Region:Middle East

Author(s):Shubham

Product Code:KRAE0471

Pages:100

Published On:December 2025

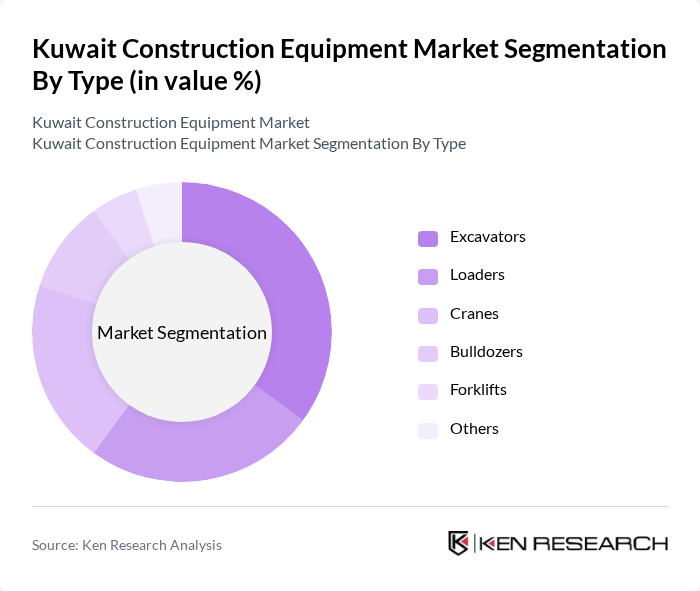

By Type:The construction equipment market in Kuwait is segmented by type, which includes excavators, loaders, cranes, bulldozers, forklifts, and others. Excavators dominate the market due to their versatility and essential role in various construction activities, including earthmoving and site preparation. Loaders and cranes also hold significant shares, driven by their application in both residential and commercial projects. The demand for specialized equipment like bulldozers and forklifts is growing, particularly in industrial and logistics sectors.

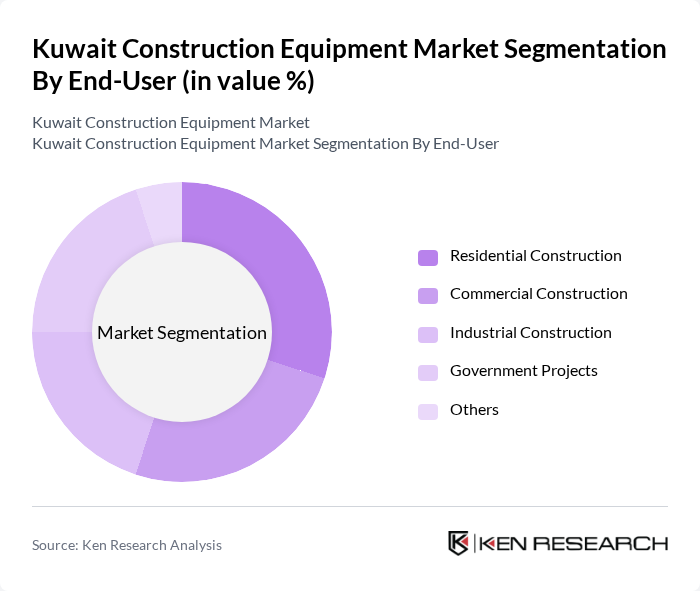

By End-User:The end-user segmentation of the construction equipment market includes residential construction, commercial construction, industrial construction, government projects, and others. The residential construction sector is a significant driver, fueled by ongoing housing developments and urbanization trends. Government projects also play a crucial role, particularly with the recent infrastructure investment initiatives. The commercial and industrial sectors are growing, reflecting the increasing demand for construction services across various industries.

The Kuwait Construction Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Machinery Company, Al-Bahar Group, Gulf Company for Equipment, Al-Futtaim Engineering, Al-Mansoori Specialized Engineering, KMC (Kuwait Machinery Company), Al-Hazaa Group, Al-Ahlia Group, Al-Muhalab Group, Al-Qatami Global for General Trading & Contracting, Al-Sayer Group, Al-Masoud Group, Al-Khaldi Group, Al-Mansour Group, Al-Muhalab Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait construction equipment market appears promising, driven by ongoing infrastructure projects and government initiatives aimed at economic diversification. As urbanization continues to rise, the demand for advanced construction technologies will likely increase. Additionally, the integration of smart technologies and eco-friendly equipment will shape the market landscape, enhancing operational efficiency and sustainability. Stakeholders must remain agile to adapt to evolving trends and capitalize on emerging opportunities in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Excavators Loaders Cranes Bulldozers Forklifts Others |

| By End-User | Residential Construction Commercial Construction Industrial Construction Government Projects Others |

| By Application | Road Construction Building Construction Infrastructure Development Mining and Quarrying Others |

| By Equipment Ownership | Owned Equipment Rented Equipment Leased Equipment Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| By Financing Type | Bank Loans Leasing Options Government Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Heavy Machinery Usage | 100 | Construction Managers, Equipment Operators |

| Rental Equipment Insights | 80 | Rental Company Owners, Fleet Managers |

| Construction Project Procurement | 70 | Procurement Officers, Project Directors |

| Market Trends in Equipment Sales | 90 | Sales Managers, Business Development Executives |

| Impact of Government Projects | 60 | Policy Makers, Urban Planners |

The Kuwait Construction Equipment Market is valued at approximately USD 305 million, driven by significant investments in infrastructure, renewable energy projects, and housing development as part of national diversification plans.