Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6059

Pages:97

Published On:December 2025

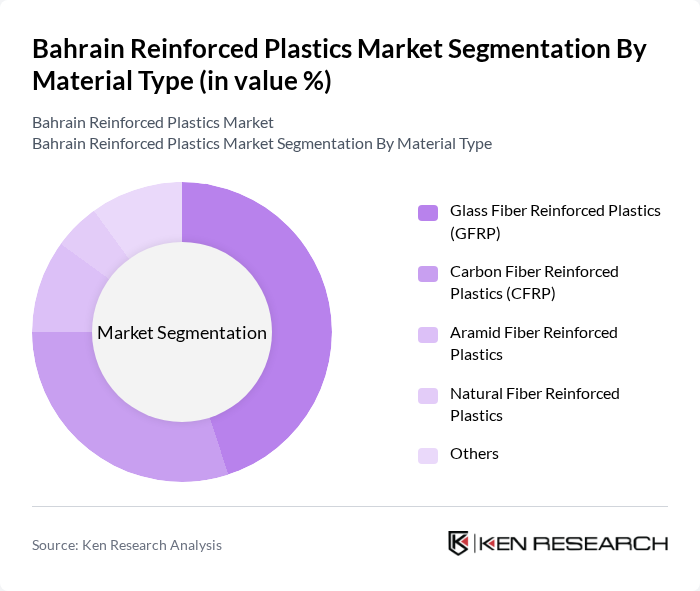

By Material Type:The material type segmentation includes Glass Fiber Reinforced Plastics (GFRP), Carbon Fiber Reinforced Plastics (CFRP), Aramid Fiber Reinforced Plastics, Natural Fiber Reinforced Plastics, and Others. Among these, GFRP is the leading subsegment due to its widespread use in construction and infrastructure applications, where its strength and lightweight properties are highly valued. The demand for CFRP is also growing, particularly in the automotive and aerospace sectors, driven by the need for high-performance materials.

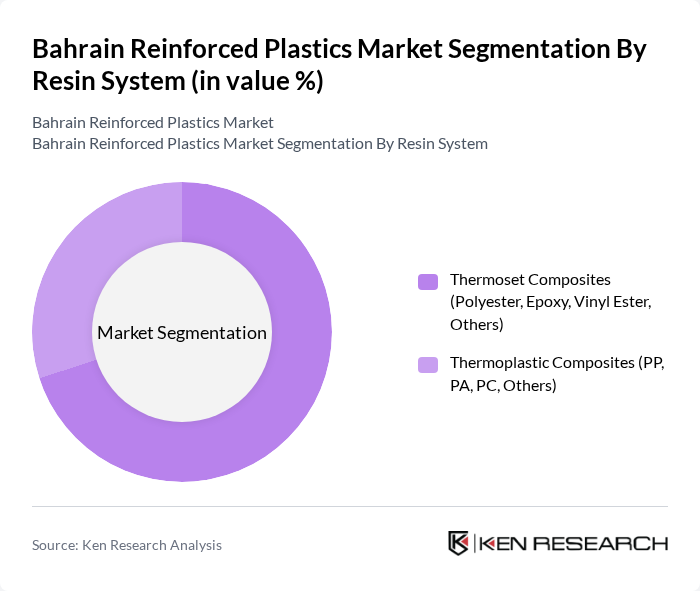

By Resin System:The resin system segmentation includes Thermoset Composites (Polyester, Epoxy, Vinyl Ester, Others) and Thermoplastic Composites (PP, PA, PC, Others). Thermoset composites dominate the market due to their superior mechanical properties and resistance to heat and chemicals, making them ideal for demanding applications in construction and oil & gas. Thermoplastic composites are gaining traction due to their recyclability and ease of processing, appealing to manufacturers looking for sustainable options.

The Bahrain Reinforced Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Fiberglass W.L.L., Bahrain Composites Company W.L.L., Gulf Fiberglass Factory W.L.L., Haji Hassan Fiberglass (Haji Hassan Group), Bahrain Pipes B.S.C. (c) – GRP Division, Arab GRP W.L.L., Yusuf Bin Ahmed Kanoo W.L.L. – Industrial & Composites Division, Bahrain National Gas Company B.S.C. (BANAGAS) – GRP Applications, Gulf Petrochemical Industries Company (GPIC) – Composite Utilization, Bahrain Steel B.S.C. (c) – Composite & GRP Usage, Al Ghalia Industrial Composites W.L.L., Kooheji Contractors – GRP & Composite Works, Mohammed Jalal & Sons W.L.L. – Industrial Services & GRP, Almoayyed Contracting Group – GRP & Piping Solutions, International Pipe Industries Co. W.L.L. – GRP / FRP Piping contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain reinforced plastics market appears promising, driven by increasing investments in infrastructure and a growing emphasis on sustainability. As the construction sector expands, the demand for innovative materials will rise, particularly those that enhance energy efficiency. Additionally, the integration of smart manufacturing technologies is expected to streamline production processes, reducing costs and improving product quality. This evolving landscape will likely attract new players and foster collaboration between local and international firms, enhancing market competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Glass Fiber Reinforced Plastics (GFRP) Carbon Fiber Reinforced Plastics (CFRP) Aramid Fiber Reinforced Plastics Natural Fiber Reinforced Plastics Others |

| By Resin System | Thermoset Composites (Polyester, Epoxy, Vinyl Ester, Others) Thermoplastic Composites (PP, PA, PC, Others) |

| By End-Use Industry | Construction & Infrastructure (pipes, tanks, GRP panels, rebar) Oil & Gas and Petrochemicals Water & Wastewater (desalination, sewage, district cooling) Marine & Shipbuilding Electrical & Electronics Automotive & Transportation Others |

| By Application | Piping & Fittings Storage Tanks & Vessels Rebars & Structural Profiles Panels, Gratings & Cladding Industrial Equipment & Components Others |

| By Manufacturing Process | Hand Lay-Up & Spray-Up Filament Winding Pultrusion Resin Transfer Molding (RTM) Compression & Injection Molding Others |

| By Distribution Channel | Direct Sales to EPCs and End-Users Industrial Distributors & Stockists Trading Companies Online / E-Procurement Portals Others |

| By Region | Capital Governorate Muharraq Governorate Northern Governorate Southern Governorate |

| By Policy & Project Exposure | Government Infrastructure & Utilities Projects Oil & Gas Capital Projects Industrial & Free Zone Developments Renewable Energy & Sustainability Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Reinforced Plastics | 100 | Project Managers, Procurement Officers |

| Automotive Applications of Reinforced Plastics | 80 | Design Engineers, Production Managers |

| Aerospace Industry Usage | 60 | Quality Assurance Managers, R&D Engineers |

| Consumer Goods Manufacturing | 70 | Product Development Managers, Supply Chain Analysts |

| Recycling and Sustainability Initiatives | 50 | Sustainability Officers, Environmental Compliance Managers |

The Bahrain Reinforced Plastics Market is valued at approximately USD 140 million, reflecting a five-year historical analysis. This valuation highlights the growing demand for lightweight and durable materials across various industries, including construction and automotive.