Region:Middle East

Author(s):Shubham

Product Code:KRAC2150

Pages:86

Published On:October 2025

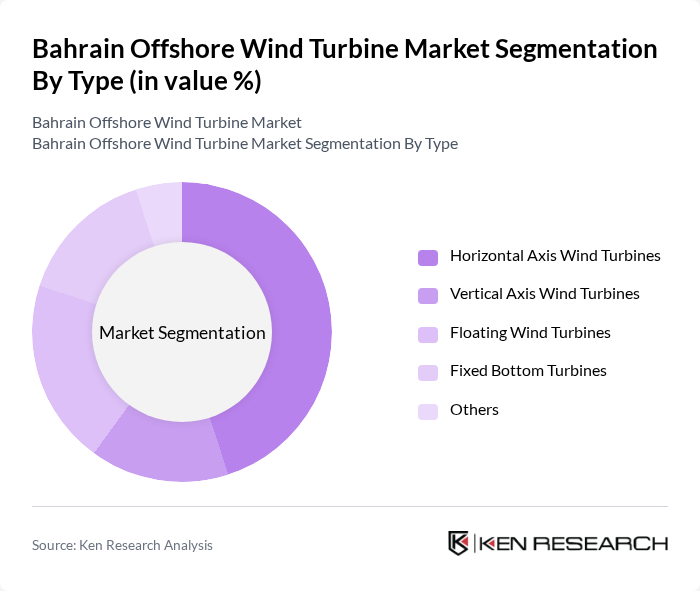

By Type:The market is segmented into various types of wind turbines, including Horizontal Axis Wind Turbines, Vertical Axis Wind Turbines, Floating Wind Turbines, Fixed Bottom Turbines, and Others. Among these, Horizontal Axis Wind Turbines are the most widely used due to their efficiency and established technology. They dominate the market as they are suitable for a variety of wind conditions and have a proven track record in energy generation. The demand for Floating Wind Turbines is also increasing, driven by the need for offshore installations in deeper waters. Floating wind technology is gaining traction in the Gulf due to challenging seabed conditions for fixed-bottom structures .

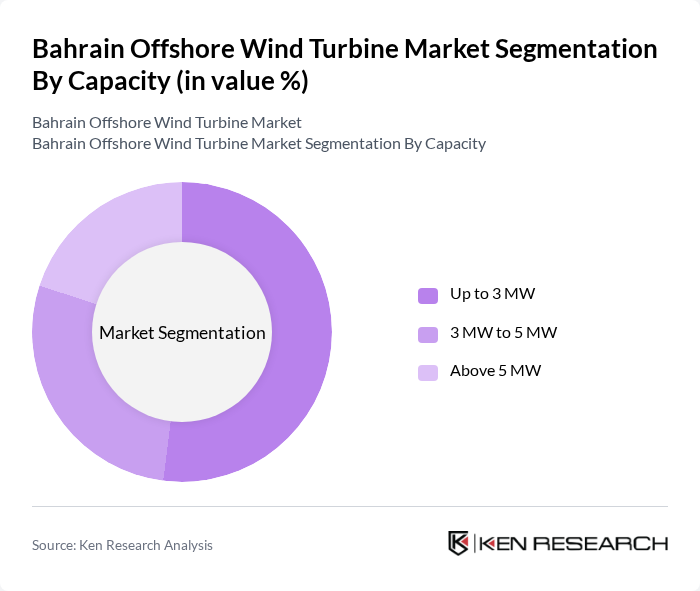

By Capacity:The market is categorized based on the capacity of wind turbines, including Up to 3 MW, 3 MW to 5 MW, and Above 5 MW. The segment of turbines with a capacity of up to 3 MW currently holds the largest market share, reflecting regional deployment trends favoring smaller units for initial offshore projects. However, demand for turbines above 5 MW is growing, driven by advancements in technology and the need for larger installations to meet energy demands. The 3 MW to 5 MW segment remains significant due to its balance between efficiency and cost-effectiveness, especially for offshore projects where space and energy output are critical considerations .

The Bahrain Offshore Wind Turbine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, GE Renewable Energy, Nordex SE, Senvion S.A., Ørsted A/S, Masdar (Abu Dhabi Future Energy Company), ACWA Power, RWE Renewables, EDF Renewables, Iberdrola Renovables, Brookfield Renewable Partners, EDP Renewables, Enel Green Power, China Three Gorges Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain offshore wind turbine market appears promising, driven by increasing energy demands and supportive government policies. As technological advancements continue to lower costs and improve efficiency, the market is likely to see a surge in offshore wind projects. Furthermore, collaboration with international firms can enhance local expertise and investment, fostering a robust renewable energy sector. The focus on sustainability and climate change awareness will further propel the adoption of offshore wind energy solutions in Bahrain.

| Segment | Sub-Segments |

|---|---|

| By Type | Horizontal Axis Wind Turbines Vertical Axis Wind Turbines Floating Wind Turbines Fixed Bottom Turbines Others |

| By Capacity | Up to 3 MW MW to 5 MW Above 5 MW |

| By Water Depth | Shallow Water (<30 m Depth) Transitional Water (30–60 m Depth) Deep Water (>60 m Depth) |

| By End-User | Government & Utilities Industrial Commercial Others |

| By Application | Utility-Scale Projects Offshore Wind Farms Hybrid Systems (e.g., Wind-to-Hydrogen) Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| By Technology | Offshore Wind Technology Turbine Design Technology Energy Storage Technology Floating Platform Technology Others |

| By Distribution Mode | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Energy Policy Insights | 45 | Energy Policy Makers, Regulatory Officials |

| Offshore Wind Project Developers | 40 | Project Managers, Business Development Executives |

| Technical Experts in Wind Energy | 35 | Engineers, Technical Consultants |

| Environmental Impact Assessors | 20 | Environmental Scientists, Compliance Officers |

| Investment Analysts in Renewable Energy | 30 | Financial Analysts, Investment Managers |

The Bahrain Offshore Wind Turbine Market is valued at approximately USD 35 million, reflecting a growing interest in renewable energy sources and government initiatives aimed at reducing carbon emissions and enhancing energy sustainability.