Region:Middle East

Author(s):Dev

Product Code:KRAB8189

Pages:83

Published On:October 2025

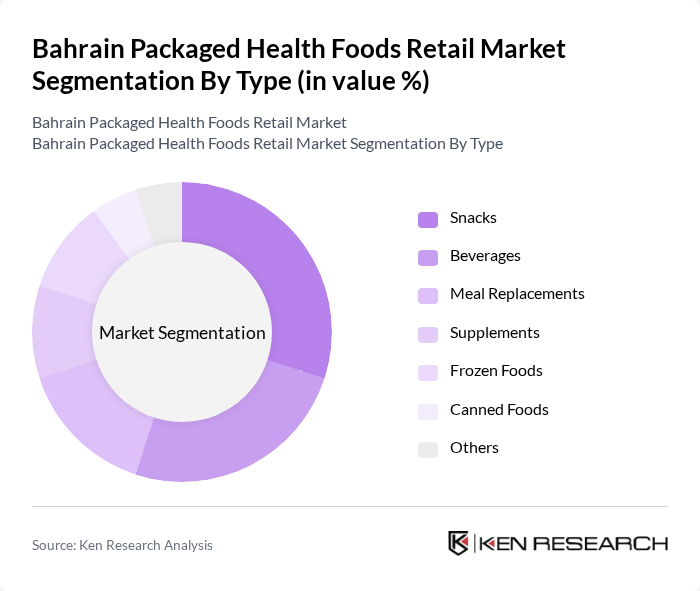

By Type:The market is segmented into various types of packaged health foods, including snacks, beverages, meal replacements, supplements, frozen foods, canned foods, and others. Among these, snacks and beverages are the most popular due to their convenience and the increasing demand for on-the-go options. Health-conscious consumers are particularly drawn to snacks that are low in sugar and high in protein, while beverages that offer functional benefits, such as energy or hydration, are also gaining traction.

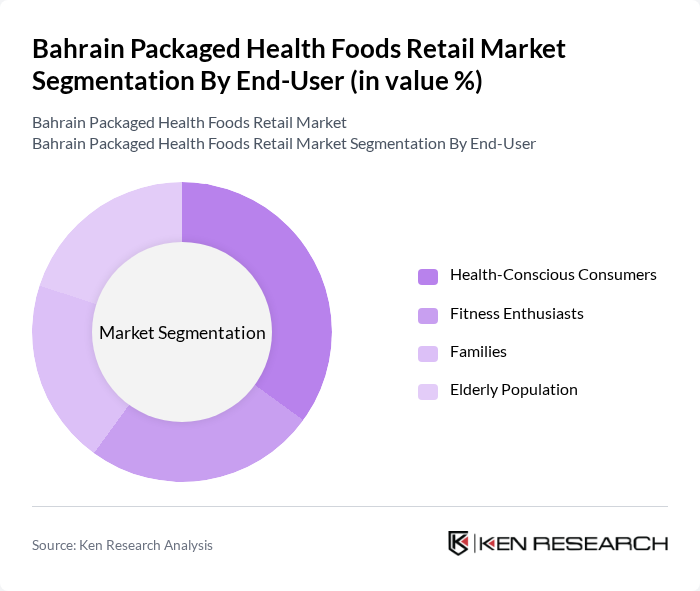

By End-User:The end-user segmentation includes health-conscious consumers, fitness enthusiasts, families, and the elderly population. Health-conscious consumers and fitness enthusiasts are the leading segments, driven by a growing awareness of nutrition and wellness. Families are increasingly purchasing packaged health foods for convenience and nutritional value, while the elderly population is targeted with products that cater to their specific dietary needs, such as low-sugar and high-fiber options.

The Bahrain Packaged Health Foods Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Food & Beverages, Gulf Food Industries, Bahrain Flour Mills, Al Marai Company, Nestle Bahrain, Americana Group, Del Monte Foods, Unilever Bahrain, Al Watania Poultry, Al Kabeer Group, Al Safi Danone, Al Ain Dairy, Al Jazeera Foods, Al Bawadi Group, Al Fawaz Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain packaged health foods market appears promising, driven by increasing health awareness and a shift towards sustainable consumption. As consumers prioritize organic and plant-based options, brands that innovate and adapt to these trends are likely to thrive. Additionally, the growth of e-commerce platforms will facilitate easier access to health foods, enhancing consumer engagement and expanding market reach. Companies that leverage these trends will be well-positioned for success in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Snacks Beverages Meal Replacements Supplements Frozen Foods Canned Foods Others |

| By End-User | Health-Conscious Consumers Fitness Enthusiasts Families Elderly Population |

| By Sales Channel | Supermarkets/Hypermarkets Online Retail Health Food Stores Convenience Stores |

| By Distribution Mode | Direct Distribution Indirect Distribution |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Rigid Packaging Flexible Packaging Bulk Packaging |

| By Nutritional Content | High Protein Low Sugar Gluten-Free Organic |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Health Food Outlets | 100 | Store Managers, Retail Buyers |

| Health Food Manufacturers | 80 | Production Managers, Marketing Directors |

| Consumer Preferences | 150 | Health-Conscious Consumers, Fitness Enthusiasts |

| Distribution Channels | 70 | Logistics Coordinators, Supply Chain Managers |

| Market Trends Analysis | 90 | Market Analysts, Industry Experts |

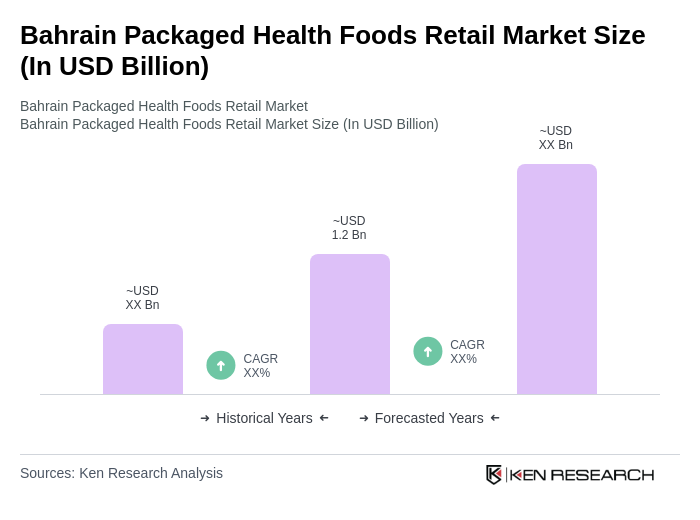

The Bahrain Packaged Health Foods Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health awareness, rising disposable incomes, and a shift towards convenience foods among consumers.