Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7332

Pages:95

Published On:October 2025

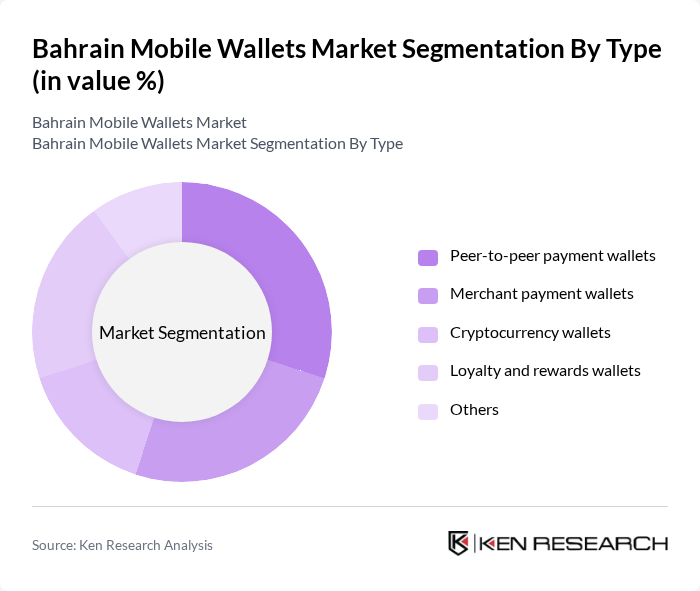

By Type:The mobile wallets market can be segmented into various types, including peer-to-peer payment wallets, merchant payment wallets, cryptocurrency wallets, loyalty and rewards wallets, and others. Each of these sub-segments caters to different consumer needs and preferences, contributing to the overall growth of the market.

The peer-to-peer payment wallets segment is currently dominating the market due to the increasing trend of social payments among individuals. Consumers are increasingly using mobile wallets for quick and easy money transfers to friends and family, especially in urban areas. The convenience of sending money instantly without the need for cash or bank visits has made this segment particularly appealing. Additionally, the rise of social media platforms that integrate payment features has further fueled the growth of peer-to-peer payment wallets.

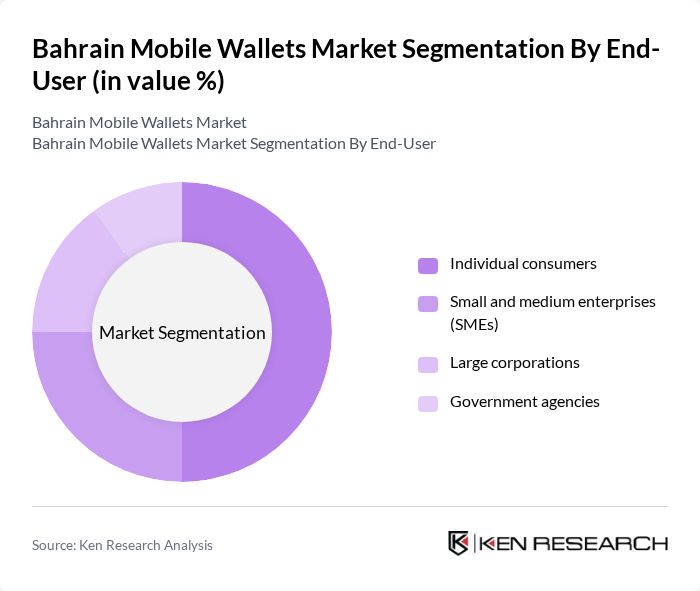

By End-User:The market can also be segmented based on end-users, which include individual consumers, small and medium enterprises (SMEs), large corporations, and government agencies. Each of these user groups has distinct requirements and preferences when it comes to mobile wallet usage.

Individual consumers represent the largest segment in the mobile wallets market, driven by the increasing adoption of smartphones and the growing preference for cashless transactions. The convenience of using mobile wallets for everyday purchases, bill payments, and fund transfers has made them a popular choice among consumers. Additionally, the rise of e-commerce and online shopping has further propelled the demand for mobile wallets among individual users, making this segment a key driver of market growth.

The Bahrain Mobile Wallets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Benefit Wallet, Tap Payments, STC Pay, Benefit Company, Zain Cash, PayTabs, Fawry, KFH Mobile Wallet, Al Baraka Bank, Bahrain Islamic Bank, Bank of Bahrain and Kuwait, Gulf International Bank, National Bank of Bahrain, Arab Banking Corporation, Al Salam Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain mobile wallet market appears promising, driven by technological advancements and evolving consumer preferences. As digital-first banking solutions gain traction, mobile wallets are expected to integrate more seamlessly with e-commerce platforms and retail businesses. Additionally, the increasing focus on user experience and interface design will likely enhance customer satisfaction, fostering greater adoption. The integration of emerging technologies, such as artificial intelligence, will further streamline transactions and improve security, positioning mobile wallets as a cornerstone of Bahrain's financial ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Peer-to-peer payment wallets Merchant payment wallets Cryptocurrency wallets Loyalty and rewards wallets Others |

| By End-User | Individual consumers Small and medium enterprises (SMEs) Large corporations Government agencies |

| By Application | Retail payments Bill payments Fund transfers Online shopping |

| By Distribution Channel | Mobile applications Web platforms Third-party integrations |

| By User Demographics | Age groups (18-24, 25-34, 35-44) Income levels (low, middle, high) Urban vs rural users |

| By Payment Method | Credit card linked wallets Bank account linked wallets Prepaid wallets |

| By Security Features | Biometric authentication Two-factor authentication Encryption methods |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mobile Wallet Usage | 150 | Regular Mobile Wallet Users, Occasional Users |

| Merchant Adoption of Mobile Payments | 100 | Small Business Owners, Retail Managers |

| Financial Institutions' Perspectives | 80 | Bank Executives, Payment Solution Managers |

| Regulatory Insights | 50 | Policy Makers, Financial Regulators |

| Technology Providers in Mobile Payments | 70 | Tech Developers, Product Managers |

The Bahrain Mobile Wallets Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions and a preference for cashless transactions among consumers.