Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4118

Pages:96

Published On:December 2025

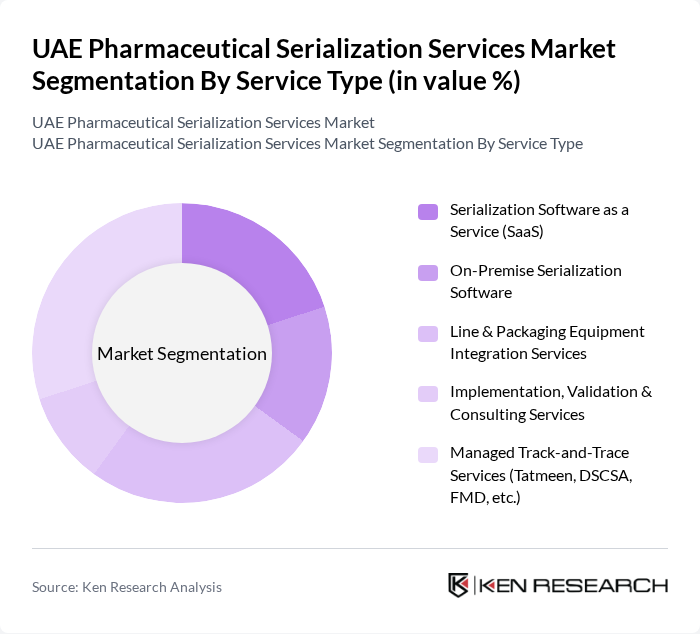

By Service Type:The service type segmentation includes various offerings that cater to the needs of pharmaceutical companies in ensuring compliance and enhancing supply chain integrity. The subsegments include Serialization Software as a Service (SaaS), On-Premise Serialization Software, Line & Packaging Equipment Integration Services, Implementation, Validation & Consulting Services, and Managed Track-and-Trace Services (Tatmeen, DSCSA, FMD, etc.). Among these, Managed Track-and-Trace Services are currently leading the market due to the increasing regulatory pressures and the need for comprehensive tracking solutions.

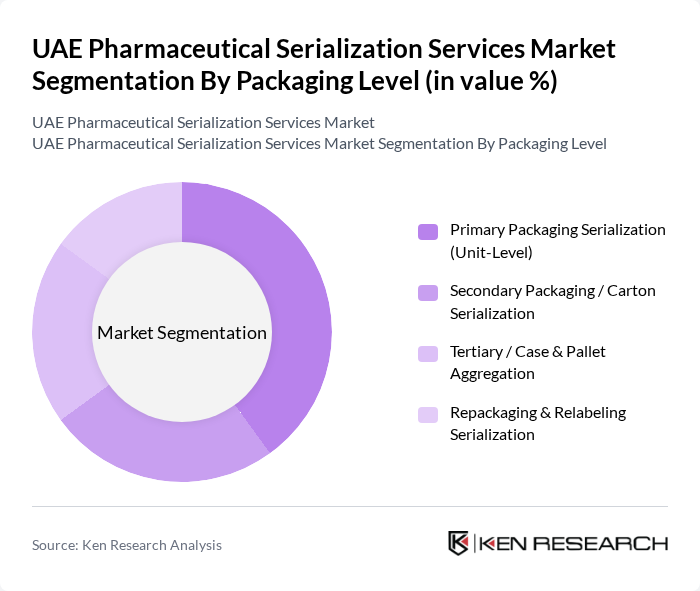

By Packaging Level:This segmentation focuses on the different levels of packaging that require serialization. The subsegments include Primary Packaging Serialization (Unit-Level), Secondary Packaging / Carton Serialization, Tertiary / Case & Pallet Aggregation, and Repackaging & Relabeling Serialization. The Primary Packaging Serialization segment is currently the most significant due to the increasing emphasis on unit-level traceability and consumer safety.

