Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4810

Pages:98

Published On:December 2025

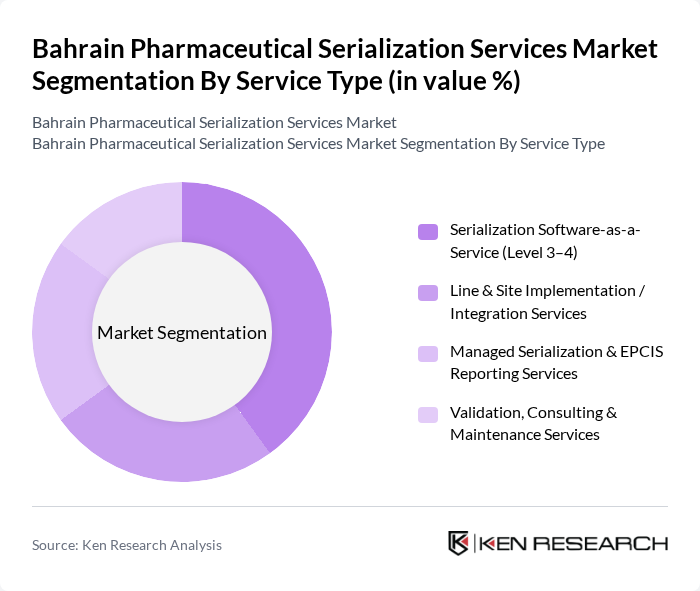

By Service Type:The service type segmentation includes various offerings that cater to the needs of pharmaceutical companies and supply chain stakeholders in Bahrain. The subsegments include Serialization Software-as-a-Service (Level 3–4), Line & Site Implementation / Integration Services, Managed Serialization & EPCIS Reporting Services, and Validation, Consulting & Maintenance Services. Among these, Serialization Software-as-a-Service is gaining traction due to its flexibility, scalability, and faster integration with the NHRA-MVC Hub and GS1-compliant EPCIS reporting, allowing companies to adapt to evolving regulations and phased NHRA requirements efficiently.

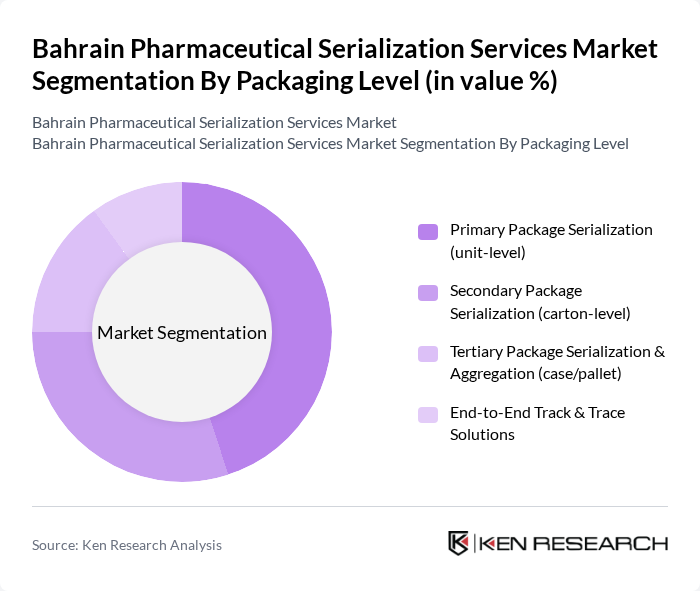

By Packaging Level:The packaging level segmentation encompasses various stages of product packaging that require serialization under Bahrain’s NHRA-MVC framework. This includes Primary Package Serialization (unit-level), Secondary Package Serialization (carton-level), Tertiary Package Serialization & Aggregation (case/pallet), and End-to-End Track & Trace Solutions. The primary package serialization is currently leading the market due to the increasing focus on unit-level tracking to prevent counterfeit drugs and enable real-time verification at pharmacies and hospitals, while aggregation at secondary and tertiary levels is driven by mandatory hierarchical packaging and reporting to the central traceability hub.

The Bahrain Pharmaceutical Serialization Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as TraceLink Inc., SAP SE (SAP Advanced Track and Trace for Pharmaceuticals), Systech (a Markem-Imaje company), Optel Group, SoftGroup AD, Visiott Traceability Solutions, Antares Vision Group, SEA Vision Srl, Körber AG (Körber Pharma Software), Keystone Technologies (Bahrain), Bahrain Packaging Industry W.L.L., Bahrain Pharma W.L.L., Gulf Biotech Company B.S.C. (Closed), Gulf Pharmaceutical Industries (Julphar), Regional System Integrators & 3PLs Supporting Serialization in Bahrain contribute to innovation, geographic expansion, and service delivery in this space, particularly in areas such as GS1-compliant Level 2–4 software, line equipment, aggregation solutions, and NHRA-MVC integration services.

The future of the Bahrain pharmaceutical serialization services market appears promising, driven by ongoing regulatory changes and technological innovations. As the government continues to enforce serialization mandates, companies are likely to invest in advanced technologies to enhance compliance and operational efficiency. Additionally, the increasing focus on patient safety and drug traceability will further propel market growth. Stakeholders must adapt to these evolving trends to remain competitive and ensure the integrity of the pharmaceutical supply chain.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Serialization Software-as-a-Service (Level 3–4) Line & Site Implementation / Integration Services Managed Serialization & EPCIS Reporting Services Validation, Consulting & Maintenance Services |

| By Packaging Level | Primary Package Serialization (unit-level) Secondary Package Serialization (carton-level) Tertiary Package Serialization & Aggregation (case / pallet) End-to-End Track & Trace Solutions |

| By End-User | Marketing Authorization Holders (MAHs) & Importers Local Pharmaceutical Manufacturers & Repackagers Contract Manufacturing & Contract Packaging Organizations (CMOs/CPOs) Wholesalers, Distributors & 3PLs Hospitals, Pharmacies & Other Healthcare Providers |

| By Technology | GS1 DataMatrix / 2D Barcodes RFID & NFC-based Track & Trace Aggregation & Warehouse Automation Systems Cloud-based Traceability & Analytics Platforms |

| By Compliance Scope | NHRA-MVC Bahrain Compliance Only GCC / Middle East Multi-country Compliance Global Multi-market Compliance (EU, U.S., others) Enterprise-wide Standardization & Harmonization |

| By Deployment Model | On-premise Solutions Private Cloud / Hosted Solutions Public Cloud / Multi-tenant Platforms Hybrid Architectures |

| By Customer Size | Large Enterprises Mid-sized Organizations Small & Emerging Players |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 45 | Production Managers, Quality Assurance Officers |

| Distributors and Wholesalers | 40 | Logistics Coordinators, Supply Chain Managers |

| Retail Pharmacies | 40 | Pharmacy Owners, Pharmacists |

| Healthcare Providers | 40 | Doctors, Hospital Administrators |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Bahrain Pharmaceutical Serialization Services Market is valued at approximately USD 140 million, reflecting a significant investment in serialization and packaging solutions driven by regulatory compliance and the need for drug traceability.