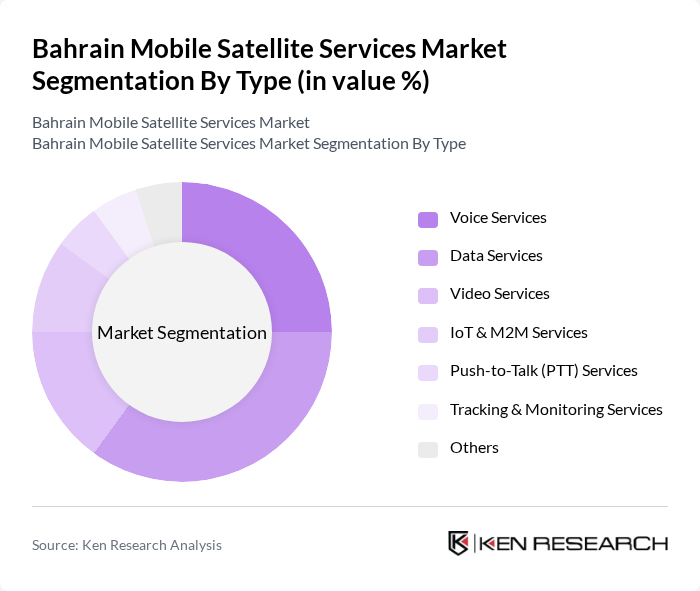

By Type:The market is segmented into various types, including Voice Services, Data Services, Video Services, IoT & M2M Services, Push-to-Talk (PTT) Services, Tracking & Monitoring Services, and Others. Among these, Data Services are currently dominating the market due to the increasing reliance on data-driven applications across industries. The demand for high-speed internet and real-time data transmission in sectors such as oil and gas, maritime, and emergency services is propelling the growth of this segment. Voice Services also hold a significant share, particularly in remote communication scenarios .

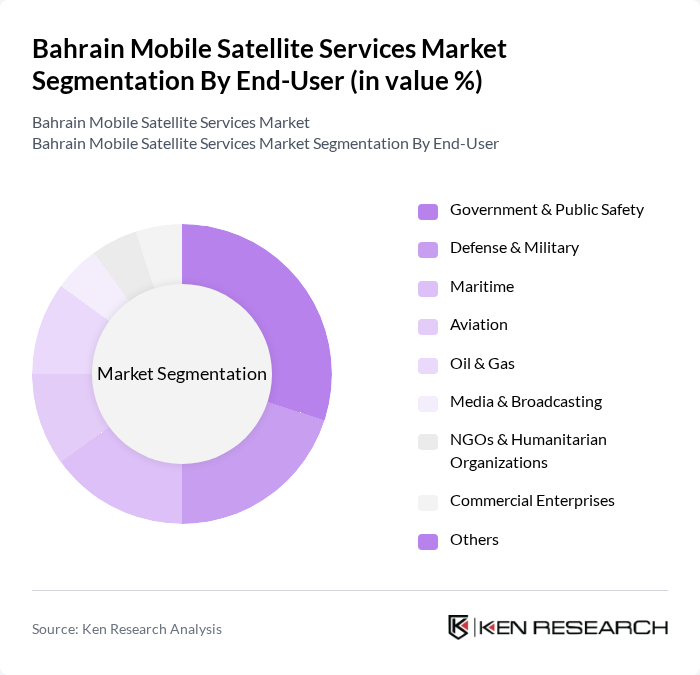

By End-User:The market is segmented by end-users, including Government & Public Safety, Defense & Military, Maritime, Aviation, Oil & Gas, Media & Broadcasting, NGOs & Humanitarian Organizations, Commercial Enterprises, and Others. The Government & Public Safety segment is leading the market, driven by the increasing need for reliable communication systems in emergency response and disaster management. The Defense & Military sector also contributes significantly, as secure and uninterrupted communication is critical for operational effectiveness. The maritime and oil & gas sectors are also notable end-users, reflecting Bahrain’s strategic role in regional logistics and energy .

