Region:Middle East

Author(s):Dev

Product Code:KRAE0048

Pages:80

Published On:December 2025

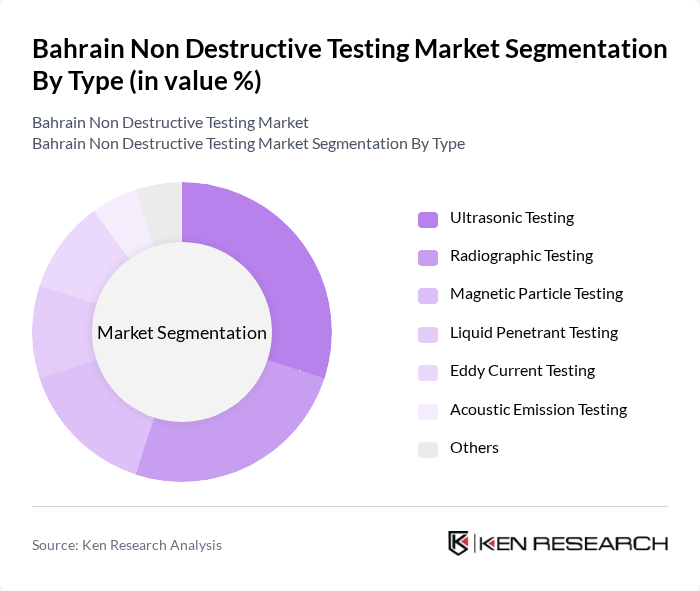

By Type:The market is segmented into various types of non-destructive testing methods, including Ultrasonic Testing, Radiographic Testing, Magnetic Particle Testing, Liquid Penetrant Testing, Eddy Current Testing, Acoustic Emission Testing, and Others. Each method serves specific applications and industries, contributing to the overall market dynamics.

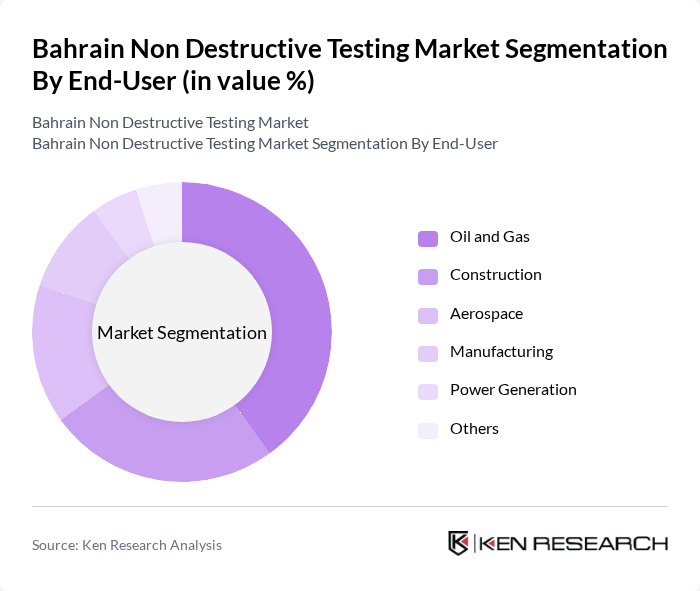

By End-User:The end-user segmentation includes Oil and Gas, Construction, Aerospace, Manufacturing, Power Generation, and Others. Each sector has unique requirements for non-destructive testing, influencing the demand for specific testing methods and services.

The Bahrain Non Destructive Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as SGS Bahrain, Bureau Veritas Bahrain, Intertek Bahrain, TUV Rheinland Bahrain, Applus+ Bahrain, DNV GL Bahrain, Element Materials Technology, Mistras Group, Acuren Group, NDT Global, Axiom NDT, NDT Solutions, Creaform, Zetec, Sonatest contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain Non Destructive Testing market is poised for significant growth, driven by increasing investments in infrastructure and a shift towards digital solutions. As industries prioritize safety and compliance, the integration of AI and machine learning into NDT processes is expected to enhance efficiency and accuracy. Furthermore, collaborative partnerships among NDT firms will likely foster innovation and expand service offerings, positioning the market for robust development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Ultrasonic Testing Radiographic Testing Magnetic Particle Testing Liquid Penetrant Testing Eddy Current Testing Acoustic Emission Testing Others |

| By End-User | Oil and Gas Construction Aerospace Manufacturing Power Generation Others |

| By Industry | Energy Transportation Marine Chemical Processing Others |

| By Service Type | Inspection Services Consulting Services Training Services Certification Services Others |

| By Technology | Conventional NDT Advanced NDT Automated NDT Others |

| By Application | Structural Integrity Testing Weld Inspection Material Testing Pipeline Inspection Others |

| By Market Segment | Commercial Industrial Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector NDT Applications | 100 | Inspection Engineers, Safety Managers |

| Construction Industry NDT Practices | 80 | Project Managers, Quality Control Inspectors |

| Manufacturing Sector NDT Utilization | 70 | Production Managers, Maintenance Supervisors |

| Aerospace NDT Standards and Compliance | 50 | Compliance Officers, Engineering Managers |

| Research Institutions and NDT Innovations | 40 | Research Scientists, Academic Professors |

The Bahrain Non Destructive Testing market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This valuation highlights the growing demand for safety and quality assurance across various industries, including oil and gas, construction, and manufacturing.