Region:Middle East

Author(s):Shubham

Product Code:KRAB7446

Pages:99

Published On:October 2025

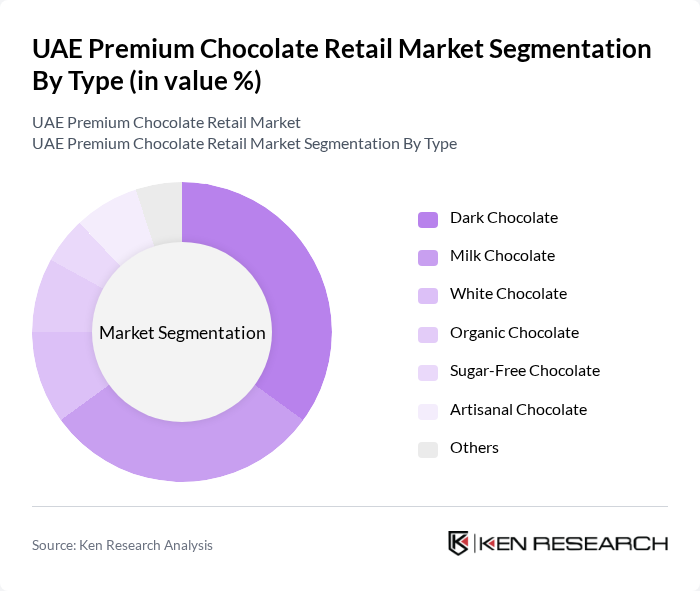

By Type:The market is segmented into various types of chocolate, including Dark Chocolate, Milk Chocolate, White Chocolate, Organic Chocolate, Sugar-Free Chocolate, Artisanal Chocolate, and Others. Among these, Dark Chocolate is currently the leading sub-segment, driven by its health benefits and increasing consumer awareness regarding healthier snacking options. Milk Chocolate follows closely, appealing to a broader audience due to its sweetness and versatility in various culinary applications.

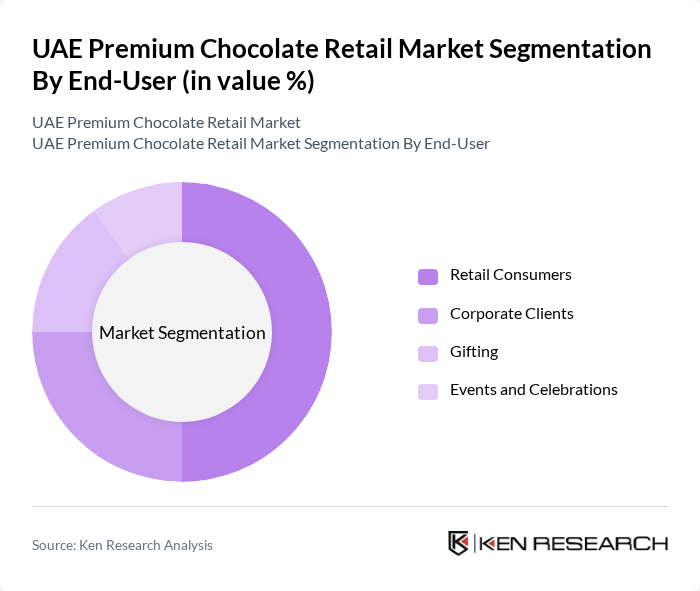

By End-User:The end-user segmentation includes Retail Consumers, Corporate Clients, Gifting, and Events and Celebrations. Retail Consumers dominate the market, driven by the increasing trend of purchasing premium chocolates for personal consumption and gifting. Corporate Clients also represent a significant segment, as businesses often use premium chocolates for corporate gifting and events, enhancing brand image and client relationships.

The UAE Premium Chocolate Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Godiva Chocolatier, Lindt & Sprüngli, Ferrero Rocher, Patchi, Maison des Chocolats, Pierre Marcolini, Neuhaus, Amedei, Valrhona, Cacao Barry, Chocolatier, Hotel Chocolat, Ghirardelli, Scharffen Berger, TCHO contribute to innovation, geographic expansion, and service delivery in this space.

The UAE premium chocolate market is poised for significant growth, driven by evolving consumer preferences towards luxury and artisanal products. As disposable incomes rise and e-commerce continues to expand, brands are likely to innovate in product offerings and marketing strategies. Sustainability will also play a crucial role, with consumers increasingly favoring ethically sourced chocolates. The market is expected to adapt to these trends, enhancing customer engagement and loyalty while navigating challenges posed by competition and fluctuating raw material costs.

| Segment | Sub-Segments |

|---|---|

| By Type | Dark Chocolate Milk Chocolate White Chocolate Organic Chocolate Sugar-Free Chocolate Artisanal Chocolate Others |

| By End-User | Retail Consumers Corporate Clients Gifting Events and Celebrations |

| By Sales Channel | Supermarkets and Hypermarkets Specialty Stores Online Retail Convenience Stores |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Gift Boxes Bulk Packaging Individual Wrappers |

| By Occasion | Festivals Weddings Corporate Events |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Premium Chocolate Retailers | 100 | Store Managers, Retail Buyers |

| Chocolate Manufacturers | 80 | Production Managers, Sales Directors |

| Consumer Preferences | 150 | Affluent Consumers, Chocolate Enthusiasts |

| Distribution Channels | 70 | Logistics Managers, Supply Chain Coordinators |

| Market Trends Analysis | 60 | Market Analysts, Industry Experts |

The UAE Premium Chocolate Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing disposable incomes and a rising preference for luxury goods, particularly during festive seasons and special occasions.