Region:Middle East

Author(s):Dev

Product Code:KRAB7551

Pages:87

Published On:October 2025

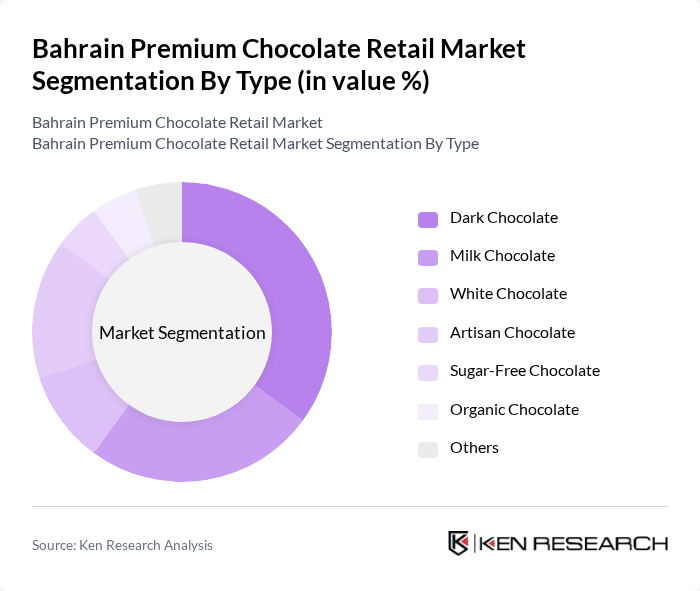

By Type:The premium chocolate market is segmented into various types, including Dark Chocolate, Milk Chocolate, White Chocolate, Artisan Chocolate, Sugar-Free Chocolate, Organic Chocolate, and Others. Among these, Dark Chocolate has gained significant popularity due to its perceived health benefits and rich flavor profile, appealing to health-conscious consumers. Artisan Chocolate is also on the rise, driven by the demand for unique flavors and high-quality ingredients, catering to niche markets.

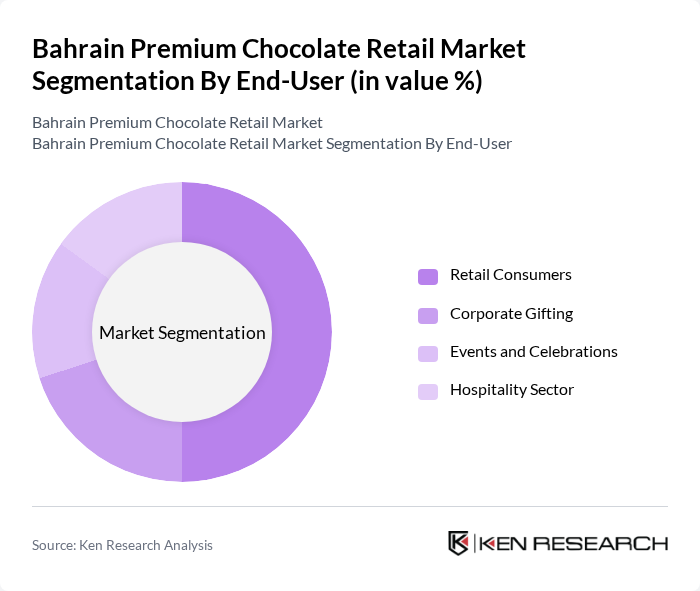

By End-User:The end-user segmentation includes Retail Consumers, Corporate Gifting, Events and Celebrations, and the Hospitality Sector. Retail Consumers dominate the market, driven by the increasing trend of gifting and personal consumption of premium chocolates. Corporate Gifting is also significant, as businesses often use premium chocolates as gifts for clients and employees, especially during festive seasons.

The Bahrain Premium Chocolate Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Nassma Chocolate, Patchi, Godiva Chocolatier, Lindt & Sprüngli, Ferrero Rocher, Maison des Chocolats, Cacao Barry, Pierre Marcolini, Amedei, Valrhona, Neuhaus, Chocolatier, TCHO, Chocolove, Hotel Chocolat contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain premium chocolate market appears promising, driven by evolving consumer preferences and economic growth. As disposable incomes rise, consumers are likely to seek out unique and high-quality chocolate experiences. Additionally, the increasing focus on sustainability and ethical sourcing will shape product offerings. Companies that adapt to these trends, particularly through innovative flavors and sustainable practices, will likely capture a larger share of the market, ensuring continued growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dark Chocolate Milk Chocolate White Chocolate Artisan Chocolate Sugar-Free Chocolate Organic Chocolate Others |

| By End-User | Retail Consumers Corporate Gifting Events and Celebrations Hospitality Sector |

| By Sales Channel | Supermarkets and Hypermarkets Specialty Stores Online Retail Convenience Stores |

| By Price Range | Premium Mid-Range Economy |

| By Packaging Type | Gift Boxes Bulk Packaging Single-Serve Packs |

| By Flavor Profile | Classic Flavors Exotic Flavors Seasonal Flavors |

| By Occasion | Festivals Weddings Corporate Events Everyday Consumption |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Premium Chocolate Retailers | 100 | Store Owners, Retail Managers |

| Consumer Preferences Survey | 200 | Chocolate Consumers, Gift Buyers |

| Online Chocolate Sales Analysis | 80 | E-commerce Managers, Digital Marketing Specialists |

| Focus Groups on Product Attributes | 50 | Chocolate Enthusiasts, Food Bloggers |

| Market Trend Interviews | 30 | Industry Experts, Market Analysts |

The Bahrain Premium Chocolate Retail Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing disposable incomes and a rising preference for luxury and gourmet chocolate products.