The UAE Pharmaceutical Serialization Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as OPTEL Group, Systech (an ATP Company), Antares Vision Group, TraceLink Inc., rfxcel (Part of Antares Vision Group), SAP SE (SAP Advanced Track and Trace for Pharmaceuticals), SEA Vision S.r.l., Mettler?Toledo International Inc., Siemens AG (Digital Industries Software), Johnson & Johnson Gulf FZ LLC, Julphar – Gulf Pharmaceutical Industries PSC, Neopharma LLC, Pharmax Pharmaceuticals FZ?LLC, Globalpharma Co. LLC (A Sanofi Company), Arabian Ethicals Co. LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE pharmaceutical serialization services market appears promising, driven by ongoing regulatory changes and technological advancements. As companies increasingly adopt cloud-based solutions and IoT technologies, operational efficiencies are expected to improve significantly. Furthermore, the growing emphasis on patient safety and drug traceability will likely propel investments in serialization services, fostering a more secure and transparent pharmaceutical supply chain in the region. Stakeholders must remain agile to adapt to these evolving trends.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Serialization Software as a Service (SaaS) On?Premise Serialization Software Line & Packaging Equipment Integration Services Implementation, Validation & Consulting Services Managed Track?and?Trace Services (Tatmeen, DSCSA, FMD, etc.) |

| By Packaging Level | Primary Packaging Serialization (Unit?Level) Secondary Packaging / Carton Serialization Tertiary / Case & Pallet Aggregation Repackaging & Relabeling Serialization |

| By Technology | GS1 2D DataMatrix Barcodes Linear Barcodes RFID & NFC?Enabled Serialization Cloud?Based Track?and?Trace Platforms Others |

| By Solution Component | Software Platforms (L3–L5) Printing & Vision Inspection Hardware (L1–L2) Connectivity & Integration Middleware Serialization Labels & Packaging Materials Others |

| By End?User | Originator & Generic Pharmaceutical Manufacturers Contract Manufacturing Organizations (CMOs) Contract Packaging Organizations (CPOs) Wholesalers & Distributors Hospital & Retail Pharmacies Others |

| By Application | Regulatory Compliance (Tatmeen, GCC, Export) Anti?Counterfeiting & Brand Protection Supply Chain Visibility & Analytics Recall Management & Returns Verification Others |

| By Emirate | Abu Dhabi Dubai Sharjah Ajman, Umm Al Quwain & Ras Al Khaimah Fujairah |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 80 | Compliance Officers, Production Managers |

| Logistics Providers | 70 | Operations Managers, Supply Chain Directors |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

| Healthcare Institutions | 70 | Pharmacy Managers, Procurement Officers |

| Serialization Technology Vendors | 60 | Product Development Managers, Sales Executives |

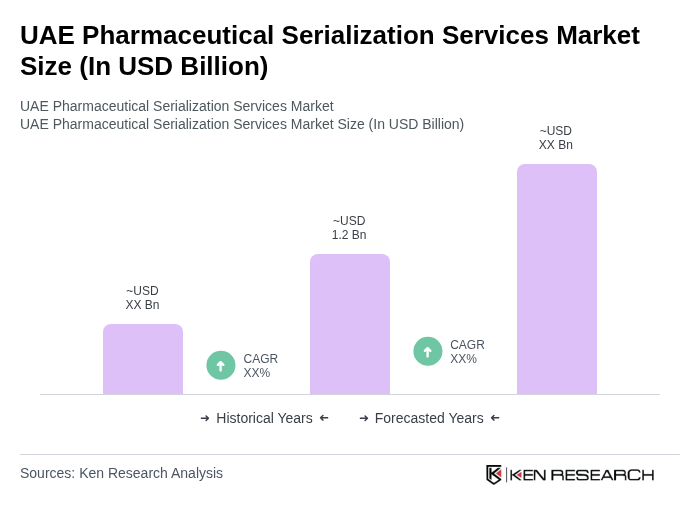

The UAE Pharmaceutical Serialization Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by regulatory requirements, demand for supply chain transparency, and technological advancements in the pharmaceutical sector.