Region:Middle East

Author(s):Shubham

Product Code:KRAC2199

Pages:80

Published On:October 2025

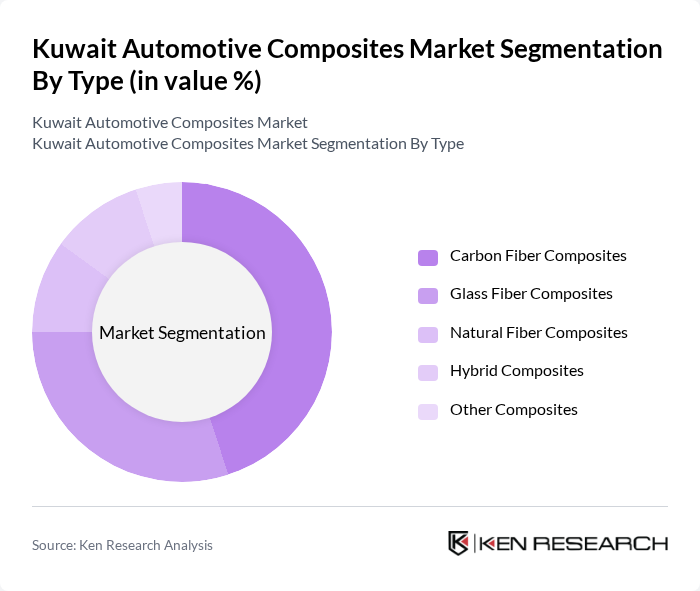

By Type:The market is segmented into various types of composites, including Carbon Fiber Composites, Glass Fiber Composites, Natural Fiber Composites, Hybrid Composites, and Other Composites. Among these, Carbon Fiber Composites are leading due to their superior strength-to-weight ratio and increasing applications in high-performance and electric vehicles. Glass Fiber Composites also hold a significant share, primarily used in mass-market vehicles for their cost-effectiveness, durability, and versatility in structural and interior applications .

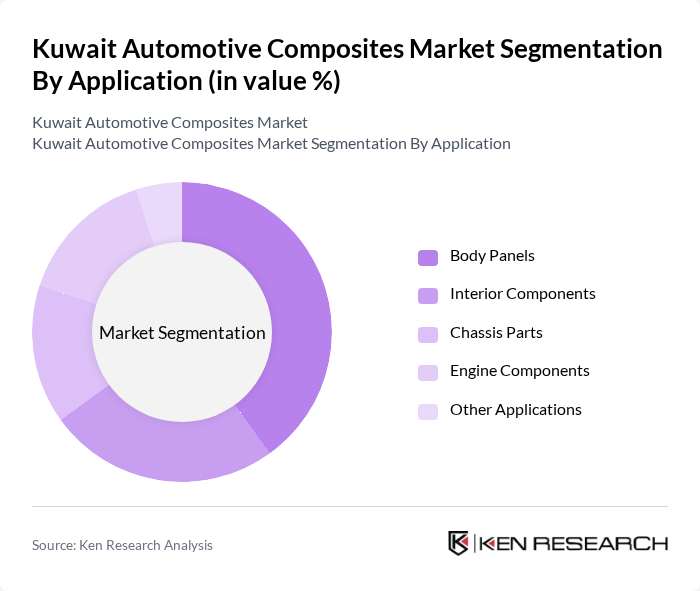

By Application:The applications of automotive composites include Body Panels, Interior Components, Chassis Parts, Engine Components, and Other Applications. Body Panels are the most significant application segment, driven by the need for lightweight materials that enhance vehicle performance, fuel efficiency, and safety. Interior Components are also gaining traction as manufacturers focus on improving vehicle aesthetics, comfort, and integrating advanced features .

The Kuwait Automotive Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC, Strata Manufacturing PJSC, Kuwait Institute for Scientific Research (KISR), Advanced Materials Company (AMC), Saudi Aramco, SGL Carbon SE, Owens Corning, Teijin Limited, Hexcel Corporation, Mitsubishi Chemical Corporation, Solvay S.A., Covestro AG, DuPont de Nemours, Inc., Jushi Group Co., Ltd., Composite Industries LLC contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Kuwait automotive composites market appears promising, driven by increasing investments in sustainable technologies and a growing emphasis on lightweight materials. As the government continues to support eco-friendly initiatives, manufacturers are likely to adopt advanced composite solutions. Additionally, the rise of electric vehicles is expected to further accelerate the demand for innovative materials, creating a dynamic landscape for automotive composites in the region. Strategic collaborations between manufacturers and research institutions will also play a crucial role in shaping future developments.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbon Fiber Composites Glass Fiber Composites Natural Fiber Composites Hybrid Composites Other Composites |

| By Application | Body Panels Interior Components Chassis Parts Engine Components Other Applications |

| By Vehicle Type | Passenger Cars Commercial Vehicles Heavy-Duty Vehicles Electric Vehicles Automotive Aftermarket Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Material Source | Domestic Suppliers International Suppliers Recycled Materials Others |

| By Price Range | Economy Mid-range Premium Others |

| By Regulatory Compliance | ISO Certified Non-ISO Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 60 | Production Managers, R&D Directors |

| Composite Material Suppliers | 40 | Sales Managers, Product Development Engineers |

| Automotive Component Distributors | 40 | Logistics Coordinators, Procurement Specialists |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Industry Experts and Consultants | 40 | Market Analysts, Automotive Consultants |

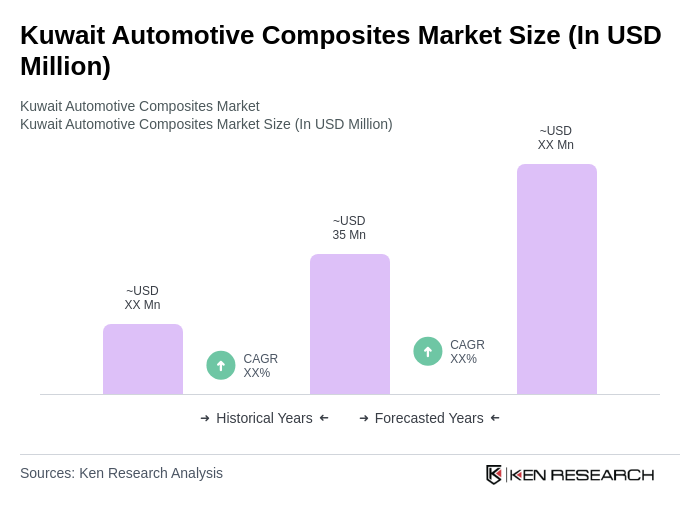

The Kuwait Automotive Composites Market is valued at approximately USD 35 million, reflecting a growing demand for lightweight materials that enhance fuel efficiency and reduce emissions in the automotive sector.