Region:Middle East

Author(s):Rebecca

Product Code:KRAB9764

Pages:98

Published On:October 2025

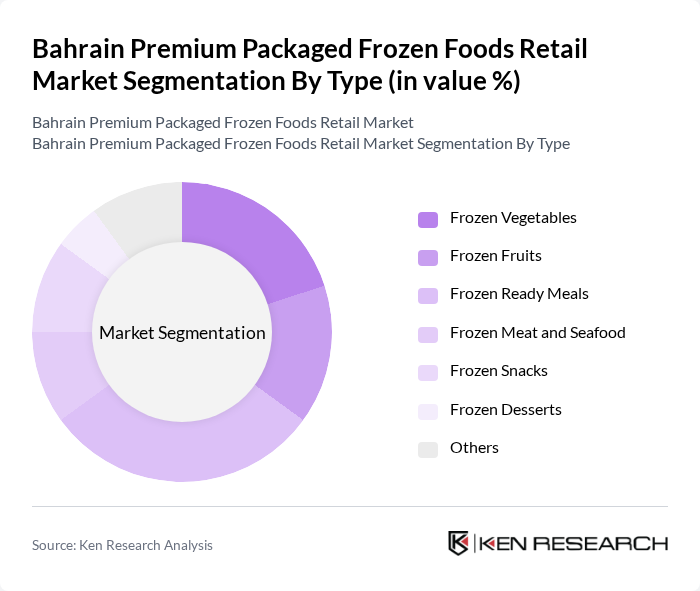

By Type:The market is segmented into various types of frozen foods, including frozen vegetables, frozen fruits, frozen ready meals, frozen meat and seafood, frozen snacks, frozen desserts, and others. Among these, frozen ready meals have gained significant traction due to their convenience and variety, appealing to busy consumers looking for quick meal solutions. The demand for frozen vegetables is also notable, driven by health-conscious consumers seeking nutritious options.

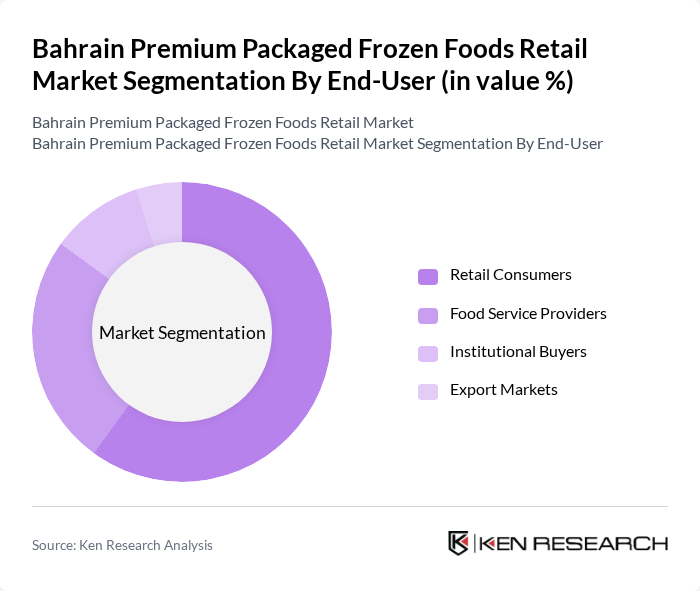

By End-User:The end-user segmentation includes retail consumers, food service providers, institutional buyers, and export markets. Retail consumers dominate the market, driven by the increasing trend of home cooking and the convenience of frozen foods. Food service providers also play a significant role, as restaurants and cafes increasingly rely on frozen products for their menu offerings, ensuring consistent quality and availability.

The Bahrain Premium Packaged Frozen Foods Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Food & Beverages, Americana Group, Gulf Food Industries, Almarai Company, Nestlé S.A., Unilever PLC, Al Kabeer Group, Al Watania Poultry, Al-Fakher Foods, Al-Maeda Frozen Foods, Al-Safi Danone, Al-Baik Frozen Foods, Al-Hokair Group, Al-Mansoori Frozen Foods, Al-Jazeera Frozen Foods contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain premium packaged frozen foods market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, the demand for organic and specialty frozen products is expected to increase significantly. Additionally, the expansion of e-commerce platforms will facilitate greater access to frozen food options, enhancing consumer convenience. Companies that adapt to these trends and invest in innovative packaging solutions will likely capture a larger market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Frozen Vegetables Frozen Fruits Frozen Ready Meals Frozen Meat and Seafood Frozen Snacks Frozen Desserts Others |

| By End-User | Retail Consumers Food Service Providers Institutional Buyers Export Markets |

| By Sales Channel | Supermarkets and Hypermarkets Online Retail Convenience Stores Wholesale Distributors |

| By Packaging Type | Vacuum Sealed Resealable Bags Bulk Packaging Single-Serve Packaging |

| By Price Range | Premium Mid-Range Economy |

| By Distribution Mode | Direct Distribution Indirect Distribution |

| By Product Origin | Local Production Imported Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Frozen Food Outlets | 150 | Store Managers, Category Buyers |

| Consumer Preferences in Frozen Foods | 200 | Household Decision Makers, Food Enthusiasts |

| Food Service Providers | 100 | Restaurant Owners, Catering Managers |

| Distribution Channels for Frozen Foods | 80 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations | 70 | Food Industry Analysts, Product Developers |

The Bahrain Premium Packaged Frozen Foods Retail Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by consumer demand for convenience foods and healthy eating options.