The Bahrain Mobile Satellite Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intelsat, SES S.A., Inmarsat, Eutelsat Group, Thuraya Telecommunications Company (a subsidiary of Yahsat/Al Yah Satellite Communications Company PJSC), Iridium Communications Inc., Telesat, Hispasat, Speedcast International Limited, Globalstar, Inc., Viasat Inc., Hughes Network Systems, LLC (EchoStar Corporation), Avanti Communications Group plc, Arabsat (Arab Satellite Communications Organization), APT Satellite Holdings Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain mobile satellite services market appears promising, driven by technological advancements and increasing demand for connectivity. The integration of artificial intelligence in satellite operations is expected to enhance service efficiency and reliability. Additionally, the shift towards hybrid communication solutions will likely provide more flexible options for users. As the government continues to invest in digital infrastructure, the market is poised for growth, particularly in underserved areas, fostering greater accessibility and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Voice Services Data Services Video Services IoT & M2M Services Push-to-Talk (PTT) Services Tracking & Monitoring Services Others |

| By End-User | Government & Public Safety Defense & Military Maritime Aviation Oil & Gas Media & Broadcasting NGOs & Humanitarian Organizations Commercial Enterprises Others |

| By Application | Emergency & Disaster Response Maritime Communication Aviation Communication Asset Tracking & Fleet Management Remote Monitoring & SCADA Broadcast & Media Transmission Environmental & Weather Monitoring Others |

| By Technology | Geostationary Earth Orbit (GEO) Satellites Low Earth Orbit (LEO) Satellites Medium Earth Orbit (MEO) Satellites Hybrid Satellite-Terrestrial Systems Others |

| By Service Model | Managed Services Hosted Services On-Premise Solutions Cloud-Based Services Others |

| By Market Channel | Direct Sales Distributors & System Integrators Online Platforms Value-Added Resellers (VARs) Others |

| By Customer Segment | Large Enterprises Small & Medium Enterprises (SMEs) Government Agencies Individual & Consumer Users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Maritime Satellite Services | 60 | Fleet Managers, Maritime Operations Directors |

| Aviation Communication Solutions | 50 | Flight Operations Managers, Aviation Safety Officers |

| Emergency Services Communication | 40 | Emergency Response Coordinators, Public Safety Officials |

| Land Mobile Satellite Services | 55 | Field Operations Managers, Telecommunications Engineers |

| Government and Regulatory Insights | 45 | Policy Makers, Regulatory Affairs Managers |

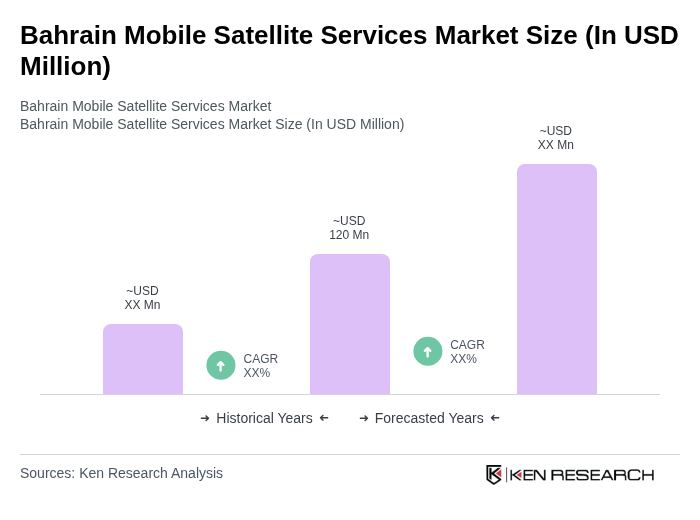

The Bahrain Mobile Satellite Services Market is valued at approximately USD 120 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for reliable communication services in remote areas and advancements in satellite technology.