Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8337

Pages:87

Published On:October 2025

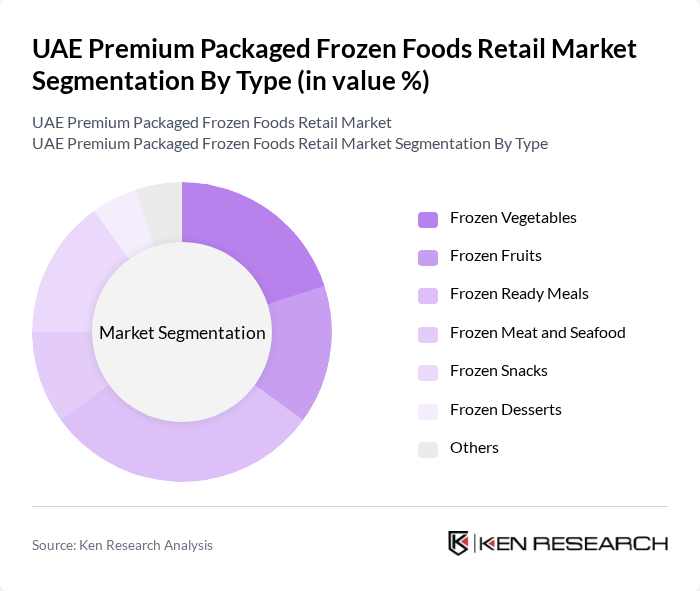

By Type:The market is segmented into various types of frozen foods, including frozen vegetables, frozen fruits, frozen ready meals, frozen meat and seafood, frozen snacks, frozen desserts, and others. Among these, frozen ready meals have gained significant traction due to their convenience and variety, appealing to busy consumers seeking quick meal solutions. The increasing trend of health-conscious eating has also led to a rise in demand for frozen vegetables and fruits, as they offer nutritional benefits while being easy to prepare.

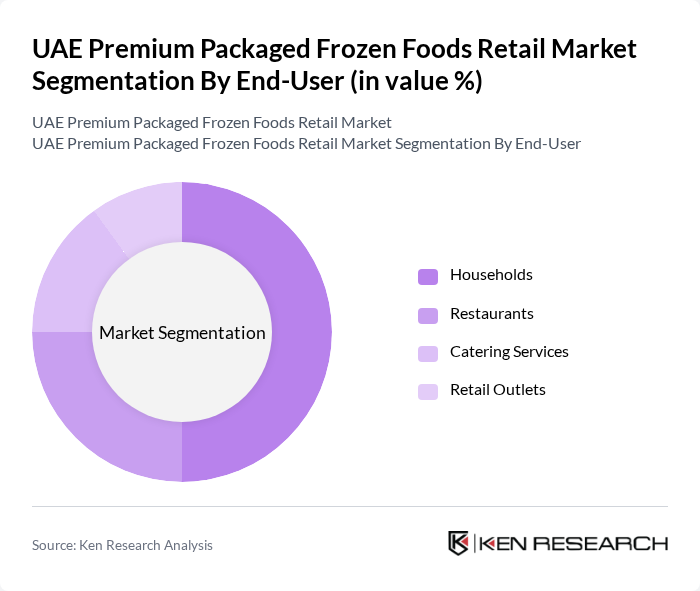

By End-User:The end-user segmentation includes households, restaurants, catering services, and retail outlets. Households represent the largest segment, driven by the increasing trend of home cooking and the convenience of frozen foods. Restaurants and catering services are also significant consumers, as they seek to offer diverse menu options while managing food costs and preparation time. The retail outlets segment is growing as supermarkets and hypermarkets expand their frozen food sections to meet consumer demand.

The UAE Premium Packaged Frozen Foods Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Food & Beverages, Americana Group, Almarai Company, Nestlé Middle East, Unilever Gulf, Al-Futtaim Group, Gulf Food Industries, Al Kabeer Group, Emirates Snack Foods, Al Watania Poultry, Al Ain Farms, Al Jazeera Foods, Al Mufeed Foods, Al Maktoum Group, Al Mufeed Frozen Foods contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE premium packaged frozen foods market appears promising, driven by evolving consumer preferences and technological advancements. As health-conscious consumers increasingly seek nutritious options, the demand for organic and plant-based frozen foods is expected to rise. Additionally, the integration of smart freezing technologies will enhance product quality and shelf life, further appealing to consumers. Retailers are likely to invest in sustainable packaging solutions, aligning with environmental regulations and consumer expectations for eco-friendly products.

| Segment | Sub-Segments |

|---|---|

| By Type | Frozen Vegetables Frozen Fruits Frozen Ready Meals Frozen Meat and Seafood Frozen Snacks Frozen Desserts Others |

| By End-User | Households Restaurants Catering Services Retail Outlets |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Convenience Stores Wholesale Distributors |

| By Price Range | Premium Mid-Range Economy |

| By Packaging Type | Rigid Packaging Flexible Packaging Bulk Packaging |

| By Brand Positioning | Established Brands Emerging Brands Private Labels |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Supermarket Frozen Food Managers | 100 | Store Managers, Category Managers |

| Frozen Food Manufacturers | 80 | Production Managers, Quality Control Officers |

| Distributors and Wholesalers | 70 | Sales Directors, Logistics Coordinators |

| Consumer Focus Groups | 60 | Regular Frozen Food Consumers, Health-Conscious Shoppers |

| Food Service Operators | 50 | Restaurant Owners, Catering Managers |

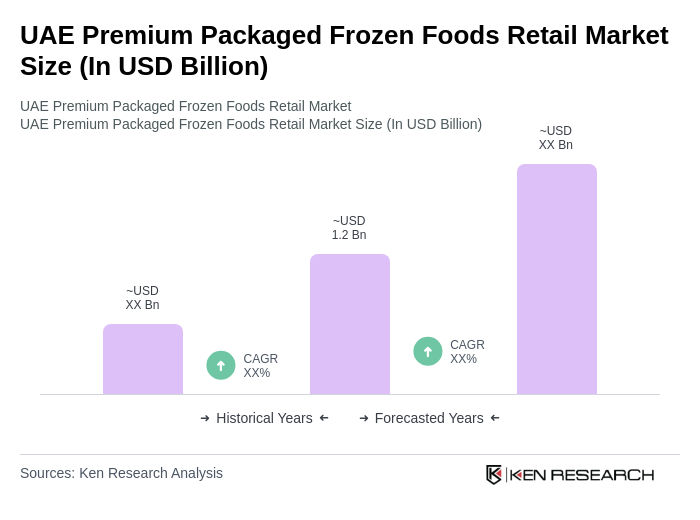

The UAE Premium Packaged Frozen Foods Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer demand for convenience foods and high-quality frozen products.